- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Is It Too Late To Consider Hims & Hers After Its 452% Three Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Hims & Hers Health is still a smart buy after its huge run, or if the easy money has already been made, this breakdown will help you decide whether the current price still stacks up against the fundamentals.

- The stock has cooled off a bit in the last month, down 6.5%, but that follows a powerful 58.8% gain year to date and a massive 452.0% jump over 3 years that has completely changed how the market views the business.

- Recent headlines have focused on Hims & Hers expanding its telehealth platform, rolling out new product lines in areas such as weight management and mental health, and deepening its subscription based model. These moves aim to lock in recurring revenue and brand loyalty. At the same time, growing competition in direct to consumer healthcare and debates about long term profitability have kept sentiment active, helping explain the sharp swings in the share price.

- On our framework the stock earns a 2 out of 6 valuation score, suggesting pockets of potential value but also areas where the market may already be paying up. Next we will walk through each valuation lens and, by the end, explore a more nuanced way to judge what Hims & Hers is really worth.

Hims & Hers Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For Hims & Hers Health, the latest twelve month free cash flow is about $189.4 million, which forms the starting point for the 2 stage Free Cash Flow to Equity model.

Analysts have provided detailed forecasts for the next few years, with free cash flow expected to rise into the low to mid hundreds of millions. Beyond those analyst estimates, Simply Wall St extrapolates the trend, projecting free cash flow to reach around $704.5 million by 2035 as growth gradually moderates.

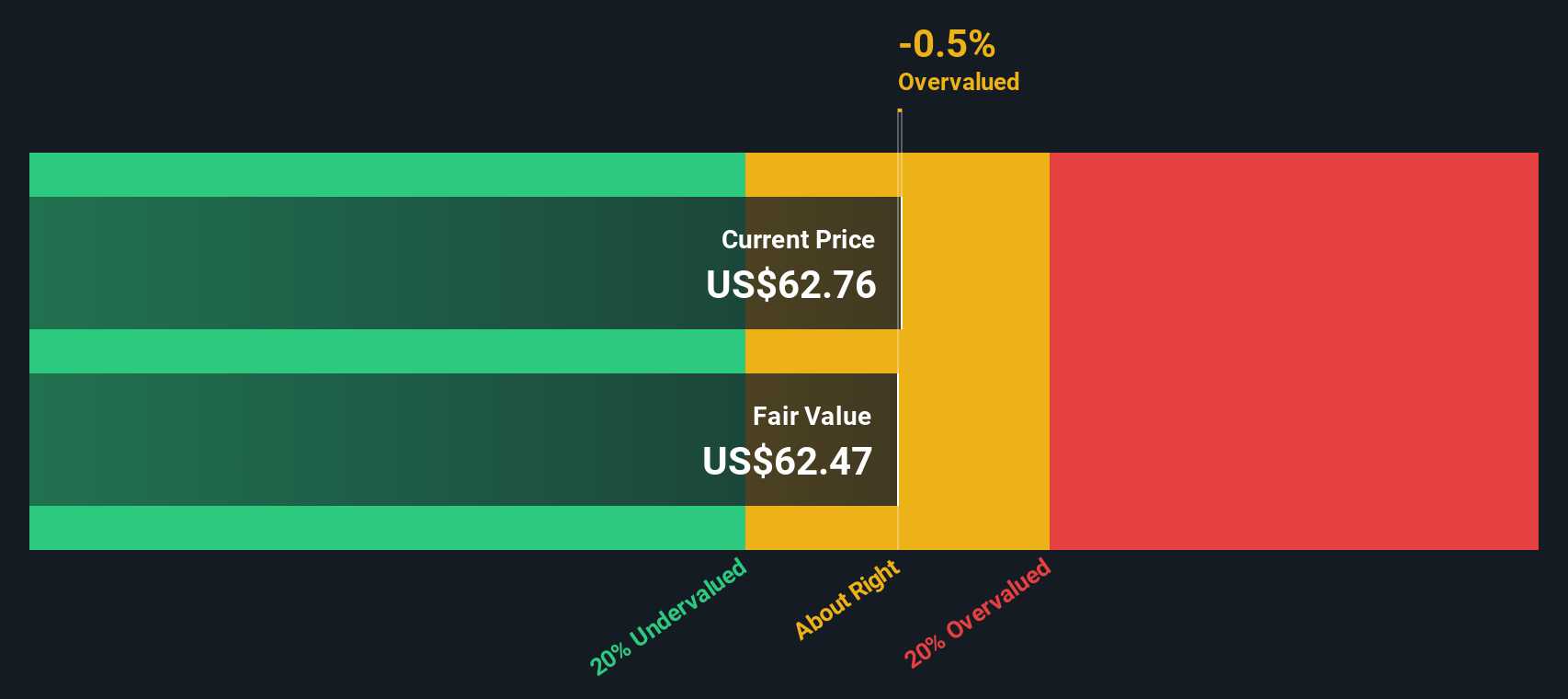

When all these future cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $58.00 per share. Compared with the current market price, this implies the stock is about 31.0% undervalued on a cash flow basis, suggesting investors are still not fully pricing in the company’s long term earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hims & Hers Health is undervalued by 31.0%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Hims & Hers Health Price vs Earnings

For profitable businesses, the price to earnings ratio is often the most intuitive way to judge valuation because it links what investors pay directly to the profits the company is generating today. A higher growth outlook or a lower risk profile typically justifies a higher normal PE range, while slower growth or more uncertainty should pull that fair range down.

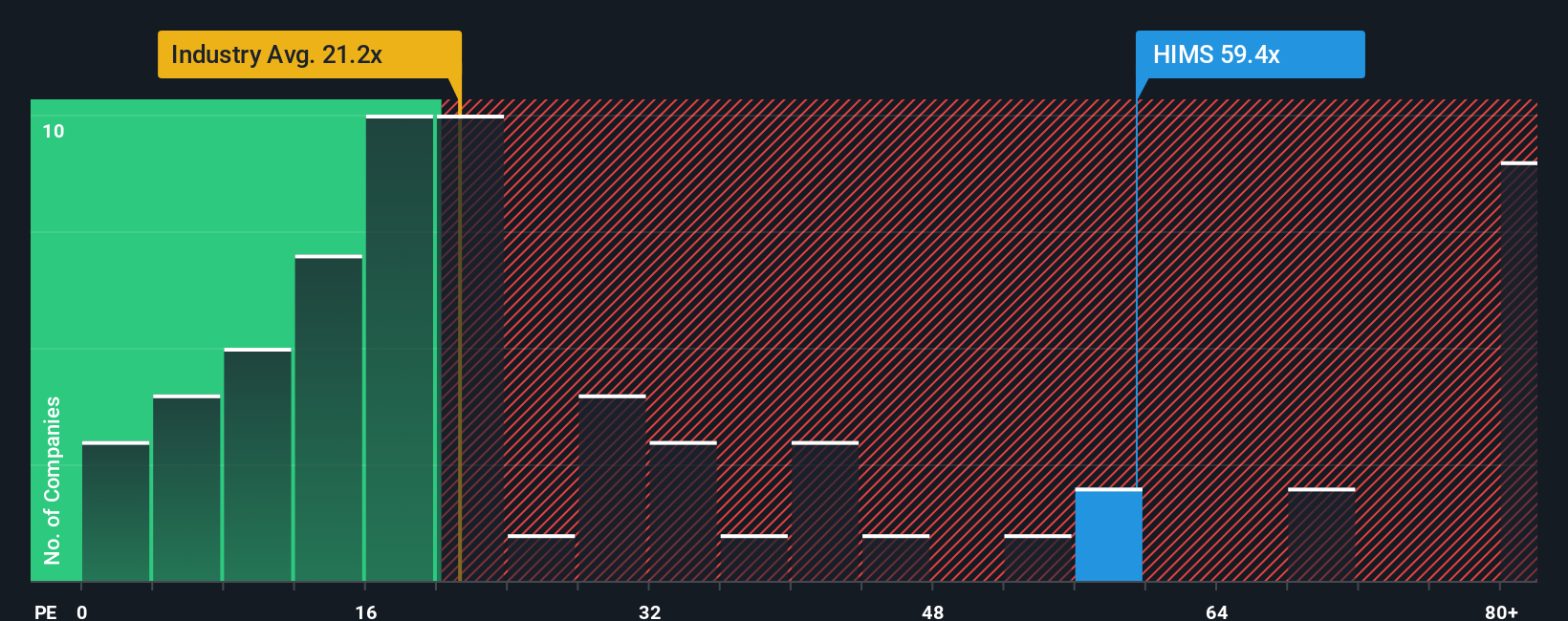

Hims & Hers currently trades on about 68.10x earnings, which is well above the broader Healthcare industry average of roughly 22.38x and also ahead of its peer group average of about 30.18x. On the surface, that makes the stock look expensive relative to both its sector and close comparables.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable PE should be once you factor in Hims & Hers earnings growth profile, profitability, industry context, market cap and company specific risks. That model suggests a Fair Ratio of around 41.97x, which is materially lower than the current 68.10x. While the company is executing well, the multiple implies that a lot of optimistic expectations are already priced in.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company tied directly to your numbers, like what you think Hims & Hers’ future revenue, earnings and margins could be, and what that implies for fair value.

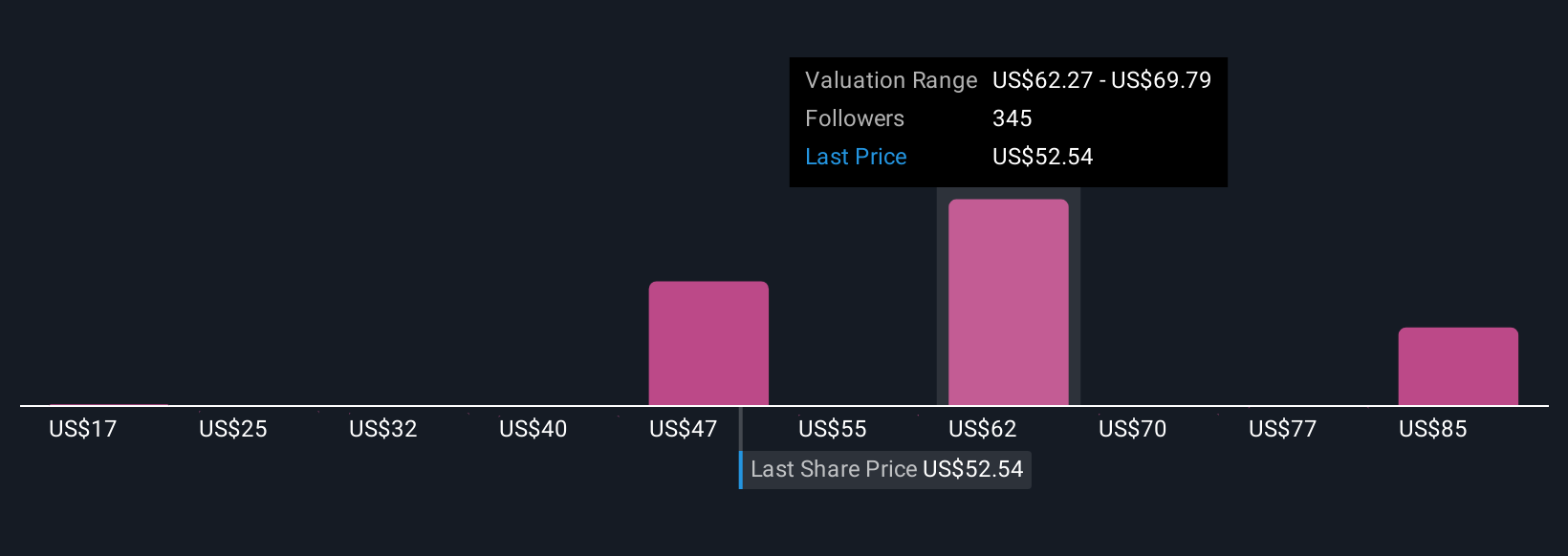

On Simply Wall St, Narratives, available to millions of investors on each company’s Community page, link three pieces together: the business story, a forecast model, and a resulting fair value that you can compare with today’s share price to decide whether you believe Hims & Hers is a buy, hold, or sell.

Because Narratives are updated dynamically when new information like earnings, news or regulatory changes arrive, your view is never static. You can see how different investors can reasonably disagree, with one Narrative treating Hims & Hers as a high conviction platform play worth around $114 per share, while another more cautious Narrative, focused on regulatory and competitive risk, lands closer to $46 per share and sees the stock as roughly fairly valued at current levels.

Do you think there's more to the story for Hims & Hers Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026