- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Is McKesson's (MCK) Role in PHYRAGO's Launch Revealing Its Specialty Pharma Ambitions?

Reviewed by Sasha Jovanovic

- Earlier this month, Cycle Pharmaceuticals announced the US launch of PHYRAGO, its first oncology product, in partnership with Handa Therapeutics, with exclusive availability through Onco360 and distribution supported by McKesson, Cencora, and Cardinal Health.

- This collaboration highlights McKesson's ongoing role in the specialty pharmaceutical supply chain, particularly in oncology, through exclusive access to newly launched therapies.

- We'll now explore how McKesson's involvement in distributing PHYRAGO may influence its position within the specialty pharmaceutical sector and shape its investment story.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

McKesson Investment Narrative Recap

To invest in McKesson, you need to believe in sustained growth from rising demand for specialty and oncology pharmaceuticals, backed by the company's scale and critical supply chain role. While McKesson's involvement in the PHYRAGO launch reinforces its position within the specialty market, the event itself does not materially affect its immediate catalysts or shift the biggest current risk, potential disintermediation from vertical integration among drug manufacturers and payers.

One recent announcement closely connected to this theme is McKesson’s April launch of the Precision Care Companion initiative, aimed at advancing cancer treatment through technology and operational best practices. This aligns with the ongoing rise of specialty pharmaceuticals as a catalyst, reflecting the company's efforts to solidify its foothold in oncology distribution and related services.

But against these growth drivers, investors should keep an eye on the accelerating trend of vertical integration among drug manufacturers and payers, which has the potential to...

Read the full narrative on McKesson (it's free!)

McKesson's outlook anticipates $478.8 billion in revenue and $5.3 billion in earnings by 2028. This scenario assumes an 8.2% annual revenue growth rate and a $2.1 billion increase in earnings from the current level of $3.2 billion.

Uncover how McKesson's forecasts yield a $829.57 fair value, a 6% upside to its current price.

Exploring Other Perspectives

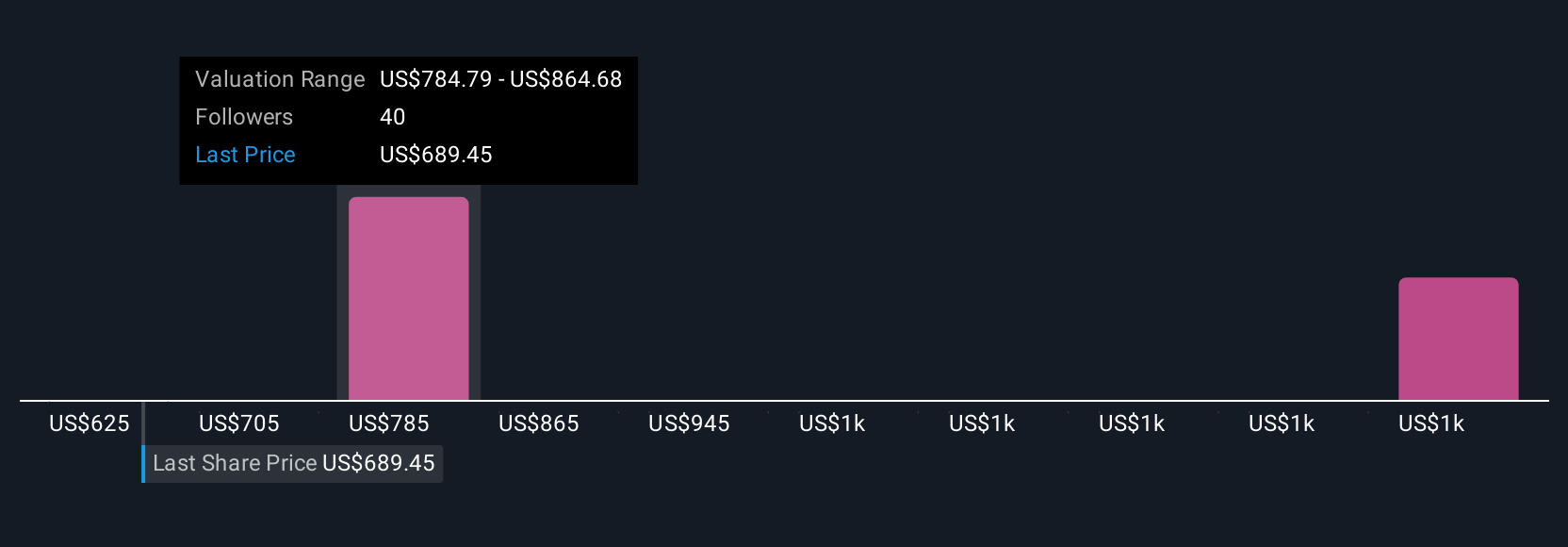

Simply Wall St Community members estimate McKesson's fair value from US$625 to US$1,365, reflecting a wide spectrum of opinions across 5 individual analyses. Growing complexity in pharmaceutical supply chains may disproportionately benefit large distributors, but it is worth considering how future shifts could reshape your expectations, compare your own outlook to these varied perspectives.

Explore 5 other fair value estimates on McKesson - why the stock might be worth 20% less than the current price!

Build Your Own McKesson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McKesson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McKesson's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives