- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Evaluating Humana’s Valuation After New Providence Data-Sharing Partnership Spurs Healthcare Innovation

Reviewed by Simply Wall St

Humana’s new partnership with Providence puts advanced data-sharing in the spotlight, highlighting a move to make healthcare coordination smoother and more secure for all parties involved. This initiative draws on evolving regulatory needs and industry trends.

See our latest analysis for Humana.

Humana’s shares have rallied sharply in recent weeks, gaining more than 22% over the past three months after revealing major partnerships, such as the data-sharing initiative with Providence and expanded veteran-focused Medicare Advantage plans. Despite recent market excitement, the stock’s one-year total shareholder return is up 13%, while longer-term returns remain well below previous highs. Momentum is picking up, but the big picture is still mixed.

If today’s healthcare innovation headlines have you watching this sector, you might want to explore the latest leaders by checking out See the full list for free.

But with Humana’s stock up sharply from its summer lows and trading just below analysts’ targets, should investors see recent gains as the start of a sustained turnaround? Or has the market already priced in the company’s future growth?

Most Popular Narrative: 1.3% Undervalued

Humana’s most-referenced narrative indicates the stock is trading just under analysts’ fair value, with the last close at $290.65 and a consensus fair value of $294.54. The small discount reflects a market view that Humana’s future growth potential is largely reflected in its current share price, with assumptions hinging on margin expansion and earnings recovery.

“Humana is focusing on operational efficiency by increasing the use of AI in its contact centers to enhance customer interactions and reduce costs, likely impacting net margins. The company is making substantial efforts to improve clinical excellence, including medication adherence campaigns and member engagement through in-home visits combined with virtual health, which is expected to enhance medical margins and member experience.”

Want to know the secret behind this barely discounted fair value? The narrative hinges on an earnings revival, steady revenue growth, and ambitious operational targets. Find out what bold projections drive this sharp consensus. There is more beneath the surface than meets the eye.

Result: Fair Value of $294.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes to Medicare Advantage rates and ongoing legal challenges could still disrupt Humana’s earnings momentum and reshape future growth expectations.

Find out about the key risks to this Humana narrative.

Another View: Valuing Humana Against Peers

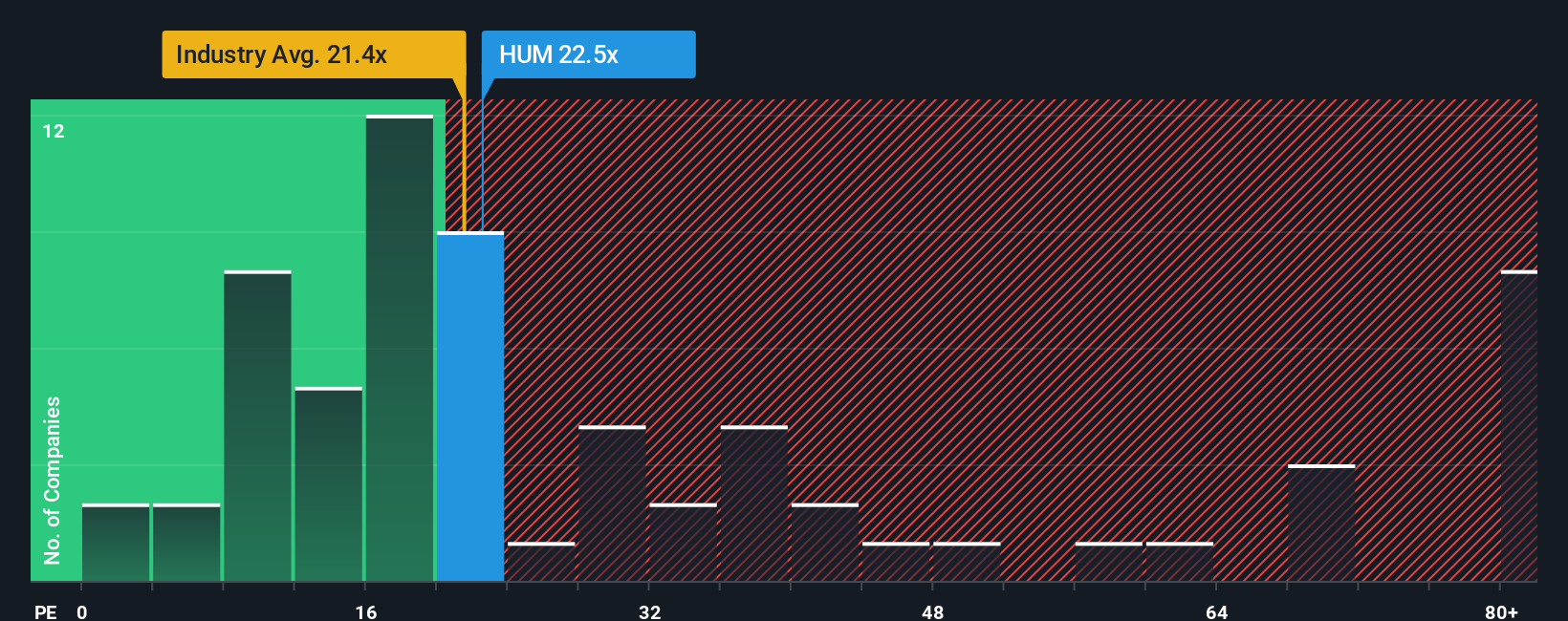

Looking at valuations through traditional market multiples, Humana trades at a price-to-earnings ratio of 22.2x. That is higher than both the US Healthcare industry average of 21.7x and the peer average of 22.1x. However, it is well below the fair ratio of 39.6x estimated by regression analysis. This suggests that while the market sees some premium, there could still be meaningful upside if sentiment shifts or downside risk if profitability falls short. Which direction will investors lean next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Humana Narrative

If you see things differently, or want to dig into the numbers on your own, you can craft your own Humana story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Humana.

Looking for More Investment Ideas?

Do not let great opportunities pass you by. Use the Simply Wall Street screener to target investments with potential, spot trends early, and add winning stocks to your watchlist before everyone else catches on.

- Capture income from stable businesses by starting with these 17 dividend stocks with yields > 3% and track companies paying reliable yields above 3%.

- Accelerate your growth portfolio by seeking out innovators in artificial intelligence using these 27 AI penny stocks, where rapid tech adoption drives future gains.

- Get ahead of the market with these 872 undervalued stocks based on cash flows, pinpointing stocks trading below their true worth based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives