- United States

- /

- Healthcare Services

- /

- NYSE:SEM

Will Executive Changes at Select Medical (SEM) Shift Its Long-Term Growth Narrative?

Reviewed by Simply Wall St

- In early September 2025, Select Medical Holdings announced a series of executive leadership changes, including the appointment of Thomas P. Mullin as Chief Executive Officer and David S. Chernow transitioning to vice chairman of the board.

- This leadership shift places a long-tenured company insider at the helm, signaling a focus on continuity and in-depth internal experience during the transition.

- We will explore how the CEO transition and internal leadership appointments could influence Select Medical's long-term growth narrative and market outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Select Medical Holdings Investment Narrative Recap

To be a shareholder in Select Medical Holdings, belief in the continued demand for inpatient rehabilitation and critical illness recovery services is crucial, with long-term industry tailwinds shaped by demographic trends. The recent CEO transition appears unlikely to materially affect the most immediate catalyst, growing patient volumes via facility expansion, nor does it alter the ongoing risk posed by challenging regulatory pressures, such as unfavorable Medicare reimbursement changes impacting margins and segment stability.

The appointment of Thomas P. Mullin as CEO is particularly relevant, given his seventeen-year history in operational leadership within Select Medical, including overseeing the national critical illness recovery and rehab hospital divisions. This depth of internal experience could help the company execute on expansion strategies and efficiency initiatives central to its near-term growth narrative, while short-term financial headwinds remain a challenge.

However, in contrast to reassuring headlines, investors should be aware of persistent regulatory headwinds that...

Read the full narrative on Select Medical Holdings (it's free!)

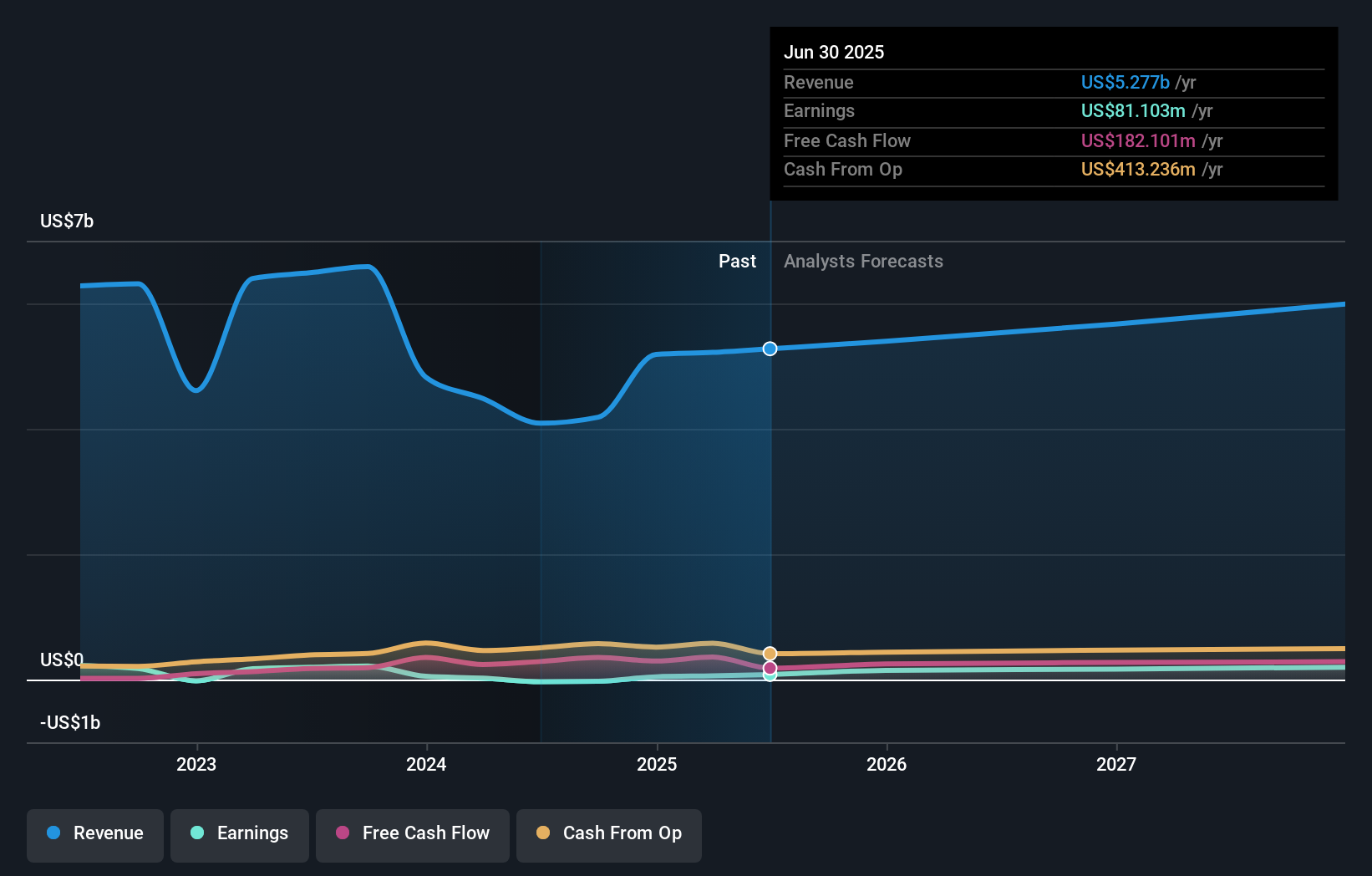

Select Medical Holdings' narrative projects $6.1 billion in revenue and $233.8 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $152.7 million earnings increase from current earnings of $81.1 million.

Uncover how Select Medical Holdings' forecasts yield a $17.83 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair value for Select Medical Holdings anywhere from US$17.83 to US$43.72, with two distinct viewpoints represented. Regulatory challenges in reimbursement could influence actual results, so reviewing a range of independent opinions helps you weigh upside versus downside risks.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth just $17.83!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEM

Select Medical Holdings

Through its subsidiaries, operates critical illness recovery hospitals, rehabilitation hospitals, and outpatient rehabilitation clinics in the United States.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives