- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Is McKesson's (MCK) Play-Based Pediatric Shift Signaling a Deeper Bet on Healthcare Consumerization?

Reviewed by Simply Wall St

- Playhouse MD™ announced that its doctor-designed, play-focused pediatric medical devices are now available to millions of families nationwide through a distribution alliance with McKesson Medical-Surgical, a subsidiary of McKesson Corporation, and via Amazon.

- This partnership marks the first play-based pediatric brand in McKesson Medical-Surgical's portfolio of more than 300,000 products, highlighting McKesson's ongoing expansion into consumer-oriented healthcare solutions.

- We'll assess how McKesson's entry into innovative pediatric offerings aligns with its broader restructuring and healthcare consumerization strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

McKesson Investment Narrative Recap

For shareholders, the key narrative around McKesson is its position as a major distributor in a highly regulated, competitive, and evolving healthcare market. The addition of Playhouse MD™ to McKesson’s product portfolio signals a growing push into consumer-focused offerings but is unlikely to move the needle on the most important short-term catalyst: growth in specialty and oncology pharmaceuticals. The biggest risk remains ongoing regulatory pressure on healthcare costs, which continues to challenge profit margins.

Among recent announcements, McKesson’s planned acquisition of Florida Cancer Specialists & Research Institute for about US$3.5 billion stands out. While the Playhouse MD™ partnership highlights a move into new consumer categories, the expansion of specialty and oncology services remains the dominant near-term driver for the company’s growth prospects.

In contrast, investors should also keep in mind the substantial effects that regulatory and governmental action around pricing could still have on McKesson’s earnings trajectory…

Read the full narrative on McKesson (it's free!)

McKesson's narrative projects $478.8 billion in revenue and $5.3 billion in earnings by 2028. This requires 8.2% yearly revenue growth and a $2.1 billion earnings increase from the current $3.2 billion.

Uncover how McKesson's forecasts yield a $788.57 fair value, a 13% upside to its current price.

Exploring Other Perspectives

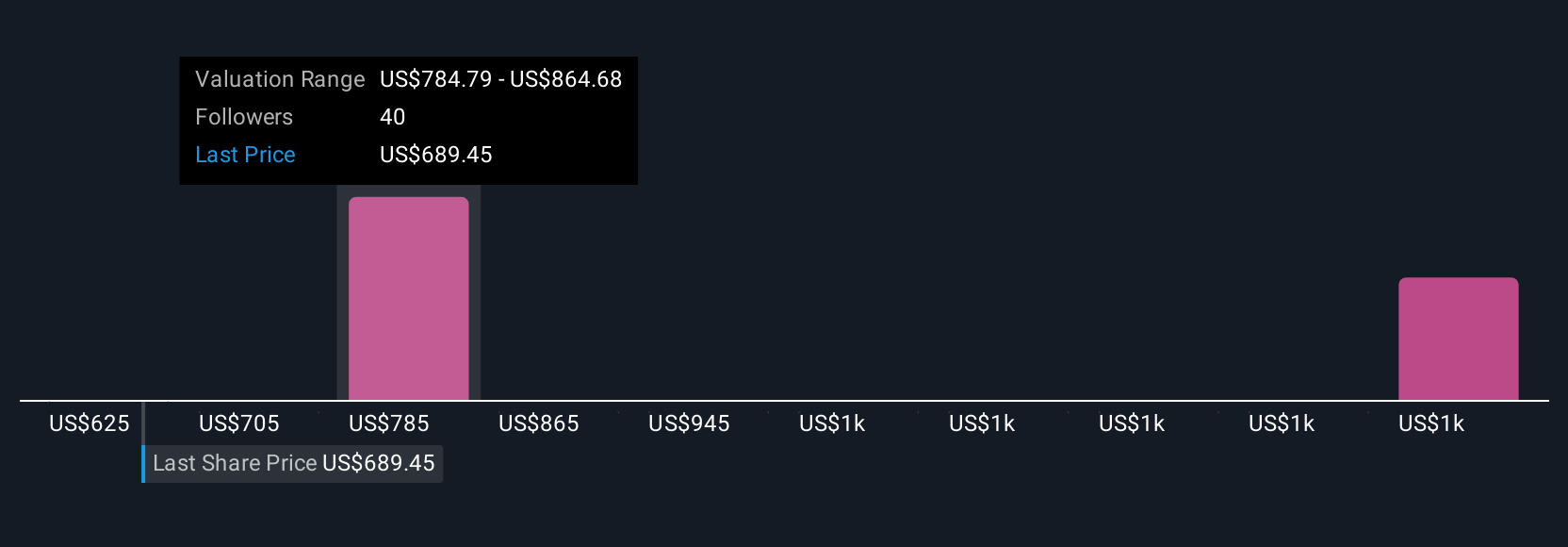

Simply Wall St Community members have estimated McKesson’s fair value between US$625 and US$1,423, showcasing broad divergence across just four forecasts. As you evaluate these views, remember that regulatory pressure on healthcare pricing could impact the company’s future profitability and warrants further consideration.

Explore 4 other fair value estimates on McKesson - why the stock might be worth over 2x more than the current price!

Build Your Own McKesson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McKesson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McKesson's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives