- United States

- /

- Healthcare Services

- /

- NYSE:MCK

McKesson (NYSE:MCK) Declares US$0.71 Dividend Per Share Payable July 2025

Reviewed by Simply Wall St

McKesson (NYSE:MCK) recently issued a regular dividend of 71 cents per share, which may have been a positive indicator to investors. During the same quarter, the company reported strong third-quarter earnings with increased sales and net income, potentially supporting its 17.9% share price increase despite a U.S. economic contraction reported in the first quarter. Moreover, McKesson's introduction of the Precision Care Companion initiative reflects its commitment to innovation. These developments occurred amid a broader market trend of gains and rising investments in AI by big tech firms, which likely provided a favorable backdrop for McKesson's positive stock movement.

Recent developments, such as McKesson's 71 cents dividend per share and strong third-quarter earnings, have likely contributed positively to investor sentiment. These steps align with McKesson's broader strategies, such as the Precision Care Companion initiative and the PRISM Vision acquisition, which are geared towards enhancing its specialty services. These initiatives are anticipated to support revenue growth and possibly improve operational efficiency, though regulatory challenges and reduced volumes in certain segments might pose risks to these expectations.

Over the past five years, McKesson's total shareholder return, including dividends, has increased by a very large amount, showcasing substantial long-term value creation. This substantial growth contrasts with the past year's performance, where McKesson outperformed the US Healthcare industry, achieving positive returns while the industry faced an 8% decline. This discrepancy underscores McKesson's resilience against broader market challenges.

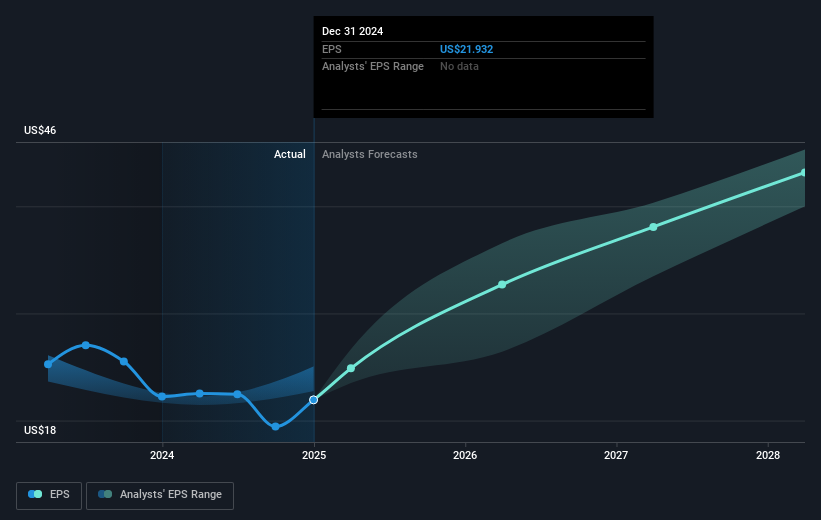

The recent share price movement, a 17.9% rise likely due to strong earnings and strategic initiatives, is closely aligned with the current analyst price target of US$709.65. With a share price near US$707.28, this indicates a minimal discount, suggesting that the market views McKesson as fairly valued. This alignment implies confidence in the company's projected revenue and earnings growth, despite any existing headwinds that could affect future forecasts.

Learn about McKesson's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives