- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

A Look at Solventum’s (SOLV) Valuation After Leadership Changes Reshape Commercial Strategy

Reviewed by Simply Wall St

Solventum (SOLV) has just named Heather Knight as its Chief Commercial Officer, bringing over 30 years of MedTech leadership to the table. Investors are watching closely, as this appointment signals potential shifts in commercial strategy.

See our latest analysis for Solventum.

Solventum’s recent leadership shake-up comes after an eventful year. While the company’s year-to-date share price return sits at 10.6%, total shareholder return for the past year has barely budged, suggesting recent optimism has yet to translate into lasting gains. Momentum may be building as investors weigh the impact of these executive changes against Solventum’s long-term potential.

Curious which other healthcare stocks are showing positive momentum? Discover new ideas with our healthcare stock screener: See the full list for free.

Given Solventum's significant executive shake-up, modest shareholder returns, and the stock currently trading at a discount to analyst price targets, the key question is whether Solventum is undervalued or if the market is already factoring in future growth.

Most Popular Narrative: 14.3% Undervalued

Solventum’s fair value, according to the most widely followed narrative, sits at $85.11, which is over $12 higher than its last close at $72.91. This difference has drawn new attention to the underlying growth story and financial assumptions driving that price target.

“Recent commercial restructuring and specialized sales teams are delivering above-expectation growth, especially in core areas like MedSurg and Dental, indicating that further market penetration and differentiated brand leverage could drive ongoing volume-based revenue increases and support margin expansion.”

What bold financial projections underpin this double-digit fair value gap? The answer may surprise you: think margin expansion, a fresh strategic push, and forecasts for an earnings surge that could reset expectations. See what’s fueling the optimism and how analysts are connecting the dots in this narrative.

Result: Fair Value of $85.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressures from the ongoing 3M separation and possible near-term demand softness could quickly dampen the company's bullish outlook.

Find out about the key risks to this Solventum narrative.

Another View: SWS DCF Model Signals Deeper Discount

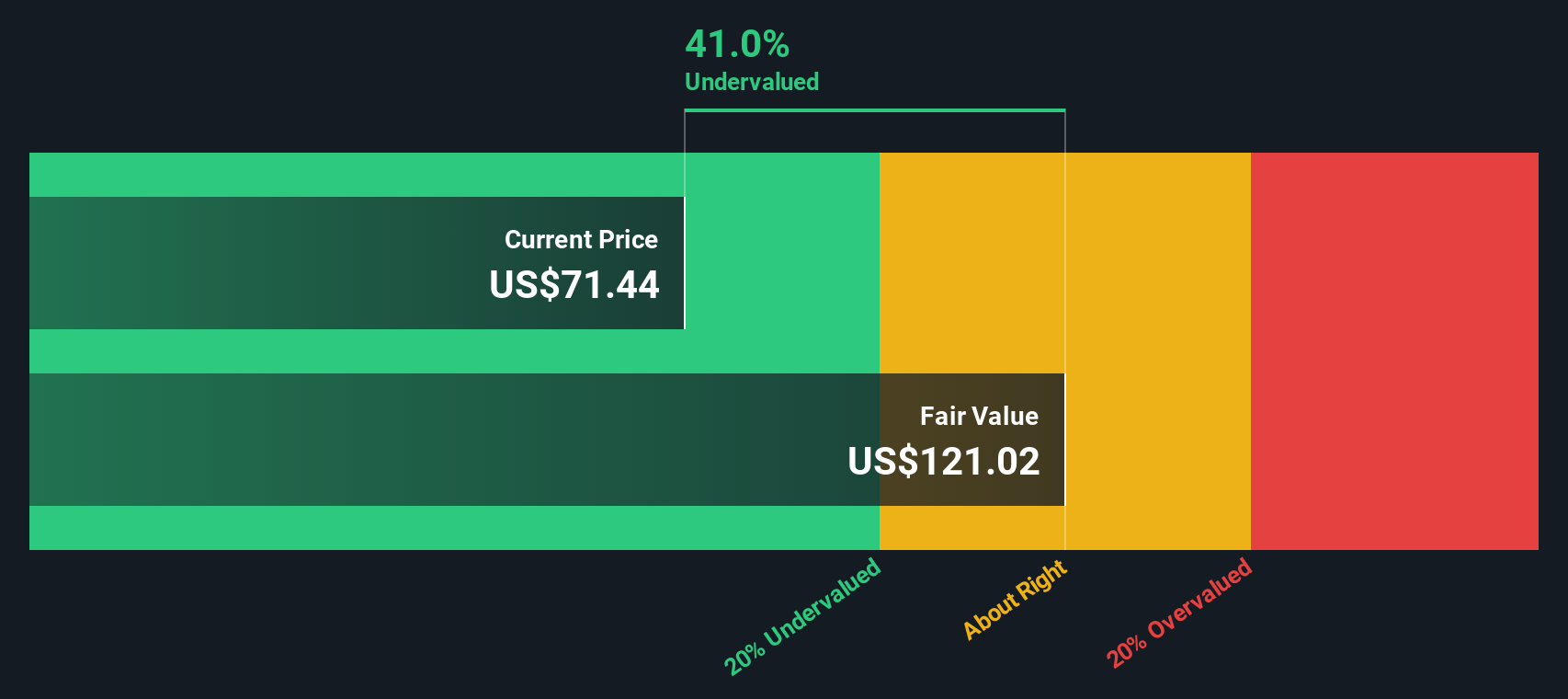

While the current price-to-earnings ratios paint Solventum as expensive compared to its industry peers, our DCF model tells a very different story. By this method, Solventum appears to be trading roughly 41% below its estimated fair value. This suggests that the market might be overly cautious or missing something about the company’s future cash flows. Could this wide gap between earnings multiples and intrinsic valuation represent a rare opportunity, or is it a sign that risks are higher than the models suggest?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Solventum Narrative

If the current outlook does not resonate with you, or you prefer to explore the details independently, it's quick and simple to develop your own case in just a few minutes. Do it your way.

A great starting point for your Solventum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let opportunity pass you by. Level up your research with these handpicked stock ideas and get ahead of the market curve right now:

- Grow your portfolio’s income by targeting reliable candidates through these 17 dividend stocks with yields > 3% with yields above 3% for dependable cash flow.

- Capitalize on cutting-edge breakthroughs by following these 24 AI penny stocks, where transformative technologies and innovative business models are propelling market leaders.

- Secure your next value play with these 881 undervalued stocks based on cash flows, highlighting stocks overlooked by the market and brimming with untapped upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives