- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

What Solventum (SOLV)'s Appointment of Heather Knight as CCO Means for Shareholders

Reviewed by Sasha Jovanovic

- Solventum recently appointed Heather Knight as Chief Commercial Officer, effective November 10, 2025, entrusting her with global commercial and R&D operations across the MedSurg, Dental Solutions, and Health Information Systems segments, while also confirming the planned departure of Chris Barry by year-end.

- This leadership change brings in over 30 years of MedTech experience, positioning Solventum to align innovation and commercial execution across its core business areas with fresh perspective.

- We'll examine how Heather Knight's appointment as Chief Commercial Officer may reshape Solventum's investment narrative and future execution priorities.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Solventum Investment Narrative Recap

To be a shareholder in Solventum, you need confidence in its ability to convert operational restructuring and product pipeline momentum into sustainable growth, even as it manages the significant ongoing challenges of its multi-year ERP implementation and 3M separation. The appointment of Heather Knight as Chief Commercial Officer brings deep industry experience but, on its own, does not materially change the short-term catalysts or the biggest risk, which remains execution amid complex operational transitions.

Among recent announcements, the sale of the Purification & Filtration business for US$4.0 billion is especially relevant, giving Solventum additional financial flexibility to support further investment in its core segments. In the context of fresh leadership, how the company uses this balance sheet strength to maintain its momentum in MedSurg and Dental will be key to monitoring both upside catalysts and the execution risks that could impair its revenue and margins.

However, as Solventum pushes forward with its ERP rollout, investors should be aware of unresolved risks around...

Read the full narrative on Solventum (it's free!)

Solventum's outlook anticipates $8.2 billion in revenue and $981.9 million in earnings by 2028. This projection is based on a -0.7% annual revenue decline and an earnings increase of $601.9 million from the current $380.0 million level.

Uncover how Solventum's forecasts yield a $85.11 fair value, a 17% upside to its current price.

Exploring Other Perspectives

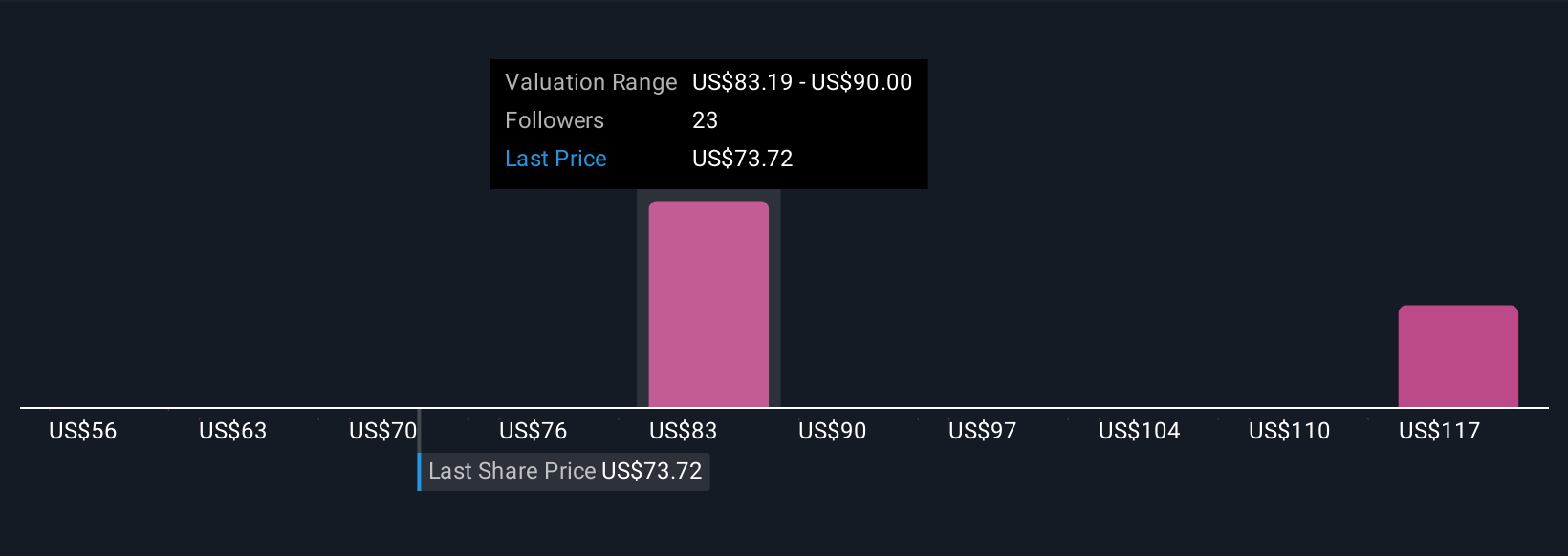

Retail investors in the Simply Wall St Community assessed Solventum’s fair value between US$55.96 and US$123.10 across three unique estimates. While execution amid the multi-year ERP upgrade remains a major risk, you can compare these diverse views to assess how opinions on future performance can vary.

Explore 3 other fair value estimates on Solventum - why the stock might be worth as much as 69% more than the current price!

Build Your Own Solventum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solventum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Solventum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solventum's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives