- United States

- /

- Healthcare Services

- /

- NYSE:MCK

McKesson (MCK): Evaluating Valuation After Launching PHYRAGO Oncology Partnership

Reviewed by Kshitija Bhandaru

Cycle Pharmaceuticals has just launched PHYRAGO, a new oncology therapy, in the US with distribution handled through McKesson. This partnership demonstrates how McKesson uses its specialty pharmaceutical distribution network to expand its presence in healthcare.

See our latest analysis for McKesson.

McKesson’s ability to leverage partnerships for major drug launches like PHYRAGO has coincided with strong price momentum, as seen in its 1-month share price return of 13.5%. The company’s 55% total shareholder return over the past year signals growing long-term confidence in its growth story.

If you’re watching how healthcare distribution leaders are performing, you’ll probably enjoy browsing See the full list for free.

But with shares reaching new highs and fundamentals looking solid, should investors see McKesson as undervalued with more room to run, or is the market already accounting for all its future growth?

Most Popular Narrative: 5.3% Undervalued

Compared to the last close price, the narrative’s fair value estimate puts McKesson at a slight discount, highlighting ongoing optimism about medium-term earnings growth and profitability. This viewpoint is being closely tracked by the market given McKesson’s rapid price gains and bullish analyst sentiment.

Investments in digitization, automation, and advanced analytics across distribution centers and logistics (for example, automated picking systems, AI, robotics) are enhancing operational efficiency, driving measurable reductions in operating expenses and supporting long-term net margin improvement.

Think McKesson's future value rests on just steady sales? The real story is how new technologies and better margins are baked into the calculations. Want to find out which bold profit projections underpin the latest price target, and where analysts see headroom for more growth? See what could change your outlook in the full narrative.

Result: Fair Value of $829.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory pressure on drug prices and industry consolidation remain factors that could challenge McKesson’s profit expansion narrative in the future.

Find out about the key risks to this McKesson narrative.

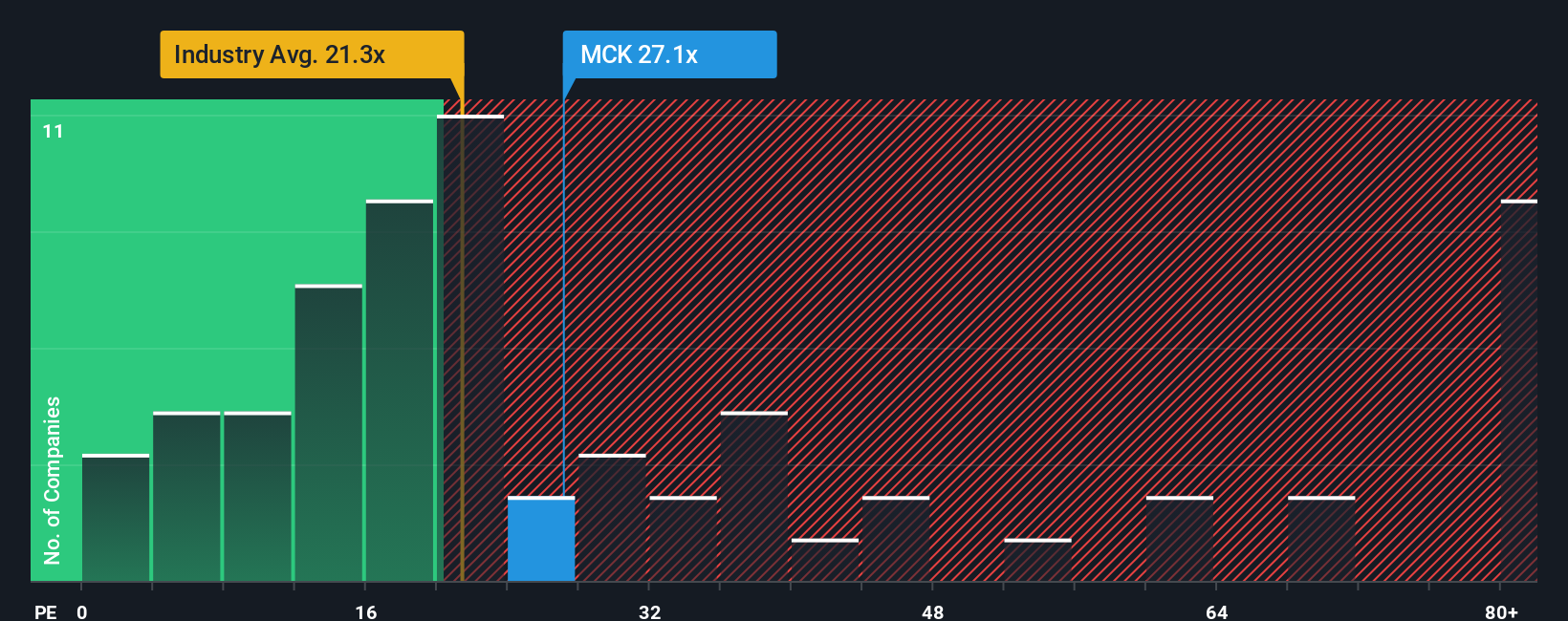

Another View: Multiples Suggest Caution

Looking at traditional valuation ratios, McKesson trades at a price-to-earnings multiple of 30.9x, which is considerably higher than both its peer average of 23.3x and the US Healthcare industry average of 21.2x. While the industry may eventually move closer to McKesson’s fair ratio of 31.2x, the current premium signals investors are paying up for future profits. This carries its own risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you’d like to dig deeper or see things from a different angle, you can build your own narrative in just a few minutes using Do it your way.

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the market by seeking opportunities others might overlook. Take action now and uncover unique stocks with serious upside potential across various themes.

- Target high growth and strong balance sheets by sorting through these 877 undervalued stocks based on cash flows where cash flows point to untapped value that may be overlooked by the crowd.

- Spot tomorrow’s innovation winners and stay one step ahead of tech trends inside these 24 AI penny stocks, which focuses on artificial intelligence breakthroughs.

- Unlock income potential instantly by screening these 18 dividend stocks with yields > 3% for stocks with dividend yields above 3% and the strength to sustain them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives