- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Is the Current Valuation a Potential Opportunity After Recent Price Steadiness?

Reviewed by Simply Wall St

See our latest analysis for Inspire Medical Systems.

While Inspire Medical Systems staged a mild comeback with a 1.24% 1-month share price return, the bigger story is its sharp pullback year-to-date and a 59.8% total return decline over the last year. That retreat suggests shifting market confidence, though recent steadiness may indicate investors are weighing the company’s long-term growth prospects against recent volatility.

If you're searching for fresh ideas in healthcare and medtech, take the next step and explore See the full list for free.

With shares trading well below analyst targets but following steep declines, investors are left to wonder whether Inspire Medical Systems is undervalued and poised for a rebound, or if the market has already priced in all future growth.

Most Popular Narrative: 38.7% Undervalued

With Inspire Medical Systems closing at $78.20, the most popular narrative values the company nearly 40% higher, setting the stage for a bold thesis about future upside driven by upcoming catalysts.

The second half of 2025 will see a ramp in marketing and new center expansion following a purposeful pause in H1 amid the Inspire V launch. This resurgence in patient education, awareness campaigns, and provider capacity building should drive higher procedure volumes and top-line acceleration into 2026 and beyond.

Want to discover the key financial levers pushing this fair value skyward? Behind this narrative is a set of aggressive forecasts for revenue, profits, and margin expansion that might surprise you. How do these optimistic projections, not yet fully reflected in today's share price, add up? Dive in to see what could drive a dramatic upside if bold assumptions hold.

Result: Fair Value of $127.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent execution delays and rising competition could undermine Inspire Medical Systems' recovery and challenge the optimistic case for a swift turnaround.

Find out about the key risks to this Inspire Medical Systems narrative.

Another View: Price-Based Metrics Signal Caution

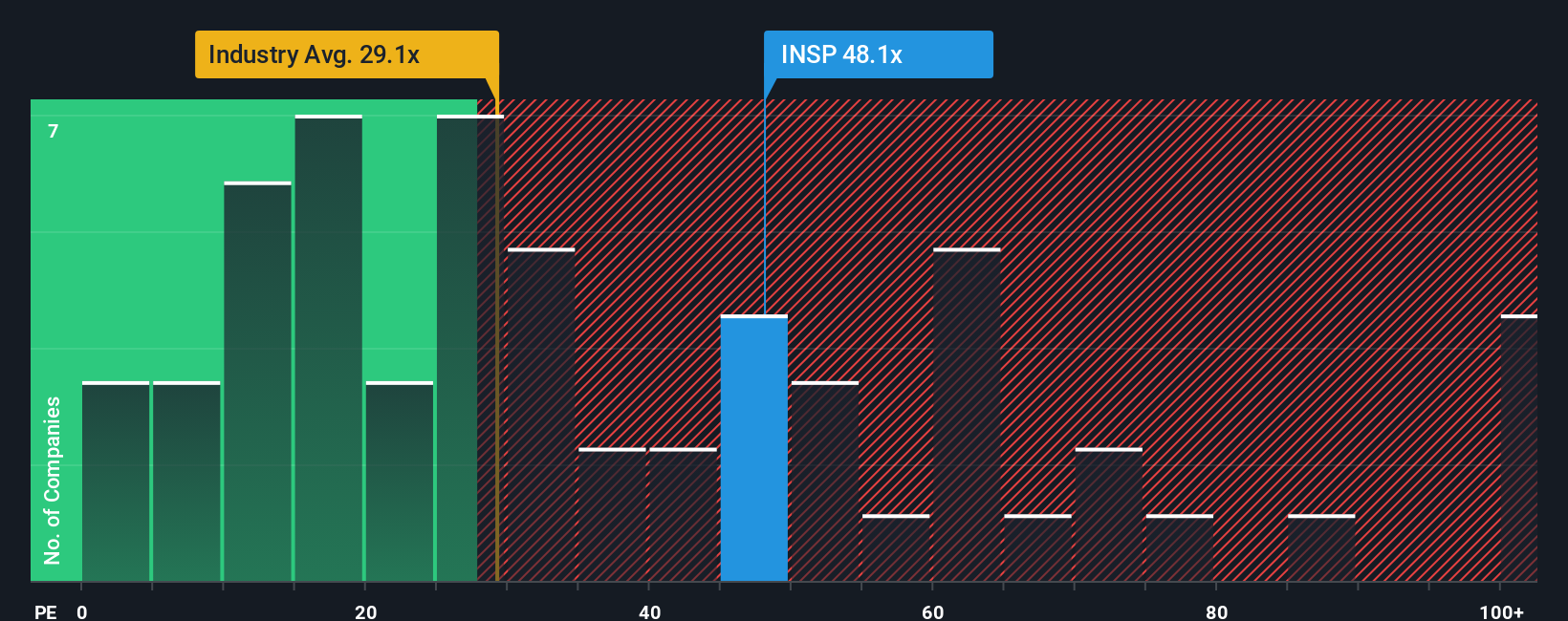

Looking at price-to-earnings, Inspire Medical Systems trades at 43.5x, which is well above the U.S. Medical Equipment industry average of 29.7x and its peer average of 36.9x. The fair ratio is 34.1x. This gap could indicate elevated valuation risk if the market shifts, but it might also suggest overlooked growth potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you want to dig into the numbers or form your own view, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock fresh opportunities before everyone else by tapping into unique stocks making waves in rapidly evolving sectors and trends with the Simply Wall Street Screener.

- Capture growth as artificial intelligence transforms healthcare by evaluating the most promising companies through these 34 healthcare AI stocks. These companies are advancing patient care and medical technology.

- Benefit from attractive yields by scanning these 19 dividend stocks with yields > 3%, which features companies with robust dividends and solid balance sheets designed to help build a resilient income portfolio.

- Capitalize on pricing misalignments by checking these 870 undervalued stocks based on cash flows. This showcases stocks trading below their intrinsic value and provides a fresh assessment based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives