- United States

- /

- Healthtech

- /

- NYSE:TDOC

Teladoc Health (TDOC) Surges 7.0% After TytoCare AI Diagnostics Integration Is Announced – Has the Growth Narrative Shifted?

Reviewed by Sasha Jovanovic

- In November 2025, TytoCare announced an integration with Teladoc Health, bringing TytoCare's Home Smart Clinic and AI-powered diagnostics into Teladoc's 24/7 Care and Primary360 programs, with rollout planned for 2026 to select customers.

- An interesting aspect is that Teladoc clinicians will be able to perform remote lung, heart, and other physical assessments using TytoCare’s FDA-cleared, AI-enabled handheld device, expanding the capabilities of home-based virtual care.

- We'll explore how adding advanced home diagnostic tools to Teladoc's platform could influence its broader investment story and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Teladoc Health Investment Narrative Recap

The core case for owning Teladoc Health centers on belief in virtual care's expanding role across chronic and primary care, with technology partnerships driving better, more accessible outcomes. The TytoCare integration adds remote diagnostic capacity, but with ongoing financial pressures and muted near-term revenue growth, its impact on immediate catalysts, such as scaling insurance-based mental health revenue, may not be material right away. The main risk remains persistent churn and revenue pressure in BetterHelp’s U.S. cash pay mental health segment, which continues to weigh on profitability and growth.

Among recent announcements, Teladoc's launch of an enhanced cardiometabolic health program in April 2025 stands out alongside the TytoCare partnership. Both initiatives expand Teladoc’s service suite for chronic condition management, an area closely tied to current catalysts such as driving digital enrollment and supporting multi-condition care amid payer and employer demand for integrated solutions.

However, investors should be aware that despite new product launches and technology integrations, cash pay mental health churn...

Read the full narrative on Teladoc Health (it's free!)

Teladoc Health's narrative projects $2.7 billion in revenue and $235.6 million in earnings by 2028. This requires 1.9% yearly revenue growth and a $443 million increase in earnings from current earnings of -$207.4 million.

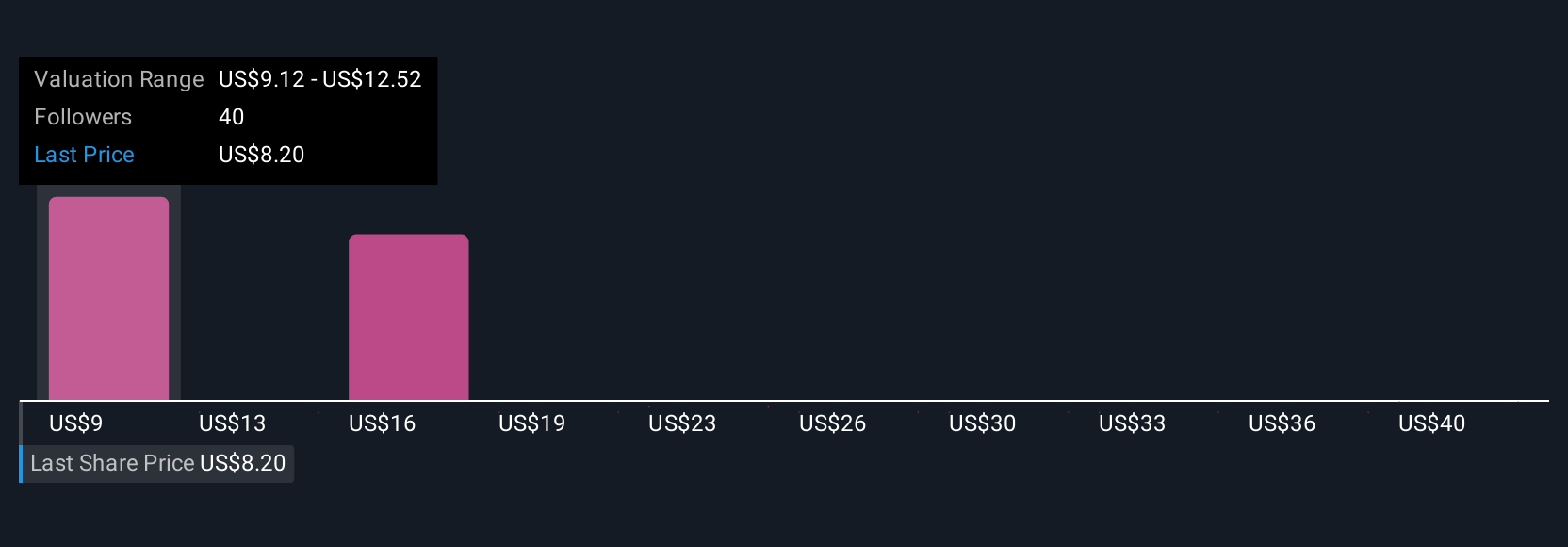

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates range from US$9.13 to US$42.04 per share. Such diversity underscores how persistent headwinds in the BetterHelp cash pay business can spark a wide range of outlooks for Teladoc’s future performance.

Explore 5 other fair value estimates on Teladoc Health - why the stock might be worth just $9.12!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDOC

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.