- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (NYSE:MDT) Reports Q4 Revenue Increase To US$8,927 Million, Provides FY26 Guidance

Reviewed by Simply Wall St

Medtronic (NYSE:MDT) recently reported impressive fourth-quarter results with sales and net income showing significant year-over-year increases. This may have helped the company's shares rise by 5% over the last month. The announced guidance for fiscal year 2026 also points toward continued growth, though external factors like currency fluctuations might pose challenges. The S&P 500 index remained relatively flat in the same period, indicating that Medtronic's robust earnings and strategic guidance could have added weight to its stock performance, countering the steadiness observed in the broader market.

Buy, Hold or Sell Medtronic? View our complete analysis and fair value estimate and you decide.

The recent uptick in Medtronic's share price by 5% over the past month aligns with strong financial results and promising guidance for fiscal year 2026. This suggests potential upside from emerging technologies like the Hugo robotic platform and expansions in the Cardiac Ablation Solutions business. The Medicare approval of RDN techniques further strengthens these projections, which could positively impact anticipated revenue and earnings. Despite competitive pressures and regulatory hurdles, these advancements may support Medtronic’s long-term growth narrative.

Over the past year, Medtronic's total return, including dividends, was 4.84%. This performance underperforms the US Medical Equipment industry which returned 9.7%. Longer-term, over a year, shareholders have experienced a consistent increase, aligning closer with the industry's growth rhythm. The S&P 500 index's comparative flatness during Medtronic's share price increase illustrates that Medtronic outperformed the broader market to some extent.

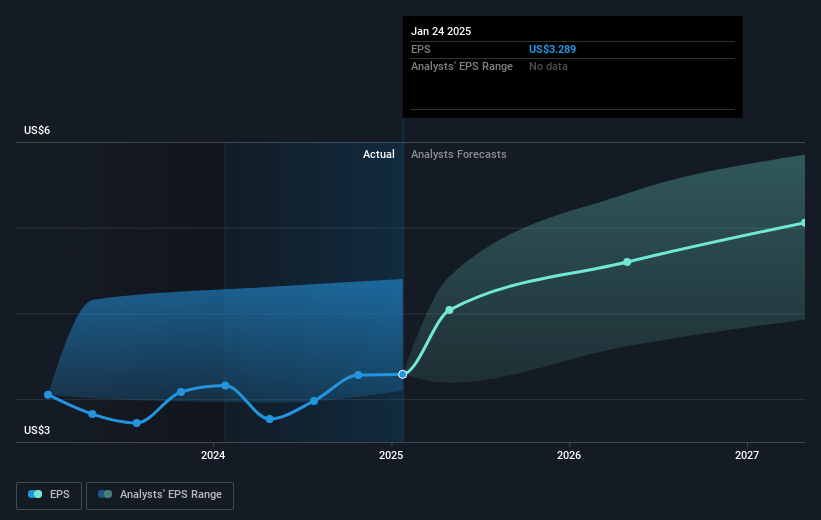

Regarding valuation, Medtronic's current share price of US$82.32 is trading at a 15.2% discount to the consensus analyst price target of US$97.10. Analysts anticipate that Medtronic's revenue will grow at 4.9% annually, with expected earnings to reach US$5.9 billion by 2028. This trajectory, supported by ongoing projects and Medicare developments, underpins the optimism reflected in the price target. Investors should consider how factors like currency fluctuations and distribution dynamics might influence these forecasts.

Evaluate Medtronic's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives