- United States

- /

- Healthcare Services

- /

- NYSE:MOH

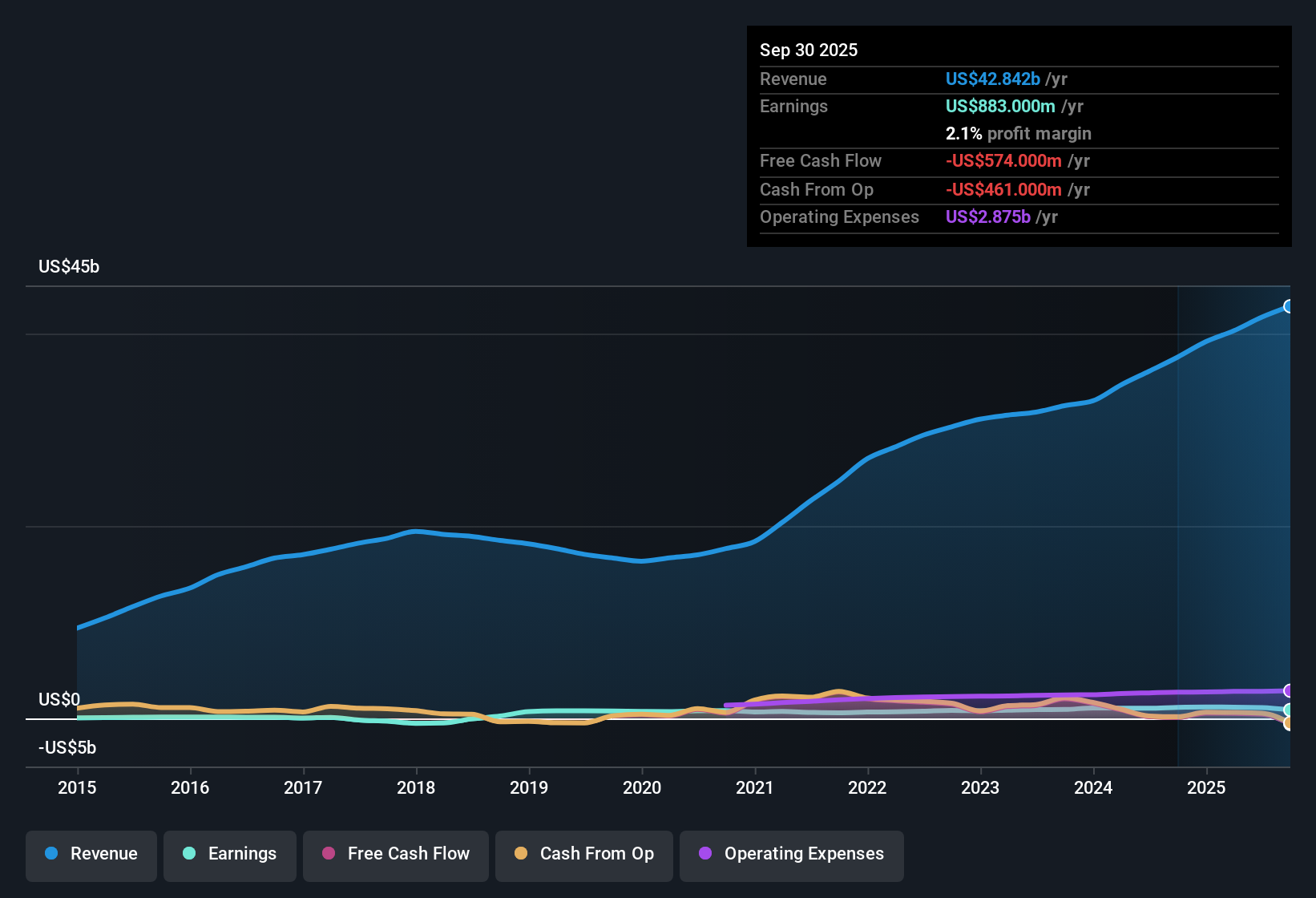

Molina Healthcare (MOH): Margin Decline to 2.1% Underscores Key Concern for Bulls

Reviewed by Simply Wall St

Earnings at Molina Healthcare (MOH) have grown at an average pace of 12% per year over the past five years, with forward estimates pointing to a 10.74% annual rise. The most recent data puts net profit margins at 2.1%, a step down from last year’s 3% and a trend that investors will be closely watching. While top-line growth remains solid, continued profit expansion will depend on how effectively the company addresses this margin pressure and maintains its current momentum.

See our full analysis for Molina Healthcare.Next, we will measure the latest numbers against key market narratives, offering a closer look at where the data supports consensus expectations and where surprises might emerge.

See what the community is saying about Molina Healthcare

Medicaid Wins Drive Revenue Momentum

- Molina's new contracts in Nevada and Illinois are set to add around $800 million in annual premium revenue. This provides a clear boost to top-line growth beyond the current trend.

- Analysts' consensus view continues to highlight Molina’s success in winning Requests for Proposal (RFPs), stating that these contract gains and Medicaid-focused strategy are expected to enhance both revenue and earnings per share growth over the next several years.

- Consensus narrative notes that expected Medicaid rate adjustments will result in slightly better-than-planned revenue uplifts. This reinforces the outlook for meaningful revenue expansion.

- Despite the extra growth, some concerns remain about integration execution. Analysts point out that successful coordination of care for high-acuity Medicare beneficiaries is key for maintaining net margins alongside revenue gains.

Margin Pressure Remains in Focus

- With net profit margins slipping from 3% last year to 2.1% now, the margin squeeze stands out as a central theme in recent results and casts ongoing pressure on profitability.

- Analysts' consensus view acknowledges the company’s disciplined medical cost management and strategic acquisitions as pathways to future margin stabilization, even as the risk of rising medical costs and tougher integration looms.

- Bears argue that moderate increases in costs for high-need drugs and behavioral health could further pressure net margins, especially if future rate adjustments are not sufficient to cover the trend.

- There is also an ongoing risk from the loss of the Virginia Medicaid contract, which could cut revenue and earnings unless offset elsewhere.

Valuation Stands Out Versus Peers

- Molina shares trade at a Price-To-Earnings Ratio of 9.3x, which is well below the US healthcare industry average of 21.8x and also at a discount to peers at 29.7x. This gap positions the stock attractively for value-focused investors.

- Analysts' consensus view connects this lower valuation to the relatively small difference between the current share price of $161.00 and the consensus analyst price target of $193.73, indicating that while upside exists, the market already reflects much of the expected growth.

- What is notable is that despite these lower valuation multiples, analysts remain constructive. They suggest the business is viewed as high quality even as they factor in the margin compression and operational risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Molina Healthcare on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your perspective and build your personal take in just a few minutes with Do it your way.

A great starting point for your Molina Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Molina’s shrinking net margins and ongoing integration risks could make it difficult for the company to maintain consistent profit growth in the future.

If steady expansion appeals to you, use stable growth stocks screener (2090 results) to uncover companies that deliver reliable earnings and revenue even when others face pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)