- United States

- /

- Medical Equipment

- /

- NYSE:NVST

Envista Holdings (NVST): Exploring Valuation Insights After Recent Subtle Share Price Gains

Reviewed by Kshitija Bhandaru

Envista Holdings (NVST) shares recently edged higher, climbing over 1% to close at $20.85. While there has not been a major event driving this move, investors may be watching the stock’s steady performance for hints about future direction.

See our latest analysis for Envista Holdings.

After holding steady throughout most of this year, Envista Holdings’ latest uptick reflects a gradual return of investor interest. While momentum has been mild, the stock’s 1-year total shareholder return of 10.7% signals that long-term holders have seen reasonable gains, even as recent months brought only modest share price growth.

If you're weighing where to look next, it’s a smart moment to broaden your sights and discover See the full list for free.

With shares trading just shy of analyst price targets while still showing a sizable intrinsic discount, the big question now is whether Envista Holdings is truly undervalued or if expectations for future growth are already fully factored into the price.

Most Popular Narrative: 2.6% Undervalued

Envista Holdings’ widely followed narrative sets fair value at $21.42, just above the last close of $20.85. This suggests a narrow but meaningful gap and sparks debate about whether the market is catching up or underestimating future prospects.

Accelerated double-digit growth in emerging markets (Latin America, Indo Pacific, Middle East, Africa) and ongoing manufacturing expansion in China positions Envista to benefit from expanding middle classes and increasing global demand for dental care. This is likely to drive stronger international revenue and more balanced geographic growth.

Want to know the strategy behind Envista’s fair value? The secret is a powerful combination of international momentum and a projected leap in profitability. Curious which financial shifts analysts are betting on to move that price target? Don’t miss the surprising assumptions that drive this valuation outlook.

Result: Fair Value of $21.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressures in China and global trade barriers could still disrupt Envista’s growth outlook. This situation puts its fair value narrative to the test.

Find out about the key risks to this Envista Holdings narrative.

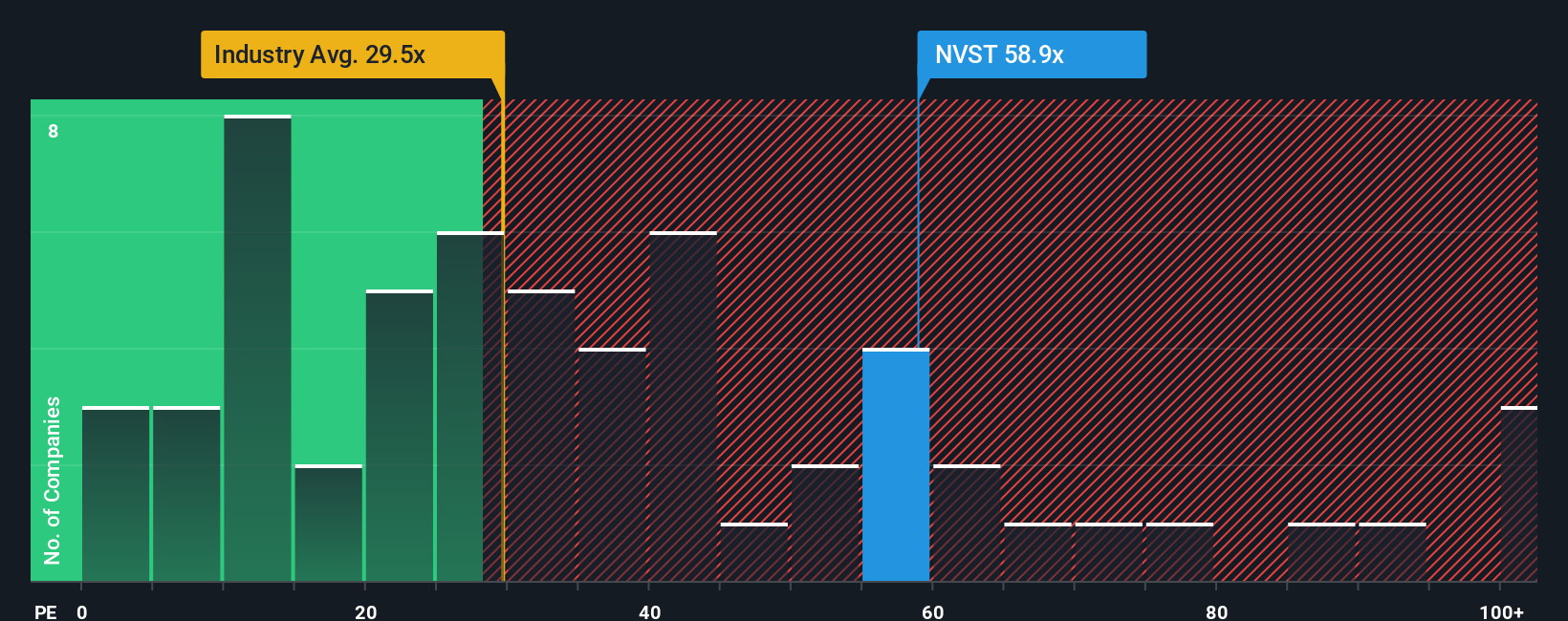

Another View: High Market Premium Raises Questions

Looking at valuation through a different lens, the company's price-to-earnings ratio currently stands at 64.4x. This is not only much higher than both the US Medical Equipment industry average of 30.4x and the peer average of 44.5x, but also well above its fair ratio of 30.2x. This sizable premium suggests the market may already be pricing in future growth, which elevates the risk if those expectations are not met. Does this premium signal a warning for cautious investors, or is it justified for a company in transition?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Envista Holdings Narrative

If you see things differently or want to take your own approach, you can dive into the numbers and build a personal narrative in just a few minutes, Do it your way.

A great starting point for your Envista Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect moment to supercharge your portfolio with investment ideas you might otherwise overlook. Fresh opportunities are waiting, so don't let the next breakout stock pass you by.

- Capitalize on game-changing innovation by scanning these 24 AI penny stocks, where artificial intelligence leaders are transforming entire industries.

- Lock in steady income streams from these 19 dividend stocks with yields > 3%, offering attractive yields above 3% for income-focused investors.

- Step into the future of money and technology with these 78 cryptocurrency and blockchain stocks, as you track companies leveraging blockchain and digital assets for exponential growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envista Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVST

Envista Holdings

Develops, manufactures, markets, and sells dental products in the United States, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives