- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Is There Now an Opportunity in Humana After Medicare Advantage Expansion?

Reviewed by Bailey Pemberton

- Ever wondered if Humana stock is a hidden gem, overpriced, or sitting somewhere in between? Many investors are searching for clues in its recent moves.

- After a 7.5% gain over the past week, Humana shares are still down 15.9% over the last month and 2.6% year-to-date. This points to both volatility and shifting investor sentiment.

- Several headlines have added fuel to the fire for Humana's recent price swings. The healthcare insurer has been expanding its Medicare Advantage plans and announcing new partnerships. Ongoing changes in the sector’s regulatory landscape have also kept market watchers alert, anticipating what is next for the company.

- On Simply Wall St’s valuation scorecard, Humana lands a 4 out of 6, reflecting its current standing across multiple valuation metrics. Read on as we break down what drives this score, examine standard valuation approaches, and provide a fresh perspective that could reshape how you gauge value altogether.

Approach 1: Humana Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them to reflect their value today. This approach is grounded in the idea that a business is worth all the money it will generate in the future, adjusted for the time value of money.

For Humana, the most recent Free Cash Flow reported is $1.24 billion. Analysts provide cash flow estimates for the next five years, after which further projections are extrapolated by Simply Wall St. By 2029, the projected Free Cash Flow is expected to reach $3.74 billion, and estimates continue to trend upward in the following years, though these are subject to increasing uncertainty.

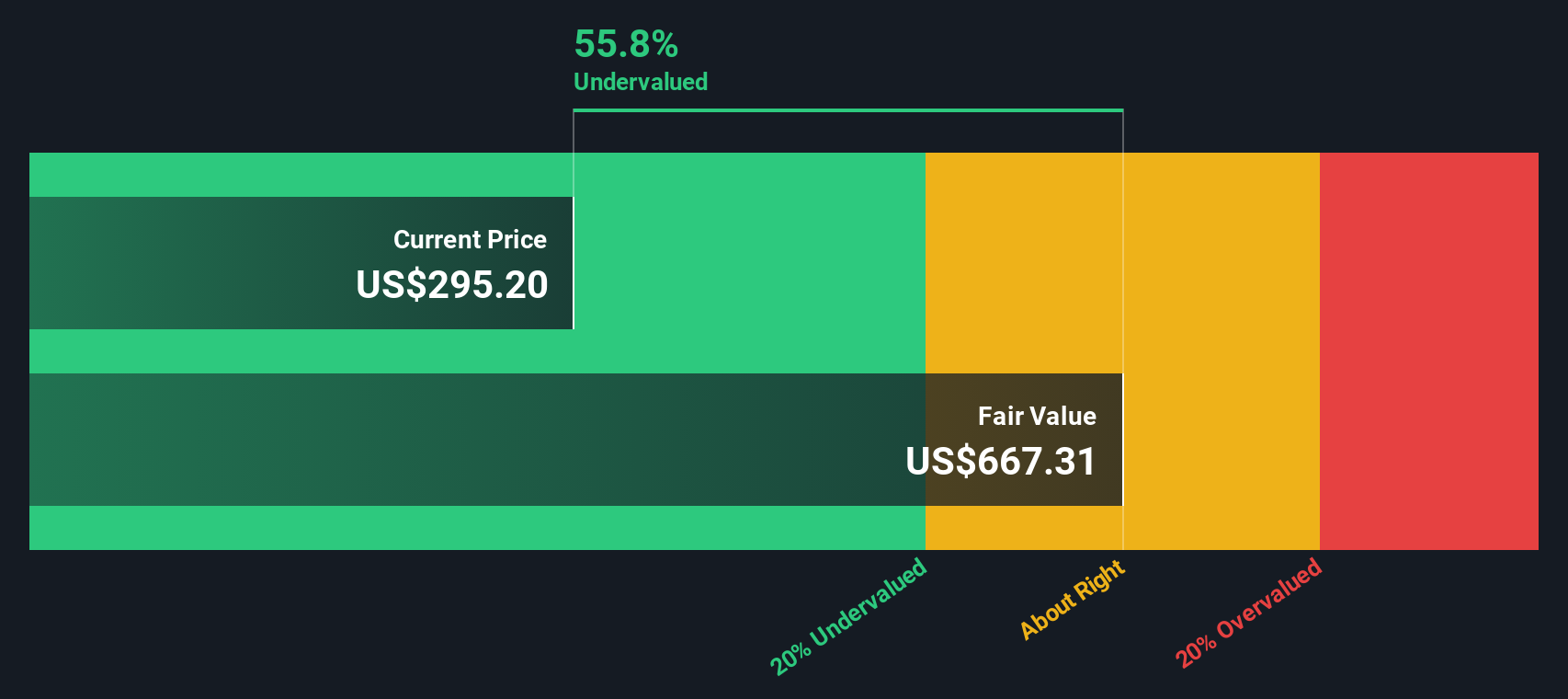

According to the DCF model, the fair value for Humana’s shares is $664.63. This is calculated using a Two-Stage Free Cash Flow to Equity model that factors in expected cash growth and discounts back to the present. With the current stock price trading at a 63.0% discount to this estimated value, the DCF indicates that Humana appears undervalued in the market today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Humana is undervalued by 63.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Humana Price vs Earnings

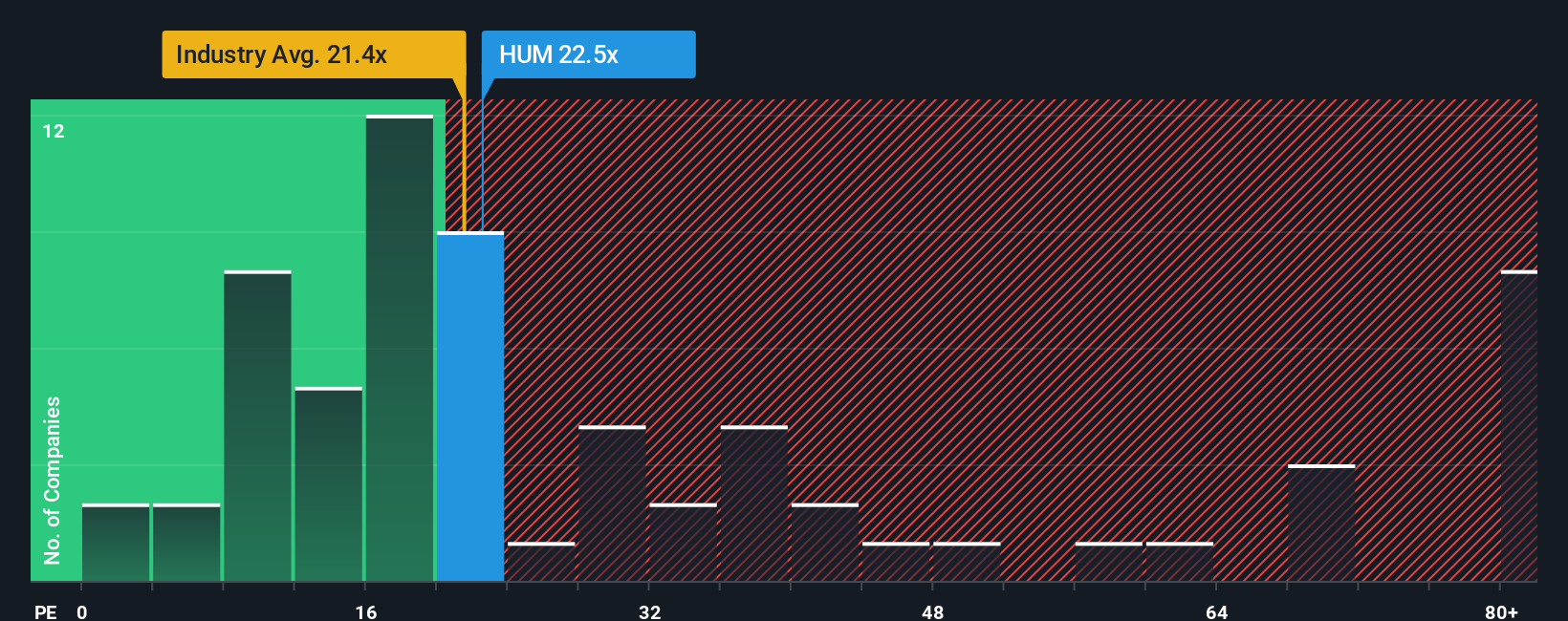

The Price-to-Earnings (PE) ratio is a widely used indicator for valuing profitable companies like Humana because it reflects how much investors are willing to pay per dollar of earnings. Investors often look at the PE ratio to gauge whether a stock is trading at a reasonable price given its profits, making it a reliable starting point for valuation.

It is important to note that growth expectations and risk play a major role in what constitutes a “normal” or “fair” PE ratio. Higher expected earnings growth or lower risk typically justify a higher PE, while companies with muted growth prospects or greater risk usually warrant a lower multiple.

Currently, Humana trades at a PE ratio of 22.9x. This is very close to the healthcare industry average of 22.8x, and just below the peer average of 25.3x. Simply Wall St’s proprietary metric, the “Fair Ratio,” assigns Humana a fair PE of 40.9x. Unlike a simple industry or peer comparison, this Fair Ratio weighs Humana’s growth, risk factors, profit margin, market cap, and unique position within the industry. This offers a more tailored valuation benchmark.

In this case, Humana’s actual PE is noticeably below its Fair Ratio, suggesting the market is underestimating its current and future earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Humana Narrative

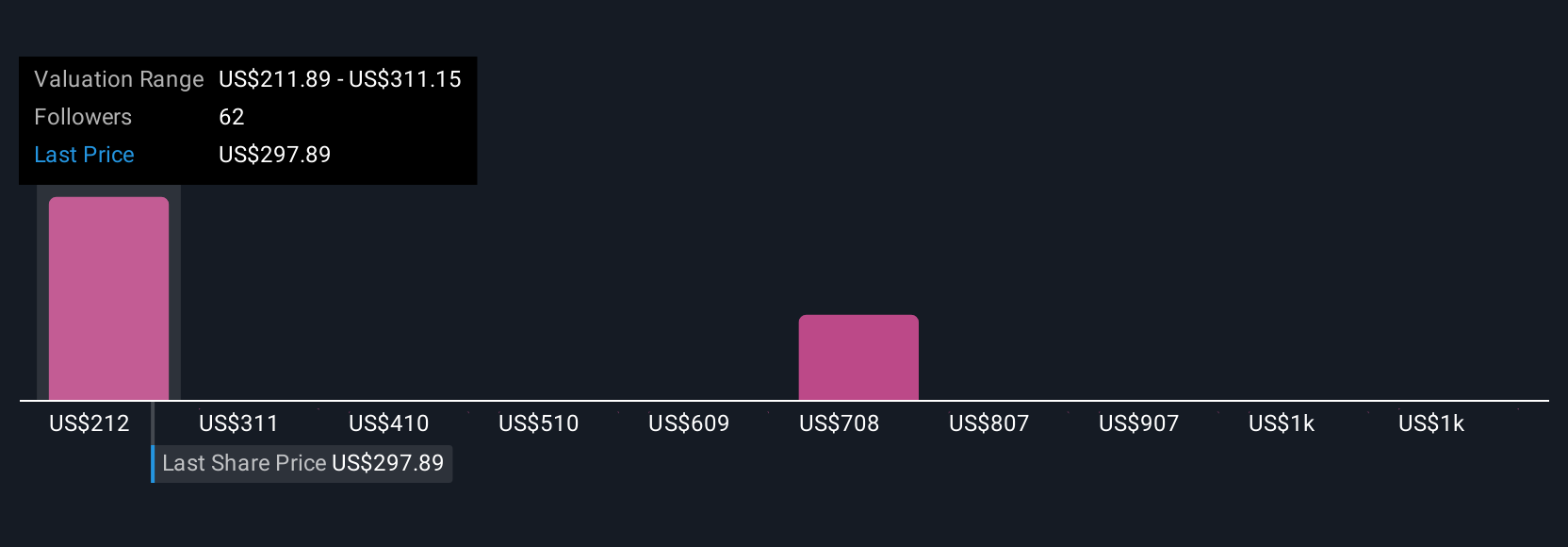

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, interactive way to connect a company’s unique story to its future financial performance and, ultimately, its estimated fair value. Instead of just crunching numbers, Narratives let you describe and share your own perspective on Humana, linking your expectations for revenue, profit margins, and growth to a complete financial forecast.

On Simply Wall St’s Community page, millions of investors use Narratives to clarify their thinking and compare their views to others. With Narratives, you can easily see whether your fair value is above or below Humana’s current share price, making it clearer when to buy, hold, or sell. Narratives update dynamically as new earnings, news, or regulatory changes are announced, ensuring you always have the latest view.

For instance, the most optimistic investors see Humana’s fair value as high as $353, based on a strong recovery in Medicare Advantage and robust revenue growth. More cautious investors assign a fair value as low as $250, focusing on regulatory uncertainty and margin risks. With Narratives, you decide the story and the numbers that fit your own outlook.

Do you think there's more to the story for Humana? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success