- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (SYK) Introduces Incompass Total Ankle System at AOFAS to Enhance Patient Care

Reviewed by Simply Wall St

Stryker (SYK) recently announced the launch of its Incompass Total Ankle System, a product designed for patients with end-stage ankle arthritis, which was showcased at the 2025 American Orthopaedic Foot & Ankle Society Annual Meeting. This innovative launch could potentially support Stryker's aim to enhance clinical performance. Over the past month, Stryker's stock gained 4%, aligning with broader market trends where benchmarks like the S&P 500 and Nasdaq reached all-time highs. Market optimism about monetary policies and a slight dip in wholesale inflation further buoyed investor sentiment, contributing to the gain.

Every company has risks, and we've spotted 3 weaknesses for Stryker you should know about.

The launch of Stryker's Incompass Total Ankle System could bolster its position in the medical technology sector by enhancing its product offerings, potentially boosting revenue and earnings forecasts. This aligns with its strategy of leveraging innovative solutions to address the needs of aging populations and the rising prevalence of chronic diseases. The introduction of new products like the Incompass system may help offset any potential regulatory and market challenges highlighted in the narrative, possibly supporting the company's long-term growth.

Over the past five years, Stryker's total shareholder return, including share price appreciation and dividends, was 96.59%. This reflects the company's ability to create shareholder value over the long term, despite recent underperformance compared to the US market, which returned 20.5% over the past year. In comparison, Stryker exceeded the US Medical Equipment industry, which had a more modest return of 3.8% over the same period.

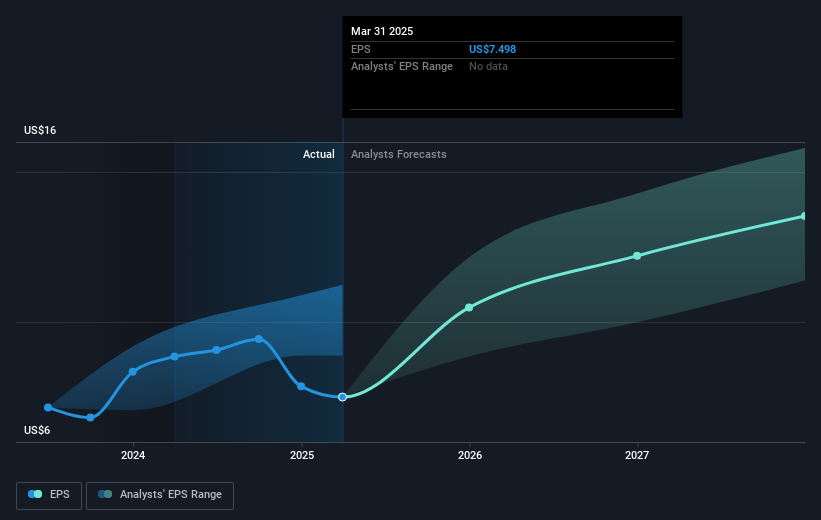

With Stryker's current share price at US$392.76, there is a notable gap to the consensus analyst price target of $433.19, suggesting potential for further upside should growth materialize as expected. The introduction of innovative products, like the Incompass system, could play a key role in achieving the anticipated revenue increase to $30.4 billion and earnings boost to $5.4 billion by 2028. However, achieving these targets will depend on overcoming potential risks such as regulatory hurdles and cost pressures.

Understand Stryker's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives