- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

How the FDA’s Super Bowl Ad Criticism Impacts Hims & Hers Health Valuation in 2025

Reviewed by Bailey Pemberton

If you follow the stock market, you have probably noticed Hims & Hers Health popping up with some eye-popping numbers. Whether you are considering it for your portfolio or just watching from the sidelines, this company demands attention right now. With a share price that has increased 130.0% year-to-date and an impressive 209.2% over the past year, there is no shortage of bold headlines. Looking further back, the company’s five-year return is a remarkable 453.7%, which highlights a story of high-growth momentum.

Of course, big moves often come with big scrutiny or even controversy. In recent months, Hims & Hers found itself in hot water with regulators over a Super Bowl ad that, according to the FDA chief, crossed the line in promoting weight-loss medications. There have also been reports of an FTC probe regarding their subscription cancellation process, making it clear the business is drawing more attention from both investors and Washington. Despite these challenges, the stock has shown resilience, gaining 2.2% just in the past week and nearly 20% over the past month. This suggests that optimism and appetite for risk may be outweighing the headlines for now.

If you are trying to decide whether Hims & Hers Health is a bargain or a bubble, the company currently scores a 1 out of 6 on a set of undervaluation checks. That means, by most traditional metrics, you might find it priced on the richer side. But as we dig into how those valuation methods work and look for an even smarter way to think about the company’s true worth, there is more to uncover than meets the eye.

Hims & Hers Health scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flow and discounting those amounts back to today. This method attempts to quantify the present worth of all expected future profits, offering a rigorous way to estimate what the business could truly be worth.

For Hims & Hers Health, the latest Free Cash Flow (FCF) stands at $159 million. Analysts forecast robust growth, projecting FCF to rise sharply each year and reach $449 million by the end of 2029. Beyond that, further cash flow growth over the next decade is extrapolated based on industry expectations, resulting in a projected FCF of $736 million in 2035. All figures are in US dollars.

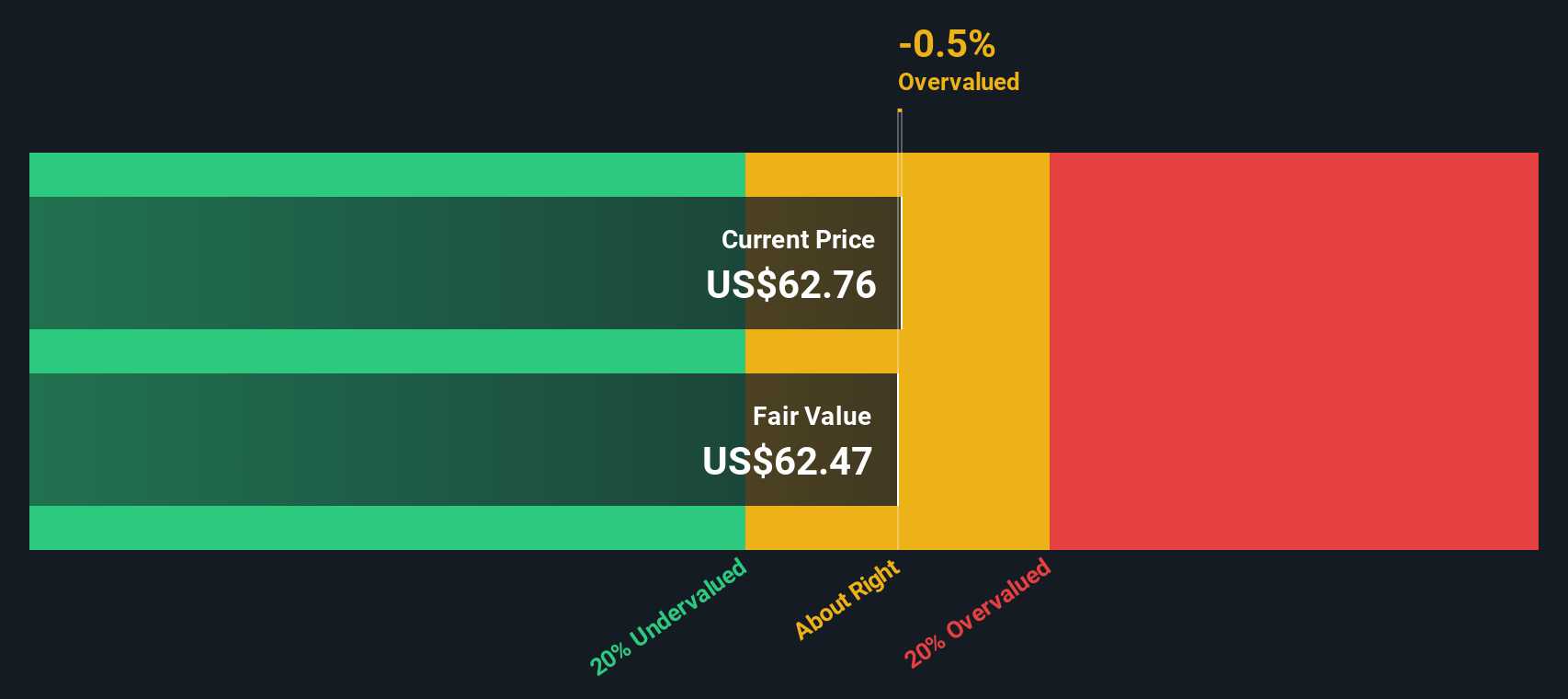

Applying the 2 Stage Free Cash Flow to Equity model, this analysis arrives at an intrinsic value per share of $62.47. When compared with the current share price, the stock screens at a 7.2% discount, meaning it is almost in line with its fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Hims & Hers Health's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Hims & Hers Health Price vs Earnings

Price-to-Earnings, or PE ratio, is a widely used metric for valuing companies that are profitable, as it shows how much investors are willing to pay today for a dollar of earnings. For businesses like Hims & Hers Health that steadily turn a profit, the PE ratio highlights the relationship between the current share price and underlying earnings power.

