- United States

- /

- Medical Equipment

- /

- NYSE:TFX

Teleflex (TFX): Evaluating Valuation After Barrigel Spacer Launch in Japan’s Prostate Cancer Market

Reviewed by Simply Wall St

Teleflex (NYSE:TFX) just rolled out its Barrigel rectal spacer in Japan, capturing attention with a timely entrance into a crucial international market. The product, already backed by strong clinical data and now approved by Japanese regulators, also benefits from insurance coverage and the support of academic societies. With prostate cancer being the most common cancer among men in Japan, the move immediately places Teleflex in front of a large pool of patients who could benefit from this innovative therapy.

This launch comes at an interesting time for shareholders. Teleflex shares have retreated nearly 46% over the past year, and this dip extends over a longer period, suggesting some investors may be weighing concerns about growth and profitability against longer-term conviction. Still, the company’s revenue and net income are both trending positively, and this expansion could add a new dimension to its growth outlook, especially as it moves past a challenging year in the markets.

With the stock trading well below its highs after a tough period, the key question is whether this product-driven growth potential in Japan signals a buying opportunity, or if the market is already factoring future earnings into Teleflex’s current price?

Most Popular Narrative: 7.6% Undervalued

According to community narrative, Teleflex is considered undervalued by 7.6% based on the consensus of analysts. This narrative highlights the company's financial growth prospects and the expectations driving its fair value target.

The recent acquisition of BIOTRONIK's Vascular Intervention business is expected to drive sustainable revenue growth of 6% or better annually beginning in 2026. It is also projected to provide near-term EPS accretion by expanding Teleflex's presence in the high-growth interventional cardiology and endovascular procedures market. Improved access to the cath lab and cross-selling opportunities are likely to boost topline revenue and margins.

Want to know the driving force behind this optimistic valuation? The narrative is built on aggressive expansion, ambitious earnings projections, and a future profit multiple that would surprise most skeptics. Curious about the bold analyst calculations that support this potential re-rating? Dive deeper to discover which numbers are fueling that undervalued call.

Result: Fair Value of $140.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in core products and integration challenges from recent acquisitions could quickly undermine these optimistic growth forecasts.

Find out about the key risks to this Teleflex narrative.Another View: SWS DCF Model Perspective

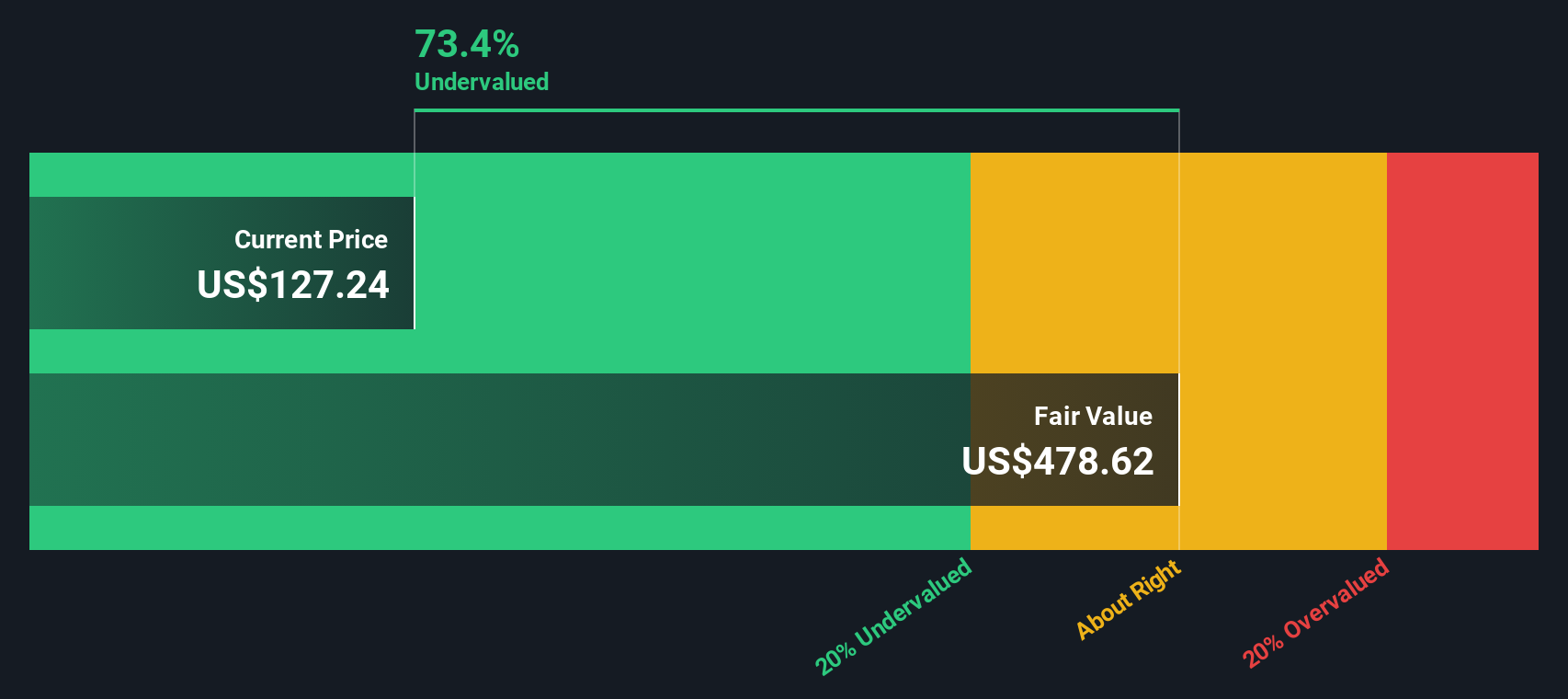

Taking a different approach, our DCF model points to a much larger disconnect between Teleflex's trading price and its underlying value. This method presents a more dramatic undervaluation story compared to analyst estimates. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teleflex Narrative

If you see things differently or favor hands-on research, you can shape your own perspective in just a few minutes. So why not do it your way?

A great starting point for your Teleflex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investing Move?

If you want fresh opportunities beyond Teleflex, don't miss your chance to get ahead of the market. The Simply Wall Street Screener brings you powerful ways to spot companies set for growth, value, or innovation. Make your next investment decision with confidence by checking out these standout ideas:

- Unlock steady income by reviewing dividend stocks yielding over 3% using dividend stocks with yields > 3% to find companies rewarding investors with robust cash payouts.

- Find the next breakout by pinpointing undervalued businesses with strong future cash flows through our undervalued stocks based on cash flows, putting you in position to act on rare value opportunities before others catch on.

- Jump on breakthrough trends by targeting cutting-edge innovation with AI penny stocks, highlighting AI-driven stocks shaping tomorrow's industries and offering standout growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFX

Teleflex

Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives