- United States

- /

- Healthcare Services

- /

- NYSE:LH

Labcorp Holdings (LH) Unveils Test Finder: AI Tool for Streamlined Lab Test Selection

Reviewed by Simply Wall St

Labcorp Holdings (LH) made significant advancements with the launch of its Test Finder tool, developed in collaboration with Amazon Web Services, aimed at enhancing lab test selection for healthcare providers. This innovation, alongside other recent achievements such as the CE-Mark for PGDx elio™ tissue complete and the launch of new health solutions, likely contributed to the company's 9% price increase last quarter. While the broader market experienced positive momentum, supported by strong earnings reports from major tech companies like Microsoft and Meta, Labcorp's strategic enhancements in healthcare technology and diagnostics further strengthened its position in the industry.

You should learn about the 2 possible red flags we've spotted with Labcorp Holdings.

The recent advancements by Labcorp Holdings, particularly the launch of the Test Finder tool in collaboration with Amazon Web Services, support the company's narrative of expanding its specialty testing capabilities and enhancing margins. These innovations align with Labcorp's broader focus on strategic partnerships and high-value services, which are crucial for positioning the company to capture future market opportunities. As Labcorp continues developing biopharma services and direct-to-consumer diagnostics, these efforts could positively influence its revenue and earnings forecasts, reinforcing its long-term growth strategy.

Over the past five years, Labcorp's total shareholder return, including dividends, reached 65.31%, indicating robust performance for investors. However, on a one-year basis, the company's returns surpassed the US Healthcare industry's decline of 36% and exceeded the broader US market's 17.5% growth, highlighting its resilience amid sector fluctuations.

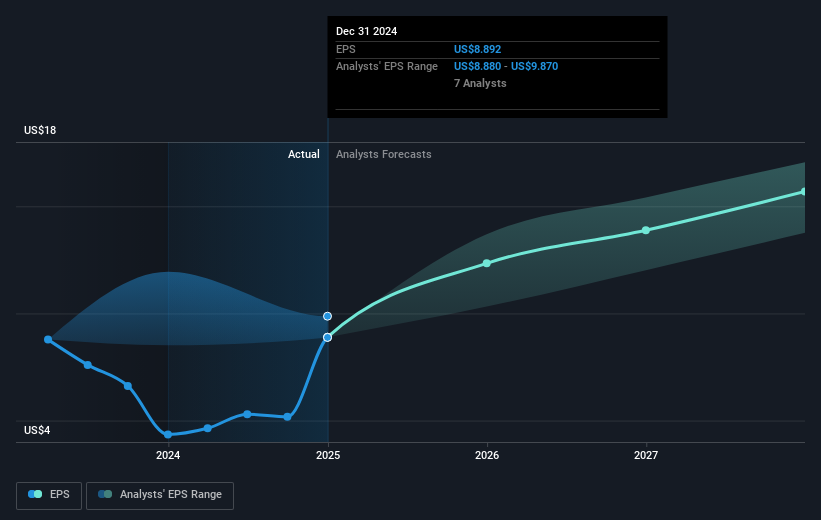

Currently trading at $263.91, Labcorp's share price remains below the consensus price target of $291.65, offering a potential 10.5% upside. Analysts project revenues to grow to $15.7 billion, with earnings reaching $1.3 billion in three years, driven by continued operational efficiencies and market leadership. Despite existing risks, such as regulatory pressures and integration challenges, Labcorp's strategic moves in healthcare technology and diagnostics set a promising trajectory for future value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LH

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives