- United States

- /

- Healthcare Services

- /

- NYSE:PACS

PACS Group (PACS): Assessing Valuation Following NYSE Extensions and Progress on Regulatory Challenges

Reviewed by Simply Wall St

PACS Group (PACS) recently secured several NYSE extensions as it resolved technical defaults with lenders. This progress signals improvement in overcoming regulatory and financial hurdles and underlines growing stability, supporting the company’s position for future gains.

See our latest analysis for PACS Group.

After losing significant ground over the past year, with a total shareholder return of -69.92%, PACS Group has shown signs of stabilization. Recent regulatory progress and improved liquidity are helping to steady nerves, and the 8.3% share price gain over the last 90 days suggests some early momentum may be returning.

If you’re curious about what else might be building strength alongside regulatory turnarounds, it’s a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With market sentiment beginning to shift, investors now face a key question: is PACS Group’s recent rebound a sign that value remains on the table, or has the market already factored in its recovery prospects?

Price-to-Earnings of 21.3x: Is it justified?

Based on its current price-to-earnings (P/E) ratio of 21.3x, PACS Group trades in line with the broader US Healthcare industry, which averages a P/E of 21.7x. At a last close price of $12.66, this suggests the stock is valued comparatively by sector standards, neither standing out as a bargain nor as overpriced by this metric.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of future earnings. In healthcare, where regulation and long-term profitability are key, the P/E ratio gives important insight into market expectations for sustained growth and profitability.

Looking closer, PACS is also considered good value when compared with its fair price-to-earnings ratio, which is estimated at 64.5x. This means the current multiple is significantly below what market fundamentals might justify if PACS executes its growth plans. If investor confidence grows, the market could eventually re-rate PACS closer to that fair ratio.

Explore the SWS fair ratio for PACS Group

Result: Price-to-Earnings of 21.3x (UNDERVALUED)

However, sustaining this rebound will depend on continued regulatory progress and delivering on growth. Any setbacks could quickly pressure sentiment and valuation again.

Find out about the key risks to this PACS Group narrative.

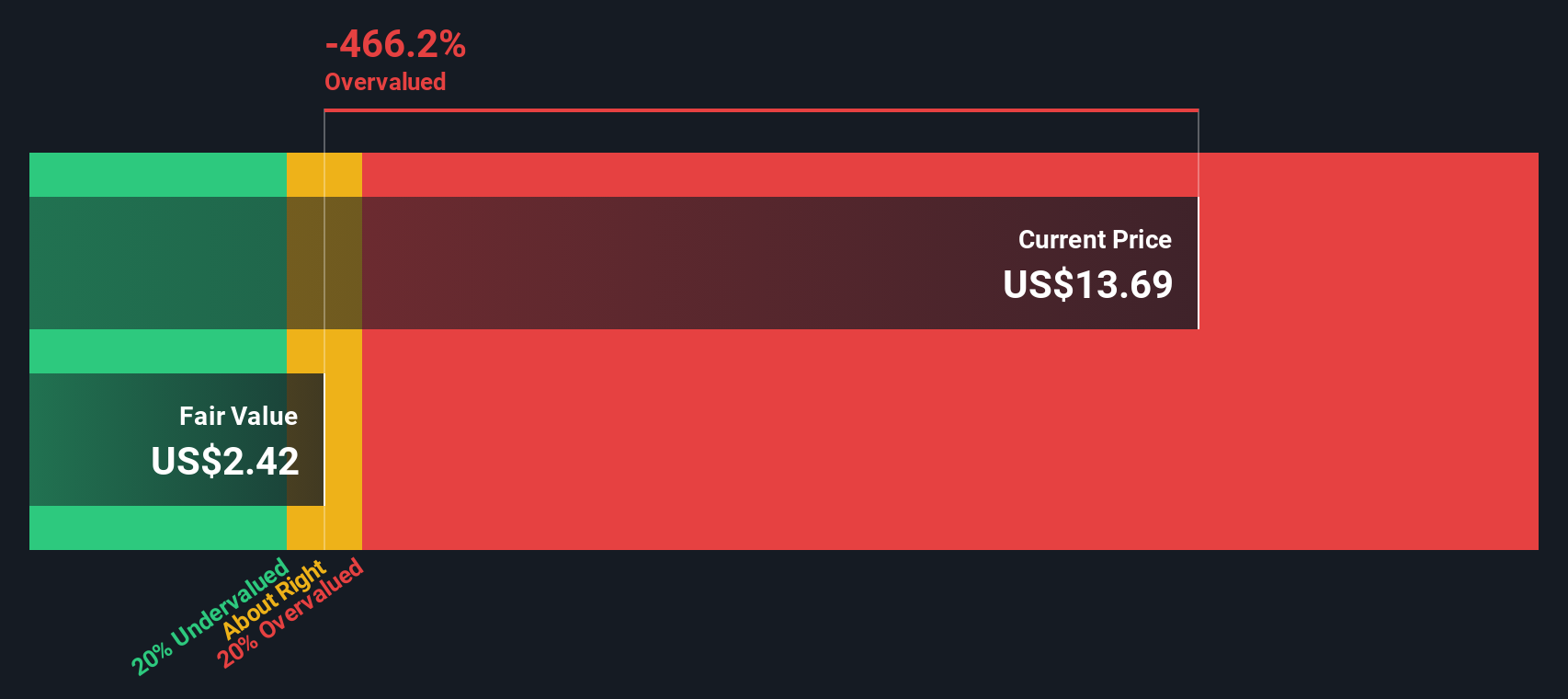

Another View: DCF Suggests Overvaluation

While PACS Group looks attractively valued by its earnings multiple, a different story emerges with our DCF model. The SWS DCF model, which estimates fair value based on future cash flows, puts PACS’s value at just $2.36, well below the current share price. This signals potential overvaluation if cash flows fall short of expectations.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PACS Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PACS Group Narrative

If you have alternative views, or want to dig into the numbers yourself, you can quickly develop your own perspective on PACS Group in just a few minutes, and Do it your way.

A great starting point for your PACS Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never limit themselves to a single opportunity. Take charge and uncover hidden gems with the tools below. Unique market trends, bold innovation, and steady income are all just a click away.

- Grow your income by checking out these 17 dividend stocks with yields > 3% with yields above 3% and strong payout histories.

- Tap into future growth by seizing the opportunity in these 27 AI penny stocks, where artificial intelligence is reshaping entire sectors.

- Stay ahead of the curve and target potential bargains with these 877 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACS

PACS Group

Through its subsidiaries, operates skilled nursing facilities and assisted living facilities in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives