- United States

- /

- Healthcare Services

- /

- NYSE:SEM

A Fresh Look at Select Medical Holdings (SEM) Valuation Following CEO Transition Announcement

Reviewed by Simply Wall St

If you’re looking at Select Medical Holdings (SEM) this week, you’re likely curious about what’s next for the stock after a shake-up at the top. The company just announced that Thomas P. Mullin is taking over as CEO, bringing a long tenure and deep operational experience to the role, while David S. Chernow shifts to vice chairman of the board. These kinds of leadership transitions can be a turning point, and for investors, they often signal more than just a new name on the letterhead. They can also mean shifts in strategy or a new focus that could impact growth and performance down the line.

Against this backdrop, the market’s view of Select Medical Holdings has been shifting. Over the past year, the stock is down roughly 31%, faring little better over the year-to-date. The past month saw a modest lift, suggesting there’s still some volatility as the market digests recent changes. While the past three years also reflect slight losses, the company’s five-year return remains positive, reflecting some longer-term resilience. Executive moves like this can either refresh momentum or raise questions about direction, so it is not surprising to see the market responding as it weighs the potential impact of new leadership.

With the stock in transition and fresh leadership at the helm, is Select Medical Holdings now trading at a discount to its future growth, or is the market already pricing in everything investors should expect?

Most Popular Narrative: 30% Undervalued

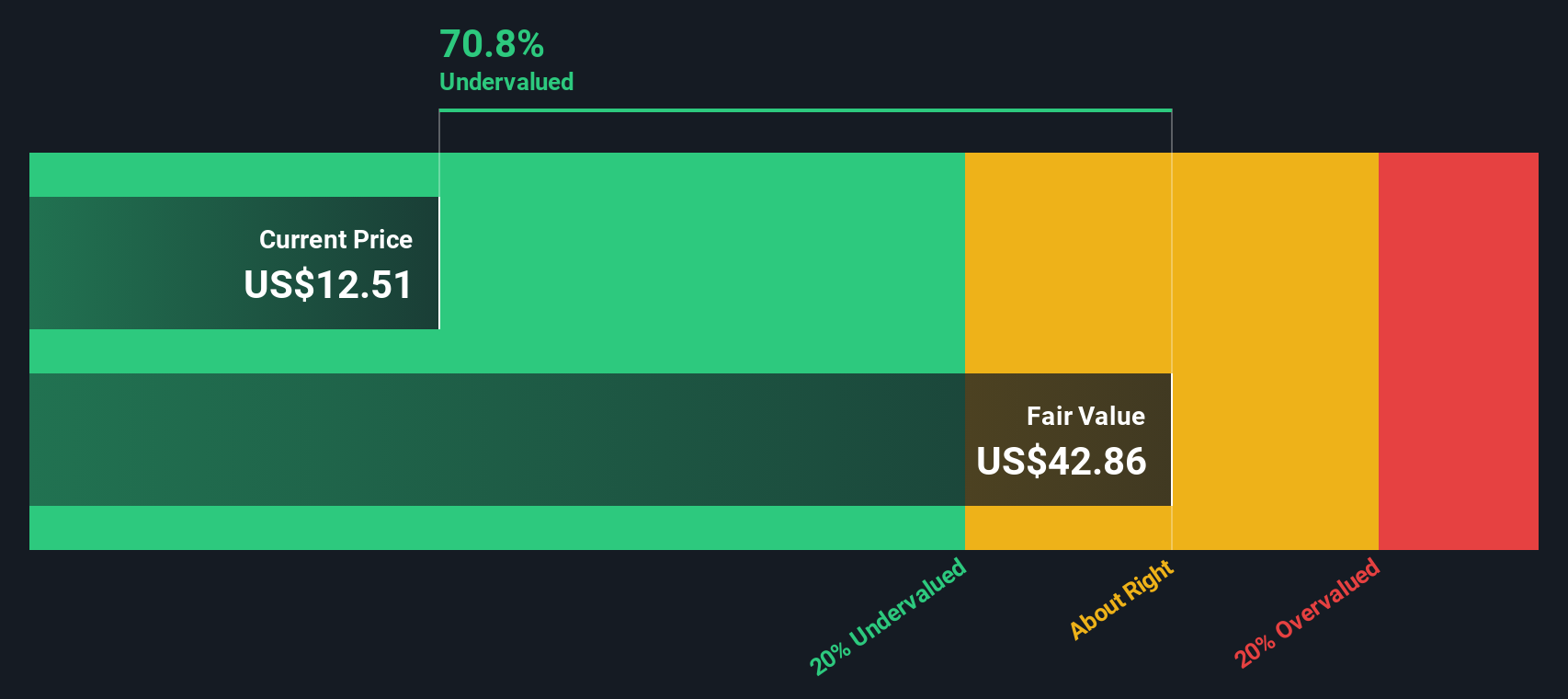

According to the most widely followed narrative, Select Medical Holdings is priced well below its fair value based on long-term earnings and revenue growth projections by analysts. The stock is currently trading at a steep discount, implying a significant upside if expectations play out as forecast.

Strong demand fundamentals in critical illness recovery and rehabilitation services, supported by demographic trends and hospital system needs to decompress crowded ICUs, suggest ongoing stability in patient flows. This underpins long-term revenue and cash flow growth.

Curious what is powering this bold undervaluation call? The fair value calculation hinges on advanced financial projections and a future earnings target that is turning heads, along with an earnings multiple usually seen in fast-growth sectors. One piece of the puzzle is a rapid turnaround in profitability that could change the game for this company. Wondering which assumptions are shaping the narrative and what it would really take for Select Medical to close that value gap? Keep reading to discover the surprising forces that are reshaping expectations behind the fair value estimate.

Result: Fair Value of $17.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory pressures and high debt levels remain key risks. These factors could limit profitability and slow the recovery story for Select Medical Holdings.

Find out about the key risks to this Select Medical Holdings narrative.Another View: What Does the SWS DCF Model Say?

Taking a different perspective, our SWS DCF model also points to Select Medical Holdings being undervalued. By focusing on expected future cash flows, this method reaches a similar conclusion. But can both approaches really be right? Or is one missing something crucial that could sway investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Select Medical Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own valuation story for Select Medical Holdings in just a few minutes by using Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your portfolio to just one story. Take charge now and tap into fresh market potential using these high-impact opportunities, all pinpointed by the Simply Wall Street Screener:

- Tap into tomorrow’s breakthroughs by scouting out powerful innovators leading the AI revolution with AI penny stocks.

- Cultivate income and stability as you target companies delivering robust yields above 3 percent through dividend stocks with yields > 3%.

- Spot undervalued gems primed for growth and seize hidden market bargains with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEM

Select Medical Holdings

Through its subsidiaries, operates critical illness recovery hospitals, rehabilitation hospitals, and outpatient rehabilitation clinics in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives