- United States

- /

- Healthtech

- /

- NYSE:PHR

Rising Earnings Optimism Could Be A Game Changer For Phreesia (PHR)

Reviewed by Sasha Jovanovic

- In recent days, analysts have become increasingly optimistic about Phreesia ahead of its October 2025-quarter earnings report, expecting year-over-year improvements in both earnings and revenue and highlighting a positive Earnings ESP alongside a consistent record of outperforming estimates.

- This growing optimism is underscored by multiple firms reaffirming positive ratings and lifting earnings forecasts, suggesting that expectations around Phreesia’s ability to extend its track record of beating consensus have become a key focus for the market.

- With analysts revising earnings estimates sharply higher, we’ll now examine how this rising optimism could influence Phreesia’s broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Phreesia Investment Narrative Recap

To own Phreesia, you need to believe its patient-intake and engagement platform can keep gaining share and lifting revenue per healthcare client as digital adoption deepens. The latest wave of analyst optimism around an expected October 2025-quarter earnings beat supports that thesis in the near term, but it does not materially change the key short term catalyst, which remains execution on new modules and AI tools, or the biggest risk, that integrated EHR platforms compress its pricing power.

The launch of Phreesia VoiceAI in September 2025 looks particularly relevant here, since it speaks directly to the company’s push to embed AI across workflows and potentially increase value delivered per client. How well VoiceAI is adopted and monetized will be closely watched against rising expectations for earnings outperformance, especially as investors weigh whether these innovations can offset competitive and regulatory pressures over time.

Yet even with upbeat earnings expectations, investors still need to be aware of the risk that growing preference for unified EHR platforms could...

Read the full narrative on Phreesia (it's free!)

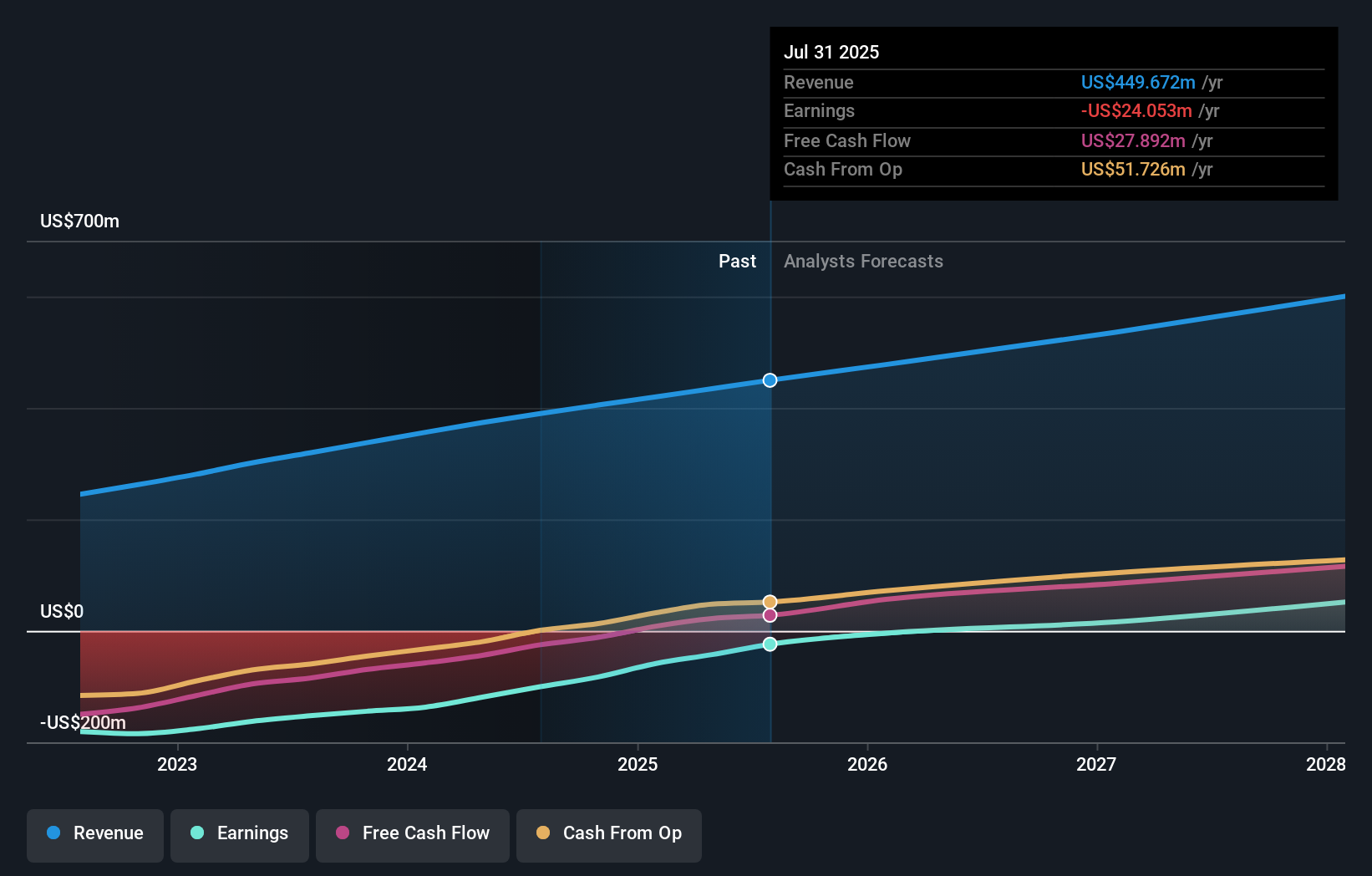

Phreesia's narrative projects $611.2 million revenue and $52.6 million earnings by 2028. This requires 12.0% yearly revenue growth and a $95.3 million earnings increase from -$42.7 million today.

Uncover how Phreesia's forecasts yield a $33.73 fair value, a 64% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently provide 1 fair value estimate for Phreesia at US$33.73, underscoring how even a single viewpoint can differ from market pricing. Set against upbeat earnings expectations and optimism around AI driven modules, this reinforces how important it is to weigh both growth catalysts and competitive risks when judging the company’s longer term performance potential.

Explore another fair value estimate on Phreesia - why the stock might be worth just $33.73!

Build Your Own Phreesia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Phreesia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phreesia's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026