- United States

- /

- Healthtech

- /

- NYSE:PHR

Did Phreesia's (PHR) Profitability Boost and AccessOne Deal Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this year, Phreesia reported second quarter results that surpassed expectations, with revenue increasing by 15% and EBITDA margins reaching 19%, while also raising its full-year profitability outlook and announcing the US$160 million acquisition of AccessOne, a receivables financing platform.

- While the acquisition expands Phreesia's capabilities and potential revenue streams, it has also led to some caution among investors regarding the complexities of integrating a new business.

- To unpack the impact of these developments, we'll assess how Phreesia's enhanced profitability forecast and AccessOne acquisition influence its long-term investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Phreesia Investment Narrative Recap

To be a shareholder in Phreesia, you need to believe the company can capitalize on healthcare’s digital transformation, leveraging its new digital modules and AI integration to expand margins and outpace competition. The recent acquisition of AccessOne could expand revenue streams, but it does not materially shift the company’s most important short-term catalyst, adoption of new value-added modules, or the biggest risk, which remains execution in a competitive and rapidly evolving market.

Among the latest developments, the launch of Phreesia VoiceAI stands out as especially relevant for investors, as it has the potential to accelerate recurring revenue growth by enhancing the product suite and broadening appeal to new and existing clients. This aligns closely with the company’s chief catalyst: greater product adoption driving revenue per client, a key factor for delivering higher margins and sustained top-line expansion.

However, investors should be aware that, despite strong execution, risks may arise if...

Read the full narrative on Phreesia (it's free!)

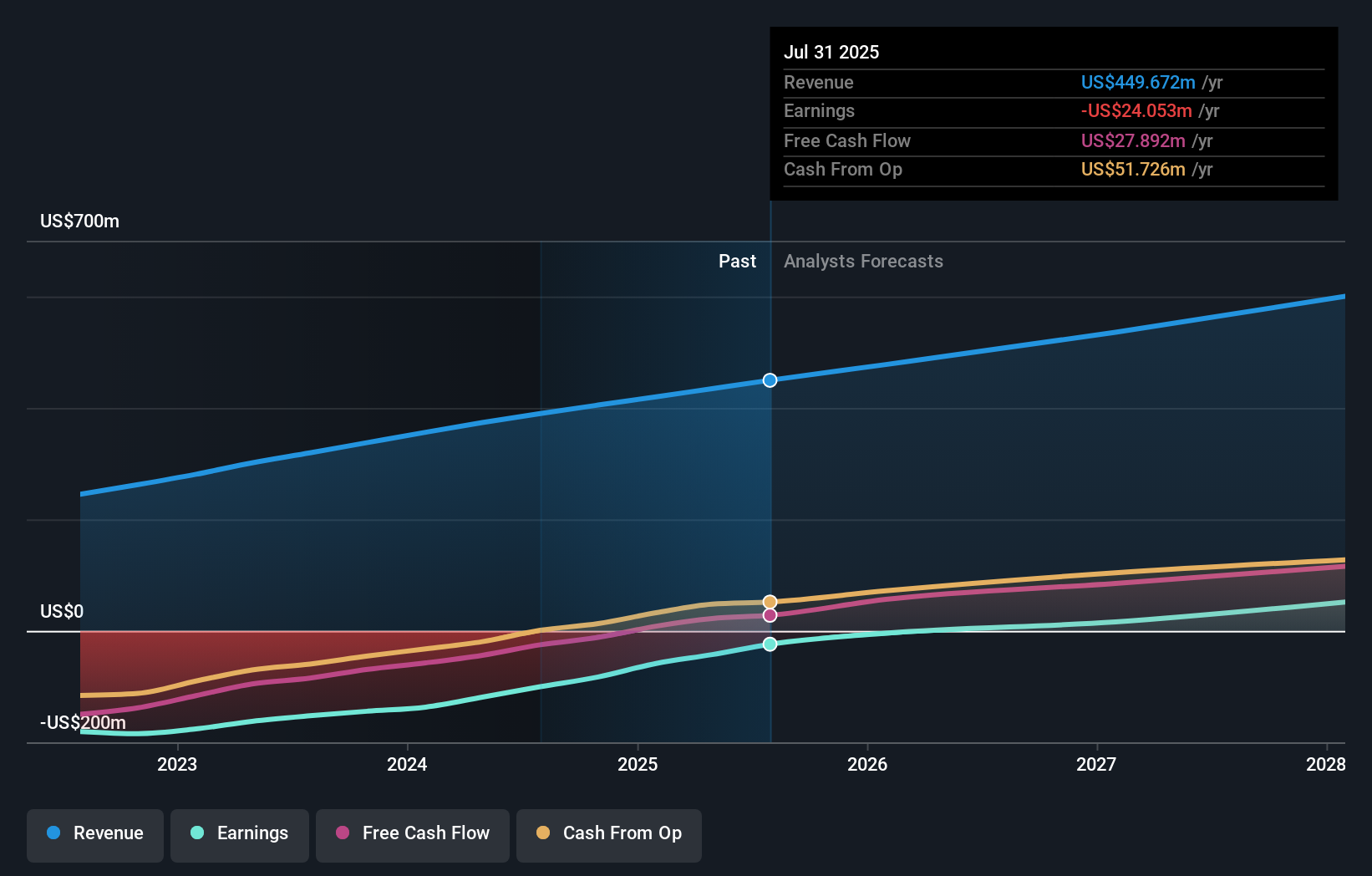

Phreesia's narrative projects $611.2 million in revenue and $52.6 million in earnings by 2028. This requires 12.0% yearly revenue growth and a $95.3 million increase in earnings from the current earnings of -$42.7 million.

Uncover how Phreesia's forecasts yield a $33.73 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community projects a fair value for Phreesia, estimating US$33.73 per share. With significant focus on new product adoption as a driver of growth, now is a good time to compare a range of community viewpoints on the company’s outlook.

Explore another fair value estimate on Phreesia - why the stock might be worth as much as 47% more than the current price!

Build Your Own Phreesia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Phreesia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phreesia's overall financial health at a glance.

No Opportunity In Phreesia?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives