- United States

- /

- Healthtech

- /

- NYSE:TDOC

Teladoc's (NYSE:TDOC) Latest Partnership is Promising, But Not Without the Risk

In the last 2 years, flying on the thematic tailwinds, stocks like Teladoc Health, Inc. (NYSE: TDOC) became multi-baggers overnight, just to give back all those gains.

After another earnings result, the company is now trying to turn the 12-month decline around that saw it lose over 70% of the market cap.

Check out our latest analysis for Teladoc Health

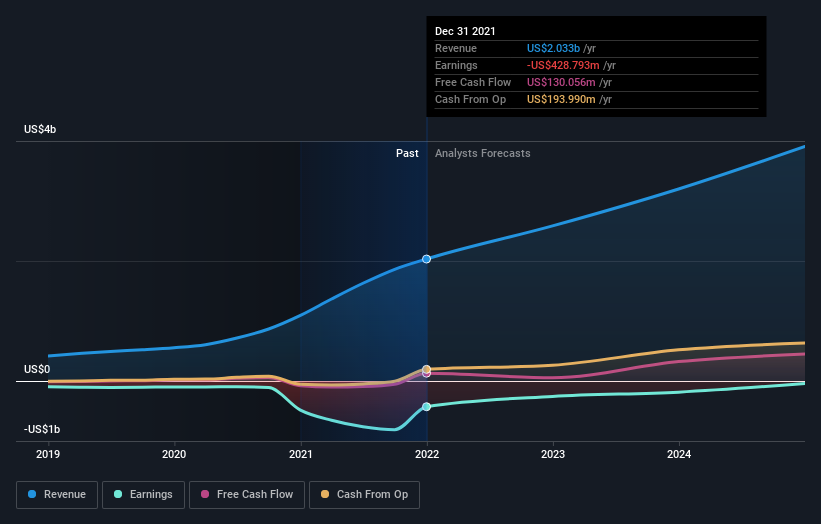

Full-year 2021 results:

- US$2.73 loss per share (up from US$5.36 loss in FY 2020).

- Revenue: US$2.03b (up 86% from FY 2020).

- Net loss: US$428.8m (loss narrowed 12% from FY 2020).

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 16%.

Over the next year, revenue is forecast to grow 27%, compared to a 22% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have fallen by 51% per year, but its share price has increased by 6% per year, which means it is well ahead of earnings.

Guidance

- Q1 Revenue: US$565-571m vs. consensus US$589m

- FY 2022 Revenue: US$2.55b – 2.65b vs consensus US$2.57b

After an initial sell-off, likely driven by weaker Q1 guidance, the stock rebounded from the lows. The primary reason seems to be the partnership with Amazon to launch its virtual healthcare service through Alexa technology.

So far, it seems that the command "Alexa, I want to talk to a doctor" will take customers to a Teladoc call center, where insured visitors would have service free of charge, while others would pay US$75 per visit.

Among many institutions that cover the stock, Oppenheimer seems the optimistic one with an Outperform rating, albeit lowering the price target from US$160 to US$130.

What is Teladoc Health worth?

According to our valuation model, TDOC's fair value is US$167 at the moment. While this seems steep discount, we'd like to point out that discounted cash flow (DCF) models aren't perfect. They estimate the value by taking in the projections of future cash flows and discounting it to todays' value.

While our data sources consider an average of 25 analyst estimates, it is seen as more of a guidance than a projection set in stone.

For more information, check the Valuation section on our platform and click on the "view data" box.

What kind of growth will Teladoc Health generate?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a low price is always a good investment, so we need to consider the company's future expectations.

With profit expected to grow by 90% over the next couple of years, the future seems bright for Teladoc Health. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Since its launch in 2014, Amazon Alexa has gained tens of thousands of skills over the years. Thus, it is not surprising to see Amazon Echo dominate the smart speaker market with a share of around 70% in the U.S.

For TDOC, this partnership is huge as it opens the doors of their service to millions of potential new customers and unlocks the synergies between the companies. Yet, some investors might see this as a dangerous gambit as Amazon could easily study the new data and eventually cut the company out in several years.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our research, we found that Teladoc Health has 3 warning signs, and it would be unwise to ignore them.

If you are no longer interested in Teladoc Health, you can use our free platform to see our list of over 50 other stocks with high growth potential.

If you're looking to trade Teladoc Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TDOC

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives