- United States

- /

- Medical Equipment

- /

- NYSE:INSP

A Look at Inspire Medical Systems's Valuation Following CFO Departure and Ongoing Performance Struggles

Reviewed by Simply Wall St

Inspire Medical Systems (NYSE:INSP) has been front and center for investors this week after it announced that CFO Rick Buchholz will be stepping down at the end of 2025. While the company emphasized that Buchholz will stay on in an advisory role until early 2026 to ensure a smooth handover, the timing comes at a challenging moment. The executive shake-up takes place just as the company is working to regain its footing following a meaningful guidance reduction and ongoing challenges rolling out a new product. For anyone tracking INSP, these changes raise fresh questions about the company's long-term game plan and leadership stability at a pivotal moment.

The market has responded quickly with signs of anxiety. After a stretch of growth in revenue and the transition to profitability, the stock has tumbled significantly, down 51% over the past year and off by 35% in the last three months. Even as Inspire Medical reaffirmed its full-year earnings guidance, sentiment has not recovered, reflecting persistent doubts about whether the company can overcome operational bumps and leadership transitions. Long-term investors have watched years of gains evaporate, and momentum remains negative for now.

This all leads to a key question: does the current weakness offer a buying window for INSP, or is Wall Street right to be cautious with more hurdles ahead?

Most Popular Narrative: 35% Undervalued

The most widely followed narrative suggests Inspire Medical Systems is meaningfully undervalued, with the fair value estimated well above current share prices.

Expanded coverage and proposed reimbursement increases for Inspire's procedures, notably the expected 2026 Medicare OPPS rule enhancements and near-complete payer coverage of the new CPT code, will reduce patient out-of-pocket costs and incentivize additional adoption. This supports both revenue growth and longer-term earnings visibility.

Curious how this valuation is possible? The secret lies in a set of growth assumptions that go far beyond recent financial results. Could this company be on the verge of an earnings surge, driven by procedure breakthroughs and fresh reimbursement tailwinds? Discover which numbers the narrative writers believe justify such a bold price target. The true upside story is hidden in the fine print.

Result: Fair Value of $144.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slower rollout of Inspire V, or rising operating expenses that outpace revenue, could easily undermine optimism about an earnings reacceleration.

Find out about the key risks to this Inspire Medical Systems narrative.Another View: A Look at Market Comparisons

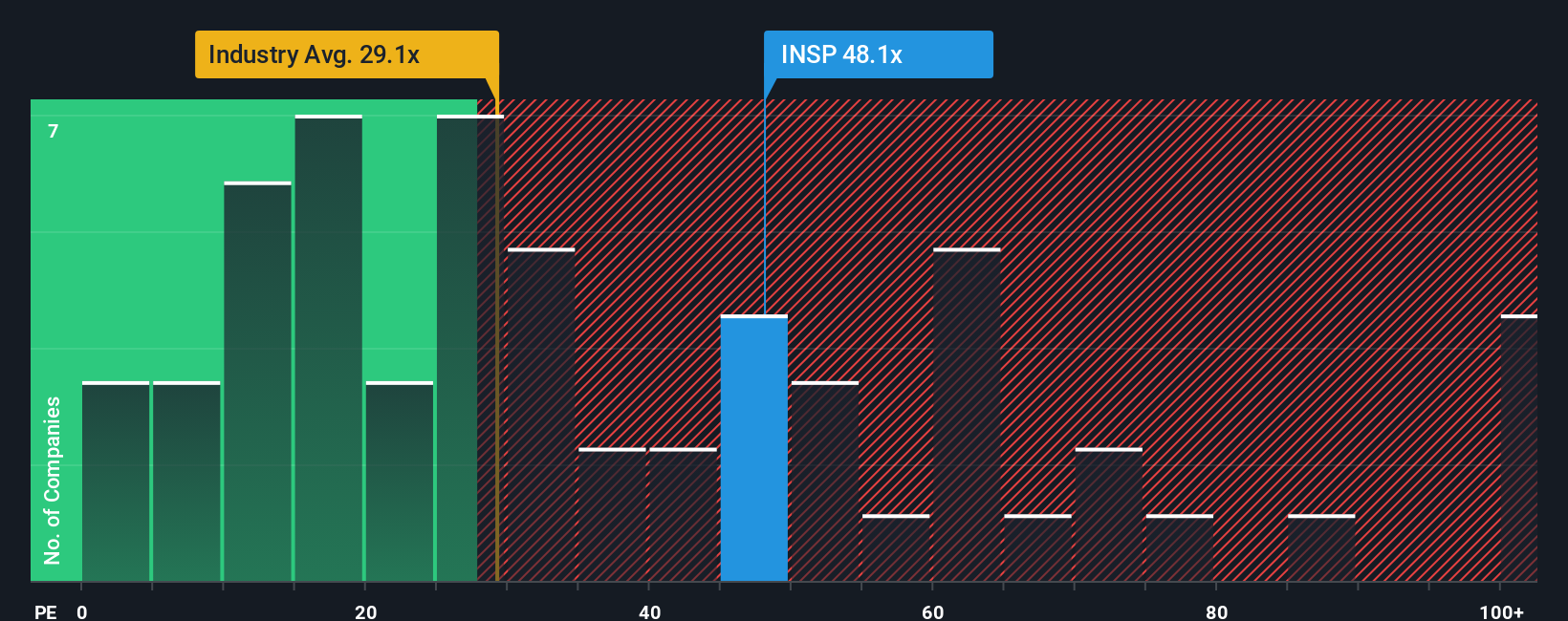

While analysts see potential upside, looking at the company’s valuation compared to its industry paints a different picture. By this approach, the shares appear expensive. Which method truly captures the reality? Does the premium signal risk or untapped growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build a custom Inspire Medical narrative in just minutes, your way. Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great investors never stop learning, so if you want to level up your portfolio, now’s the moment to act. The market rewards those who stay curious and keep searching for the next opportunity. Don’t be the one who looks back and wishes they had.

- Seize strong yield opportunities by checking out dividend stocks with yields > 3% that consistently provide income higher than 3%.

- Catch the next technology boom by tapping into AI penny stocks that lead innovation in artificial intelligence, automation, and data science.

- Tilt the odds in your favor and browse undervalued stocks based on cash flows trading at deep discounts, based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives