- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (NYSE:SYK) Reports Positive Sales Growth But Decline in Net Income

Reviewed by Simply Wall St

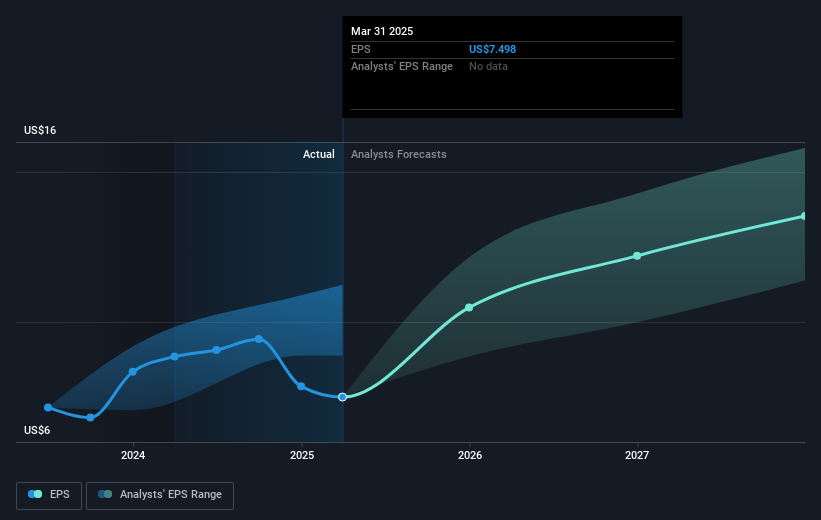

Stryker (NYSE:SYK) delivered mixed financial results, with first-quarter 2025 earnings showing increased sales but reduced net income and EPS compared to the previous year. The company's decision to raise its earnings guidance amid strong sales growth and demand for capital products might have bolstered investor confidence, coinciding with a 3.6% rise in its stock price over the past week. This movement aligns with broader market trends, as markets rose following a strong jobs report and potential trade discussions between the U.S. and China. Stryker's trajectory reflects these broader market dynamics while showcasing its robust commercial momentum.

You should learn about the 2 possible red flags we've spotted with Stryker.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent financial results and strategic decisions by Stryker, including its mixed earnings report and subsequent guidance upgrade, could influence the company's trajectory as outlined in the narrative. The acquisition of Inari Medical and the divestment of the Spinal Implants segment align with Stryker’s focus on high-growth, high-margin areas. This strategic realignment is anticipated to bolster revenue streams, especially in the mechanical thrombectomy market, which offers a substantial $15 billion opportunity. Additionally, the favorable reaction to increased sales expectations might uplift future revenue and earnings forecasts, with analysts projecting revenues to increase from US$22.60 billion currently, alongside profit margin improvements.

In a broader context, Stryker's stock has delivered a total shareholder return of 105.27% over the past five years, substantially outperforming the US Medical Equipment industry's 1-year return of 6.3% and surpassing the overall US market's 9.5% return over the same period. This long-term performance suggests strong confidence in its business strategies.

The latest 3.6% weekly rise in Stryker’s share price situates it close to the analyst’s consensus price target of US$421.86, which is significantly higher than the current US$370.92 share price. Continued confidence in the company's strategic initiatives and market opportunities could potentially narrow this valuation gap. Nonetheless, the divergence in analyst price targets underscores the need for investors to reconcile these projections with their own assessment of Stryker's potential growth and profitability.

Our expertly prepared valuation report Stryker implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Stryker, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives