- United States

- /

- Healthcare Services

- /

- NYSE:MCK

McKesson (MCK): Revisiting Valuation After a Recent Pullback in a Longer-Term Uptrend

Reviewed by Simply Wall St

McKesson (MCK) has quietly pulled back about 8% over the past week and 4% over the past month, even though the stock is still up roughly 18% in the past 3 months.

See our latest analysis for McKesson.

At around $808.62 per share, McKesson’s recent pullback comes after a strong run, with its year to date share price return still firmly positive and a three year total shareholder return above 100%. This suggests momentum is consolidating rather than breaking.

If McKesson’s move has you rethinking where healthcare fits in your portfolio, this could be a good moment to discover healthcare stocks for more ideas beyond the usual names.

With earnings still growing at double digits and the share price trading at a notable discount to analyst targets and some intrinsic value estimates, is McKesson quietly setting up a fresh buying opportunity, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 13.5% Undervalued

With McKesson last closing at $808.62 versus a fair value estimate near $934.79, the most widely followed narrative sees meaningful upside still on the table.

Increasing complexity of the pharmaceutical supply chain (e.g., biosimilars, cold chain logistics, personalized medicine) disproportionately benefits large, sophisticated distributors like McKesson. This enables competitive market share gains and enhanced supply chain resiliency, contributing to both top line and margin expansion.

Curious how steady but rising revenues, fatter margins, and a leaner share count combine into that higher price tag? The narrative maps a surprisingly aggressive earnings path and a premium future multiple usually reserved for faster growth stories. Want to see the full financial playbook behind that confidence?

Result: Fair Value of $934.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on drug pricing policy and consolidation trends, which could squeeze margins or reduce McKesson’s role in the pharma supply chain.

Find out about the key risks to this McKesson narrative.

Another Angle on Valuation

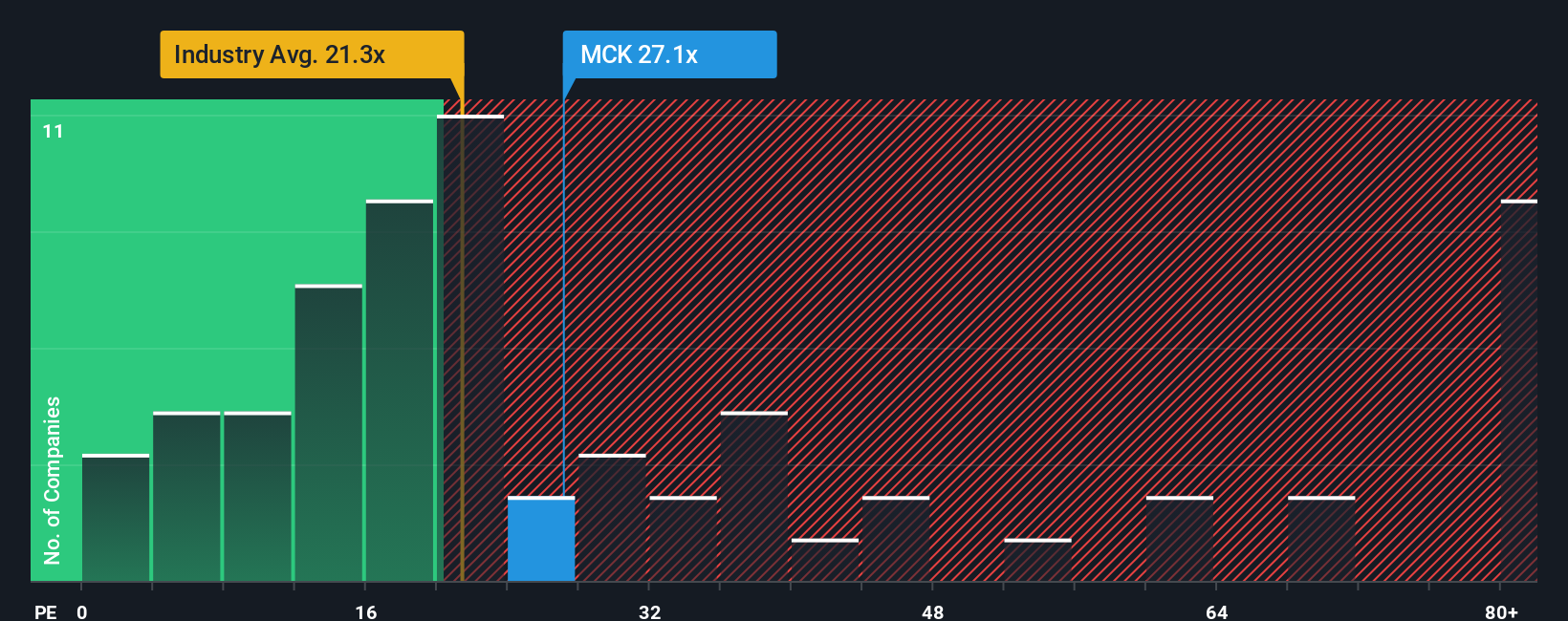

Look past the narrative of fair value and McKesson still screens as cheap on earnings. Its current P/E of 24.7 times sits below peers at 27.9 times, and well under a 33 times fair ratio our models suggest the market could move toward, which hints at more room for re rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you see the story differently or want to test your own assumptions using the same data, you can build a fresh view in minutes: Do it your way.

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more high conviction ideas?

Before markets move on without you, put your research edge to work with targeted stock ideas tailored to specific themes and strategies on Simply Wall Street.

- Capture early stage potential by scanning these 3576 penny stocks with strong financials that already show strong financial foundations instead of relying on hype alone.

- Target the next wave of innovation by focusing on these 30 healthcare AI stocks that blend medical expertise with scalable AI driven platforms.

- Lock in more resilient income streams by zeroing in on these 15 dividend stocks with yields > 3% that can strengthen the yield side of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026