- United States

- /

- Healthtech

- /

- NYSE:PHR

A Look at Phreesia’s Valuation After Profitable Quarter and New VoiceAI Launch

Reviewed by Simply Wall St

Phreesia (PHR) just delivered a quarter that will turn some heads. The company swung to profitability in its latest results, posting a $0.654 million net income for the second quarter, a dramatic shift from the net loss it posted a year earlier. On top of that, management reaffirmed their outlook for the year, signaling steady confidence in meeting their revenue targets. In addition, Phreesia rolled out VoiceAI, an always-on, AI-powered phone solution designed to reduce workload for healthcare staff and enhance patient interactions. These moves, combining financial improvement with innovation, give investors fresh reasons to revisit the stock.

This wave of news comes at a time when Phreesia’s momentum has been building. While shares have had ups and downs in recent months, the stock is up 12% over the past year, showing a recovery from its longer-term declines. The launch of VoiceAI and better-than-expected earnings could be a turning point, following a year of operational gains and a focus on automation. All eyes will be on whether these changes can accelerate growth or if it is already reflected in the share price.

After a profitable quarter and new AI-driven product rollout, the question is whether Phreesia is trading at a value that leaves room for upside, or if the market has already priced in this next chapter.

Most Popular Narrative: 20.6% Undervalued

According to the most popular narrative, Phreesia is seen as significantly undervalued. The narrative attributes this potential to the company’s digital expansion and rapid integration of advanced technologies within the healthcare sector.

The continued rollout and adoption of new value-added modules, such as appointment readiness, enhanced bill pay, and post-script engagement, are increasing recurring revenue per client and expanding Phreesia's addressable market. This supports both top-line growth and enhanced net margins over time. Ongoing integration of AI across products and internal operations is expected to drive future efficiencies, enable new product capabilities, and strengthen Phreesia's competitive differentiation. This, in turn, supports operating leverage and potential EBITDA margin expansion.

Hungry to see what powers this bullish view? The secret sauce behind this valuation features bold revenue and margin expansion forecasts, along with a profit leap that could rewrite the company’s story. Discover which aggressive analyst assumptions make up the backbone of this future fair value.

Result: Fair Value of $33.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition in healthcare IT and potential changes in industry regulations could present challenges to Phreesia’s ambitious growth and margin assumptions.

Find out about the key risks to this Phreesia narrative.Another View: Market Multiples Paint a Different Picture

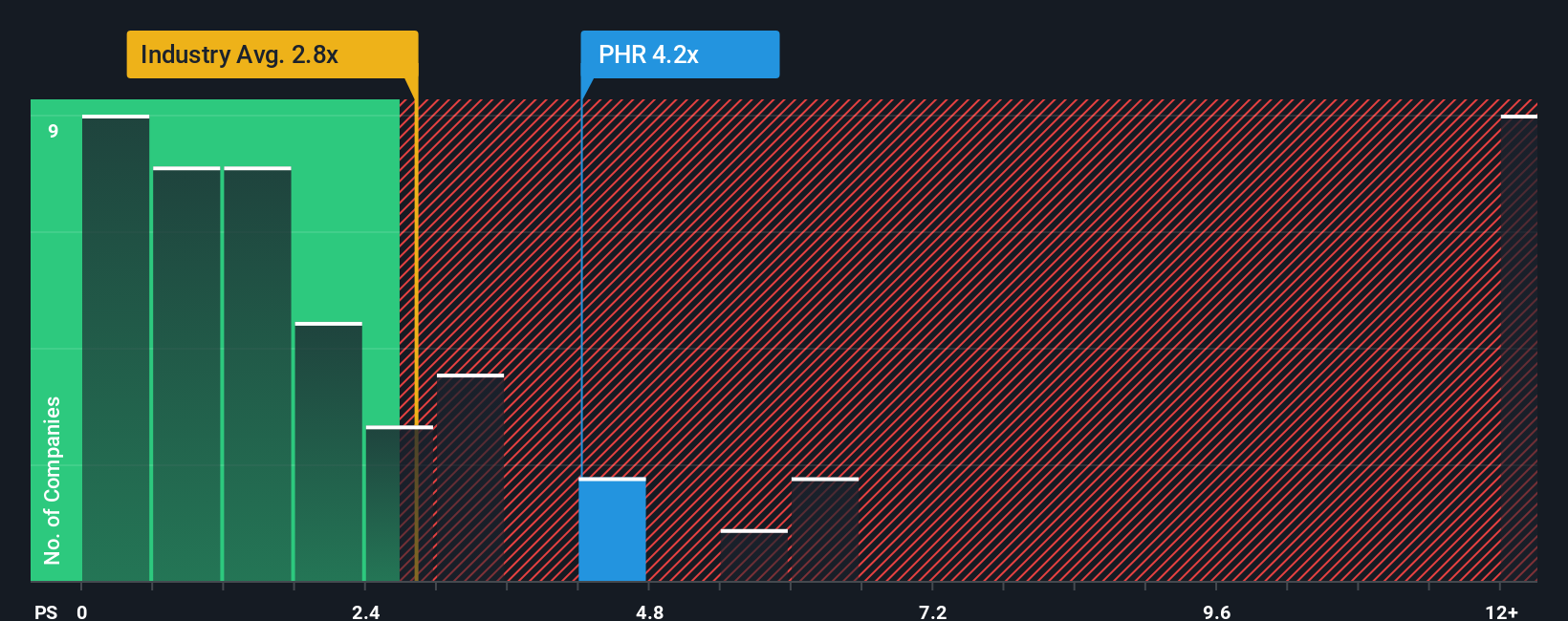

While one method suggests the stock is undervalued, a look at Phreesia's valuation compared to its industry peers tells a different story. On this basis, it appears more expensive than its sector rivals. Could the market be pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phreesia Narrative

If you see things differently or want to dig into the data on your own terms, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for the next opportunity. Make your money work harder by checking out these fresh stock ideas tailored to your strategy.

- Uncover overlooked values and track hidden gems among companies that financial experts rate as undervalued stocks based on cash flows right now.

- Tap into the future of medicine by researching groundbreaking innovations driving progress in healthcare with some of the most promising healthcare AI stocks available today.

- Secure your portfolio with steady income streams by finding reliable dividend stocks with yields > 3% that offer consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives