- United States

- /

- Medical Equipment

- /

- NYSE:OWLT

Owlet (OWLT): Valuation Check After New 1 Natural Way Partnership Expands BabySat Insurance Access

Reviewed by Simply Wall St

Owlet (OWLT) is back on traders’ screens after announcing a new DME partnership with 1 Natural Way, opening insurance backed access to its FDA cleared BabySat monitor for higher risk infants nationwide.

See our latest analysis for Owlet.

The DME deal lands after a busy stretch that included the UK and Ireland rollout of Owlet360 and a recent shelf registration closing. The market seems to be reassessing the story, with the share price at $14.05 and a powerful year to date share price return of 219.32 percent, alongside a 1 year total shareholder return of 202.8 percent, pointing to momentum that is still building rather than fading.

If Owlet’s surge has you rethinking your exposure to health focused names, it could be a good moment to explore other opportunities across healthcare stocks and see what else fits your strategy.

With shares now hovering just below analyst targets after a triple digit run and revenue inflecting alongside recurring subscriptions, is Owlet still trading at a discount to its true potential, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 5.5% Undervalued

With Owlet closing at $14.05 against a most popular narrative fair value of $14.88, the implied upside is modest but still meaningful for valuation focused investors.

Analysts are assuming Owlet's revenue will grow by 23.0% annually over the next 3 years. Analysts assume that profit margins will increase from -52.2% today to 2.7% in 3 years time.

Want to see what bridges deep losses to positive margins and fast compounding revenue, all in just a few years? The narrative leans on ambitious growth curves, margin rebuild, and a future earnings multiple more often associated with market darlings than turnarounds. Curious which assumptions really carry the weight in that fair value math, and how sensitive the story is if any of them slip?

Result: Fair Value of $14.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow healthcare channel uptake and prolonged hospital integration cycles could delay subscription growth and test whether today’s optimistic assumptions are truly durable.

Find out about the key risks to this Owlet narrative.

Another Lens on Valuation

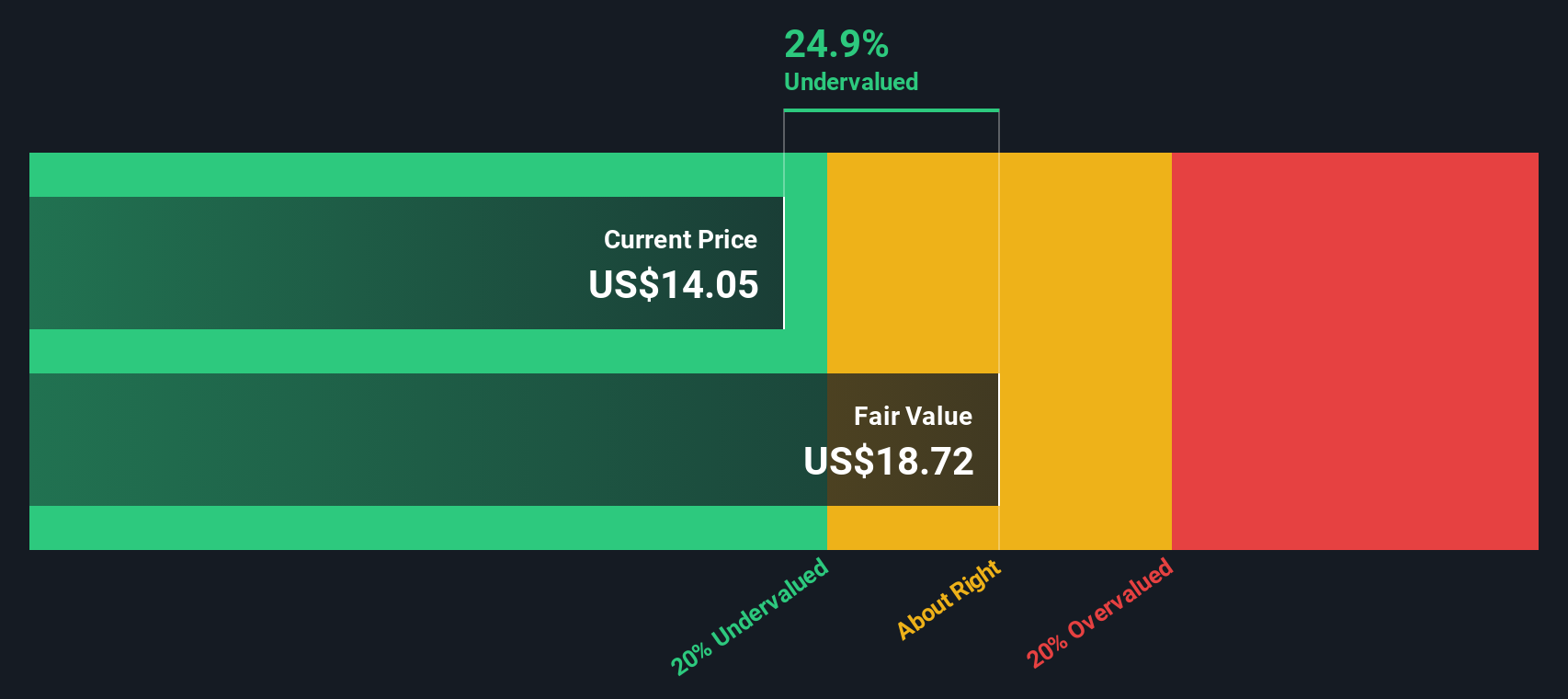

While the popular narrative sees Owlet as about 5.5 percent undervalued, our DCF model is more optimistic, suggesting shares at $14.05 trade roughly 24.9 percent below an $18.72 fair value. If cash flows come through as assumed, is the market underestimating the runway here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Owlet Narrative

If the story here does not fully resonate, or you prefer to lean on your own due diligence, you can shape a fresh perspective in minutes, Do it your way

A great starting point for your Owlet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investing angles?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven ideas that could support the next stage of your portfolio.

- Target reliable cash flow by hunting for income opportunities across these 12 dividend stocks with yields > 3% that can help anchor your returns when growth stories wobble.

- Focus on transformative innovation by tracking these 24 AI penny stocks that may benefit as artificial intelligence reshapes entire industries.

- Explore the intersection of digital assets, blockchain infrastructure, and next generation financial rails by reviewing these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWLT

Owlet

Provides digital parenting solutions in the United States, the United Kingdom, and internationally.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion