- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Should You Rethink Hims After Volatile Moves and New Product Launches in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Hims & Hers Health lately and wondering what to do next, you’re not alone. The past year has been a wild ride for the stock, with gains of over 100% in both the last twelve months and year to date. Even more impressive, the stock has soared an eye-popping 1040% over three years. But before you start thinking these kinds of returns are set in stone, there’s more to the story. Just over the past week and month, shares have dipped 8.6% and 14.6%, respectively. What is driving all this volatility? Is it an opportunity, or a warning sign?

Recent buzz around Hims & Hers Health focuses on new product launches aimed at expanding its reach in telehealth beyond its original core offerings. The company’s ambitions to tap into bigger markets have not gone unnoticed, fueling optimism and, at times, raising investor expectations to lofty heights. However, some investors are reassessing risk, especially as the broader health sector faces headwinds and competition intensifies.

On the valuation front, Hims & Hers Health currently gets a score of 2 out of 6 when screening for undervaluation across several key checks. That means it looks undervalued on a couple of fronts, but there are definite caveats. So what exactly goes into that score? Is there more to valuation than numbers? Let’s break down the company’s fundamentals using the major valuation tools analysts rely on, before digging into an even more insightful approach that could change how you see the stock entirely.

Hims & Hers Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to today’s value. For Hims & Hers Health, this involves taking what the company currently generates in Free Cash Flow and forecasting how much it could generate in the years ahead, using both analysts’ estimates and extrapolated projections.

Currently, Hims & Hers Health produces $159 million in Free Cash Flow. Analysts project this figure will rise significantly, with future estimates indicating around $449 million by 2029. Beyond those analyst forecasts, longer-term estimates suggest the company could continue to grow Free Cash Flow into the following decade, although that involves more assumptions.

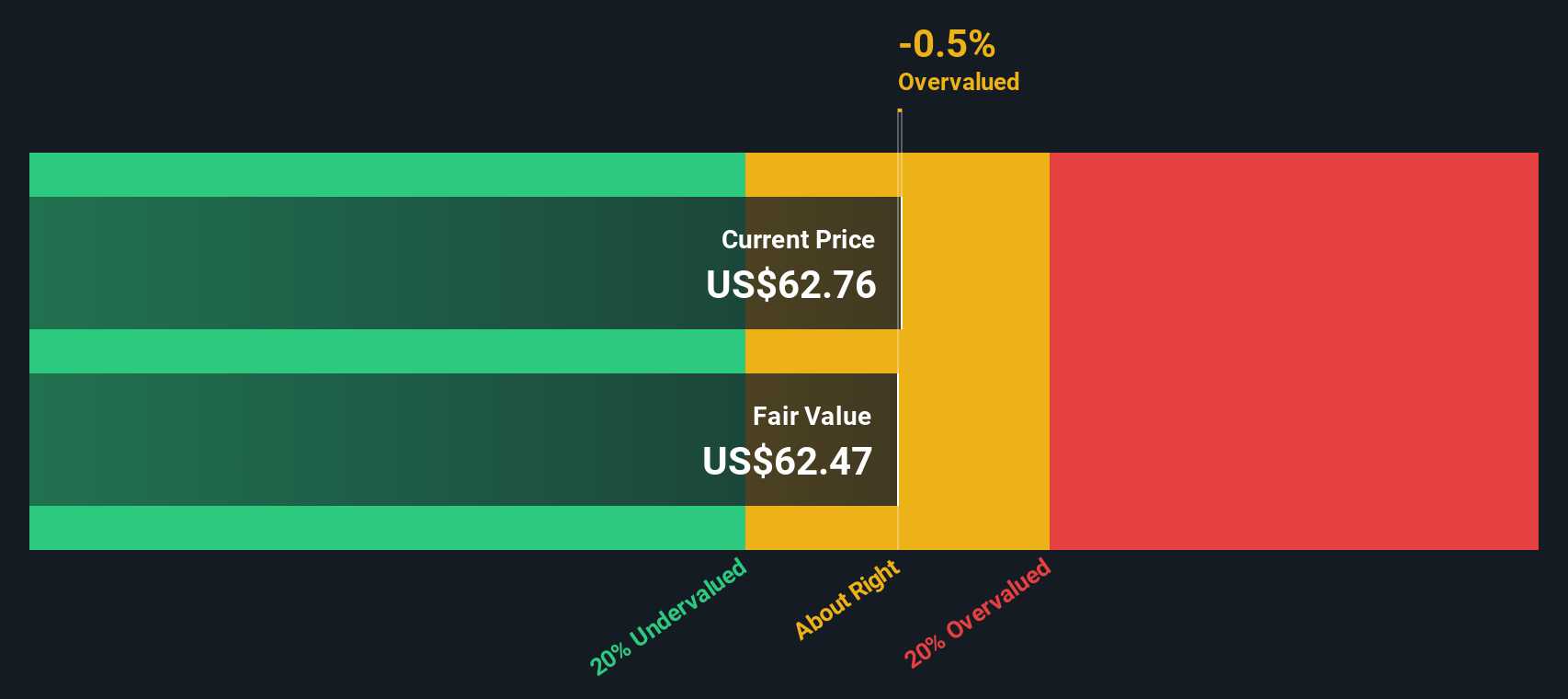

Based on these cash flows, the DCF model calculates an estimated intrinsic value of $59.78 per share. This is about 17.4% above the current share price, which suggests the stock is undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hims & Hers Health is undervalued by 17.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hims & Hers Health Price vs Earnings

For profitable companies, the Price-to-Earnings (PE) ratio is a widely used metric because it connects what investors are willing to pay with the company’s bottom-line profits. It is especially useful for businesses like Hims & Hers Health that are now posting consistent earnings, as it reflects both future growth prospects and market risk.

A company’s PE ratio is influenced by factors such as expected earnings growth, business stability, and broader industry conditions. Faster-growing or less risky companies typically deserve higher PE multiples, while slower-growing or riskier firms merit lower ones. Comparing Hims & Hers Health to key PE benchmarks sheds light on how the market views its outlook.

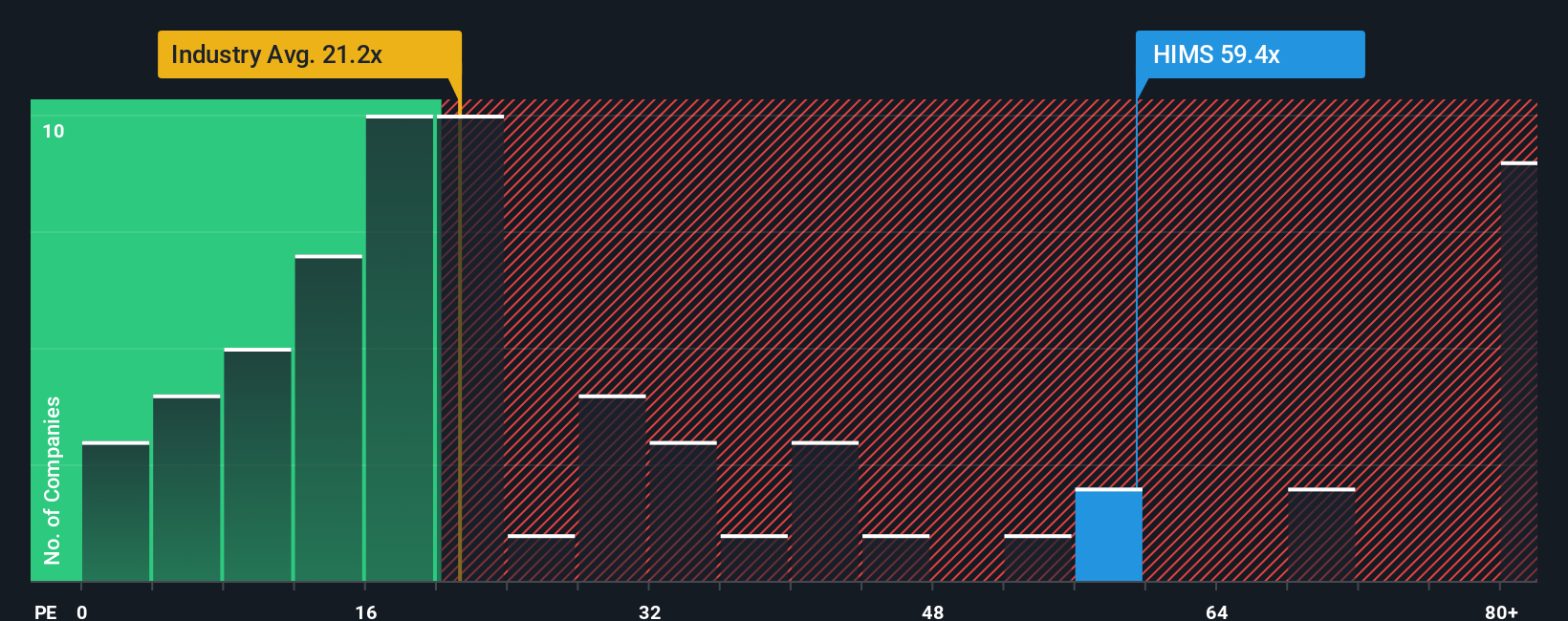

Currently, Hims & Hers Health trades at a PE ratio of 57.6x, which is well above the healthcare industry average of 21.5x and higher than the peer group average of 30.9x. At first glance, this might make the stock appear expensive on traditional metrics.

However, Simply Wall St’s “Fair Ratio” calculation, which is 65.5x for Hims & Hers Health, goes beyond simple comparisons and incorporates forward-looking elements such as expected earnings growth, profit margins, market cap, industry trends, and even company-specific risks. This comprehensive approach means the Fair Ratio offers a more tailored benchmark than industry or peer averages alone.

With the company’s current PE ratio of 57.6x sitting just below its Fair Ratio of 65.5x, the stock appears to be undervalued when all key growth and risk factors are taken into account.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

Earlier, we mentioned a better way to understand valuation. Let’s introduce you to Narratives, a powerful and user-friendly tool that lets you connect your view of a company’s story with financial forecasts and a fair value. This approach can make your investment process more dynamic and personalized.

A Narrative is simply your perspective on where a company is headed. It explains not just what the numbers say but also why you think future revenue, earnings, and margins will look a certain way. Narratives turn your research and assumptions into a living forecast and fair value, helping you decide if now is the time to buy or sell by directly comparing your fair value to today’s price.

They are available within the Simply Wall St Community page, which is used by millions of investors, and automatically update as new news or earnings are released. This gives you the real-time context you need to stay ahead.

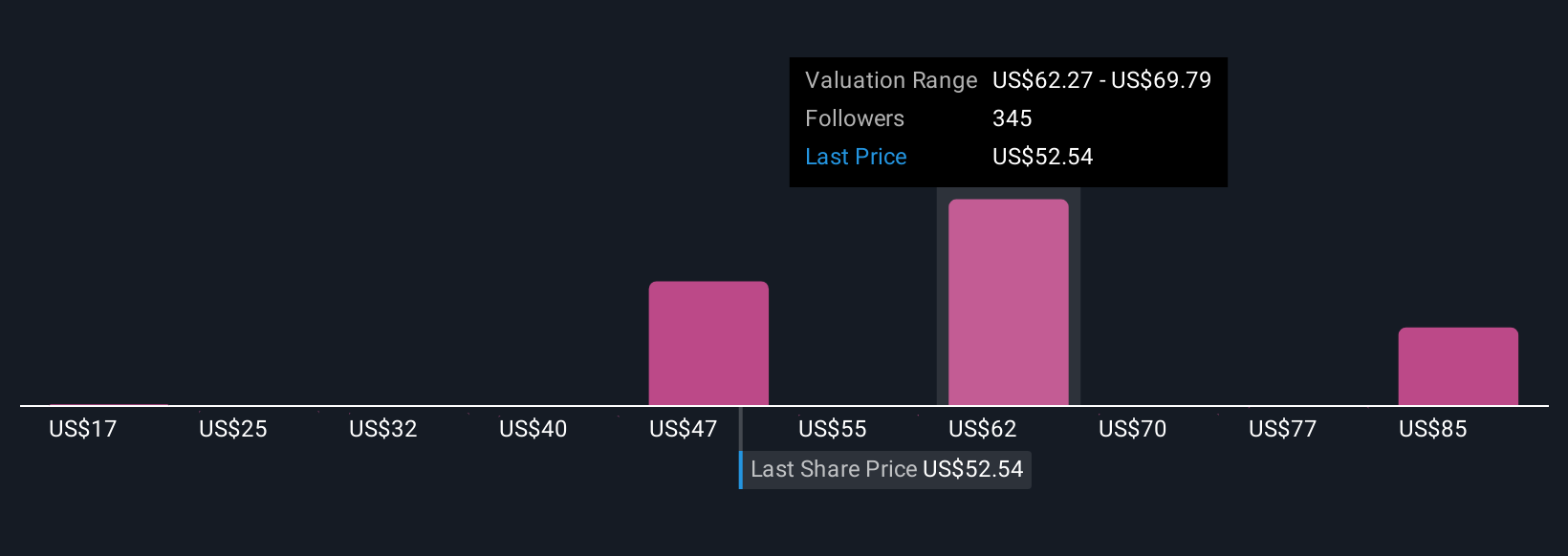

For example, when it comes to Hims & Hers Health, some investors see a long runway for growth and have set a fair value as high as $86 per share. Others are more cautious, with estimates as low as $28, based on their differing views of future risks and opportunities.

For Hims & Hers Health, we'll make it really easy for you with previews of two leading Hims & Hers Health Narratives:

🐂 Hims & Hers Health Bull Case

Fair value: $86.09

Currently trades at 42.7% below this fair value

Expected annual revenue growth: 22.0%

- Building a platform for personalized, direct-to-consumer healthcare, Hims & Hers Health is scaling efficiently with high retention, rising margins, and zero debt.

- Personalization and new healthcare verticals drive user growth, increased engagement, and a stronger moat, with more than half of subscribers on tailored plans.

- Despite regulatory risks and recent setbacks, the narrative sees a rare, long-term asymmetric opportunity and views the stock as fundamentally undervalued at current prices.

🐻 Hims & Hers Health Bear Case

Fair value: $47.42

Currently trades at 4.1% above this fair value

Expected annual revenue growth: 18.8%

- Growth relies on new categories and international expansion, but faces significant regulatory, operational, and margin risks that may limit profitability and customer growth.

- Recent regulatory and legal setbacks, including the terminated Novo Nordisk partnership and negative FDA scrutiny, have pressured growth momentum and increased uncertainty.

- Consensus sees the stock as only slightly overvalued, as slowing core growth, tighter advertising guidelines, and legal risks weigh on future earnings and justify a lower price target.

Do you think there's more to the story for Hims & Hers Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives