- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Can Humana’s (HUM) Data-Sharing Push Shape Its Role in Value-Based Care’s Digital Transformation?

Reviewed by Sasha Jovanovic

- On October 20, 2025, Providence announced a new collaboration with Humana to advance seamless data exchange for value-based care using national interoperability standards and advanced APIs.

- This initiative anticipates regulatory changes, aims to streamline operations, and highlights a shift toward industry-wide digital health ecosystems with broader payer-provider alignment.

- We'll explore how accelerating interoperability for value-based care could influence Humana's investment narrative and future competitive outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Humana Investment Narrative Recap

To see value in Humana today, an investor needs to believe in the company’s ability to drive operational efficiency, improve care quality, and profitably expand its Medicare Advantage and value-based care offerings. The recent partnership with Providence to create a scalable, interoperable data exchange sets a foundation for adapting to regulatory changes and improving care coordination, but it is not expected to materially influence the short-term earnings catalyst or fundamentally reduce the ongoing risk tied to CMS Star ratings litigation or medical cost ratio pressures.

Among the various recent announcements, Humana’s alliance with USAA Life Insurance to continue Medicare Advantage plans for veterans, including expanded mental health benefits, stands out as the most relevant. This move underscores Humana’s continued push to address clinical excellence and social determinants of health, areas that could support future growth in value-based care, but are unlikely to offset the foremost risks tied to regulatory scrutiny and program ratings in the near term.

But despite these positive advancements, investors should be especially aware of how unresolved litigation around 2026 CMS Star ratings could still...

Read the full narrative on Humana (it's free!)

Humana's outlook anticipates $150.9 billion in revenue and $3.3 billion in earnings by 2028. This is based on a 7.0% yearly revenue growth rate and a $1.7 billion increase in earnings from the current level of $1.6 billion.

Uncover how Humana's forecasts yield a $294.54 fair value, in line with its current price.

Exploring Other Perspectives

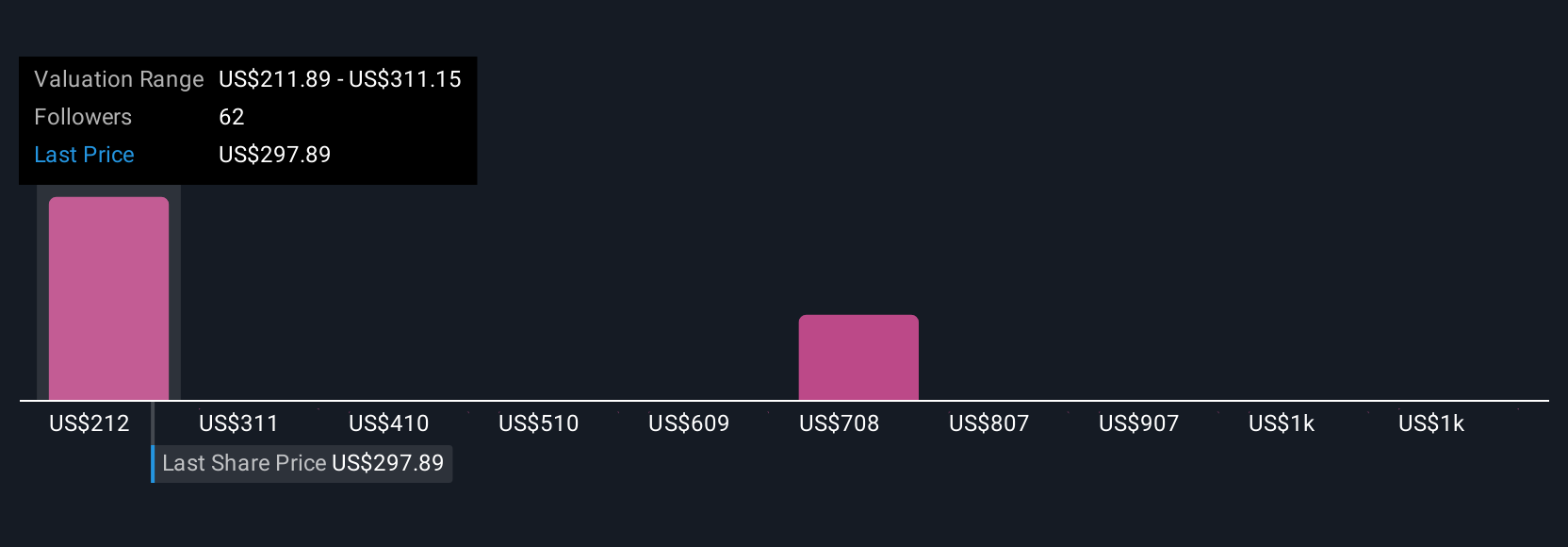

Nine Simply Wall St Community estimates value Humana between US$211.89 and US$667.31 per share, reflecting wide differences in outlook. With medical cost ratio pressures flagged as a key risk, consider how regulatory and reimbursement changes could shape future returns.

Explore 9 other fair value estimates on Humana - why the stock might be worth 27% less than the current price!

Build Your Own Humana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humana research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Humana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humana's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives