- United States

- /

- Healthtech

- /

- NYSE:PHR

Phreesia (PHR): Assessing Valuation After Strong Earnings and AccessOne Acquisition

Reviewed by Simply Wall St

Phreesia (PHR) grabbed investor attention after reporting second quarter revenue growth of 15% and a margin expansion to 19%. The company also raised its full-year profitability outlook and announced the acquisition of AccessOne.

See our latest analysis for Phreesia.

Phreesia’s strong quarterly results and the headline-grabbing AccessOne acquisition have spurred renewed investor interest, although some near-term volatility remains. Despite a 27.5% one-year total shareholder return that hints at underlying momentum, the share price hasn’t kept pace in recent months as investors weigh future risks and rewards.

If the latest moves in healthcare technology have you searching for the next standout, this is a great opportunity to explore innovators through our healthcare screener: See the full list for free.

With shares trading roughly 44% below analyst price targets, is Phreesia an overlooked value in healthcare tech? Or are current valuations already accounting for all the upside from recent outperformance and expansion plans?

Most Popular Narrative: 30.5% Undervalued

Phreesia’s last close of $23.45 sits well below the most widely followed fair value estimate of $33.73, hinting at significant upside according to the consensus. Analyst projections, product launches, and recent dealmaking are all shaping this narrative, with one major catalyst at its core.

The $160M acquisition of AccessOne, Phreesia's largest to date, is expected to complement its payment processing business, generate synergistic benefits, and strengthen value proposition for larger clients. However, the purchase multiple raised some valuation concerns.

Want to know what future growth rates and margin targets drive this bullish valuation? The narrative is built on ambitious assumptions about profitability, revenue, and how much investors will pay for future earnings. Ready to discover what bold projections underpin the fair value?

Result: Fair Value of $33.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures or unexpected regulatory changes could challenge Phreesia's revenue momentum and margin expansion. This could risk the strength of the current bullish narrative.

Find out about the key risks to this Phreesia narrative.

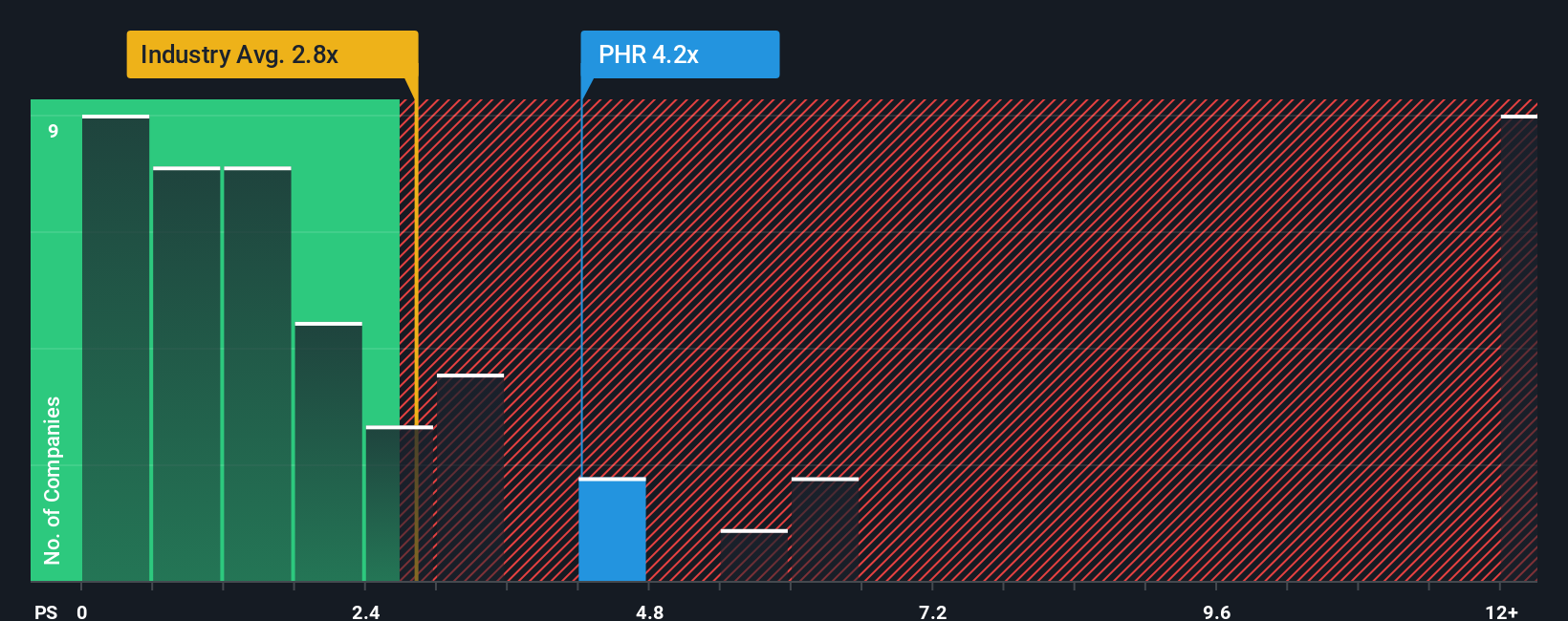

Another View: What Do Market Multiples Say?

While analyst models see Phreesia as undervalued, looking at its current price-to-sales ratio tells a different story. At 3.1x, the company trades above both its peer average of 2.3x and even the fair ratio of 2.9x. This suggests the market may already be pricing in much of the future optimism, which could mean there is less room for upside from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phreesia Narrative

If you see the story differently, or would rather draw your own conclusions from the data, you can do it quickly and on your terms with Do it your way.

A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Expand your search for powerful stocks that match your goals with these top screens from Simply Wall Street:

- Power up your portfolio by targeting high potential with these 26 AI penny stocks, capturing big shifts in artificial intelligence innovation and disruptive growth trends.

- Tap into promising undervalued opportunities by researching these 877 undervalued stocks based on cash flows and maximize your returns with companies priced below their cash flow potential.

- Boost your income strategy by selecting these 17 dividend stocks with yields > 3% that consistently deliver 3%+ yields and stable payouts amid shifting markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives