- United States

- /

- Healthcare Services

- /

- NYSE:THC

Tenet Healthcare Corporation (NYSE:THC) Might Not Be As Mispriced As It Looks

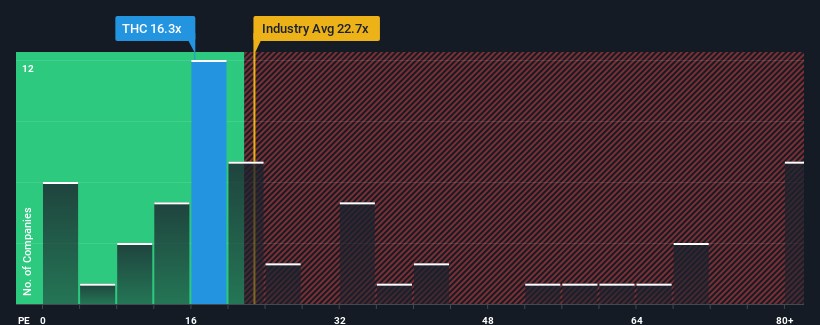

It's not a stretch to say that Tenet Healthcare Corporation's (NYSE:THC) price-to-earnings (or "P/E") ratio of 16.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Tenet Healthcare has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Tenet Healthcare

How Is Tenet Healthcare's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Tenet Healthcare's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader market.

With this information, we find it interesting that Tenet Healthcare is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Tenet Healthcare's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tenet Healthcare currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tenet Healthcare (1 makes us a bit uncomfortable) you should be aware of.

Of course, you might also be able to find a better stock than Tenet Healthcare. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Very undervalued with proven track record.