- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Did Lawsuits Over Cost Assumptions and Guidance Cuts Just Shift Molina Healthcare's (MOH) Investment Narrative?

Reviewed by Sasha Jovanovic

- Molina Healthcare has recently become the subject of multiple securities class action lawsuits and shareholder investigations alleging failures to disclose material adverse information about its medical cost trend assumptions, premium rate misalignment, and 2025 financial guidance cuts.

- These legal actions highlight concerns not just about current earnings pressure, but also about governance, disclosure practices, and how reliably investors can assess Molina’s underlying medical cost risks.

- We’ll now examine how these disclosure-related lawsuits and investigations could affect Molina Healthcare’s investment narrative, especially its medical cost management assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Molina Healthcare Investment Narrative Recap

To own Molina Healthcare, you need to believe it can price and manage medical costs accurately in tightly regulated Medicaid and Marketplace programs. The current lawsuits directly challenge that premise, since they focus on alleged misstatements around medical cost trends and 2025 guidance. In the near term, the most important catalyst remains Molina’s ability to realign premium rates with underlying costs, while the biggest risk is that higher-than-expected medical costs persist without timely rate relief.

Among recent developments, the wave of securities class actions and shareholder investigations is most relevant, because it speaks directly to disclosure around medical cost assumptions and premium misalignment. These cases add another layer of uncertainty on top of already rising operating expenses and pressure on the medical care ratio, and they could keep investor attention tightly focused on how transparent and credible Molina’s future guidance and cost management disclosures really are.

Yet investors should also be aware that allegations of premium rate misalignment and rising medical costs could...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's narrative projects $50.7 billion revenue and $1.3 billion earnings by 2028. This requires 6.8% yearly revenue growth and roughly a $0.2 billion earnings increase from $1.1 billion today.

Uncover how Molina Healthcare's forecasts yield a $170.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

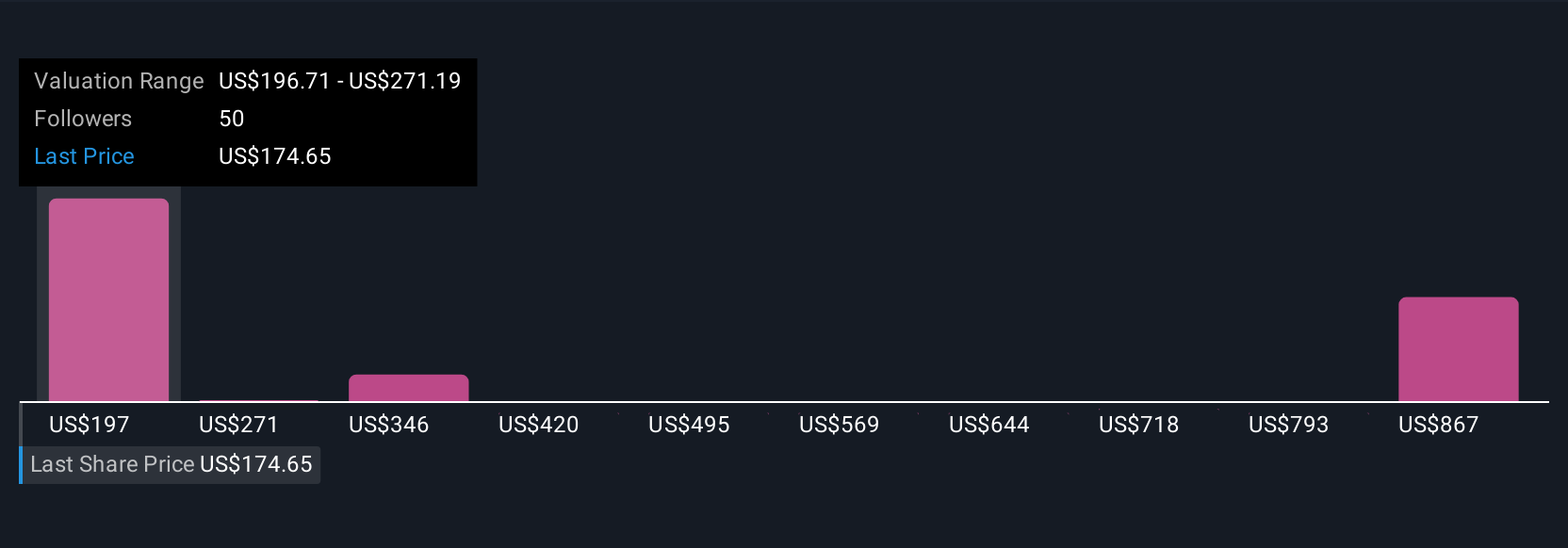

Ten members of the Simply Wall St Community currently value Molina between US$170 and about US$649 per share, showing very different expectations. When you set those against the legal challenges around medical cost assumptions and 2025 guidance, it underlines why you may want to compare several views before deciding what Molina’s future could look like.

Explore 10 other fair value estimates on Molina Healthcare - why the stock might be worth just $170.00!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026