What counts as a “normal” or “fair” PE depends on a few factors. Companies with higher expected growth, robust profit margins, or lower risk often trade at loftier multiples, since investors anticipate better returns ahead. Conversely, lower-growth or riskier businesses tend to have discounted PE ratios.

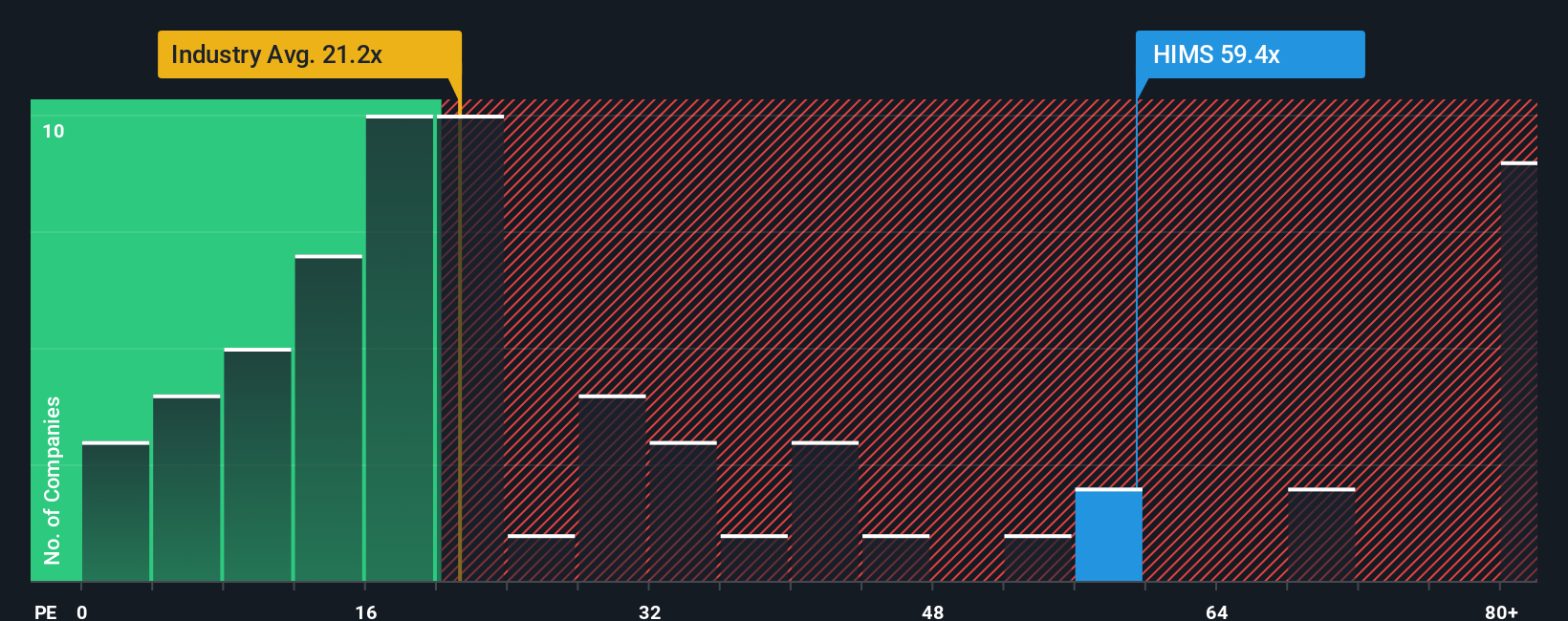

Hims & Hers Health currently trades on a PE ratio of 67.68x, which is well above the healthcare industry average of 21.56x and ahead of its peer average of 44.16x. At first glance, this premium may seem excessive. However, Simply Wall St’s proprietary “Fair Ratio” model, which incorporates future growth, risk, profit margins, company size and other factors, estimates that a fair PE for Hims & Hers is 64.93x. This tailored benchmark helps cut through the noise of simple peer or industry comparisons and offers a more nuanced view that reflects Hims & Hers’ unique profile and prospects.

Because the current PE and the Fair Ratio are so closely aligned, it suggests the market pricing is in line with the company’s earnings outlook and fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple but powerful way to bring your perspective to the investment process, letting you tell the story you see in the numbers by defining your own fair value, revenue growth, earnings, and margin assumptions for a company like Hims & Hers Health.

A Narrative is more than a model or metric. It directly links a company’s unique story to a forecast and translates that into a fair value, helping you see how your beliefs compare to the market. With Narratives on Simply Wall St’s Community page (used by millions of investors), anyone can quickly create and share their investment thesis in just a few clicks.

Narratives make it incredibly easy for investors to know if now is a good time to buy or sell, simply by comparing their estimated fair value to today’s share price. These views stay up to date dynamically, reacting automatically when earnings reports, breaking news, or regulatory changes hit the market.

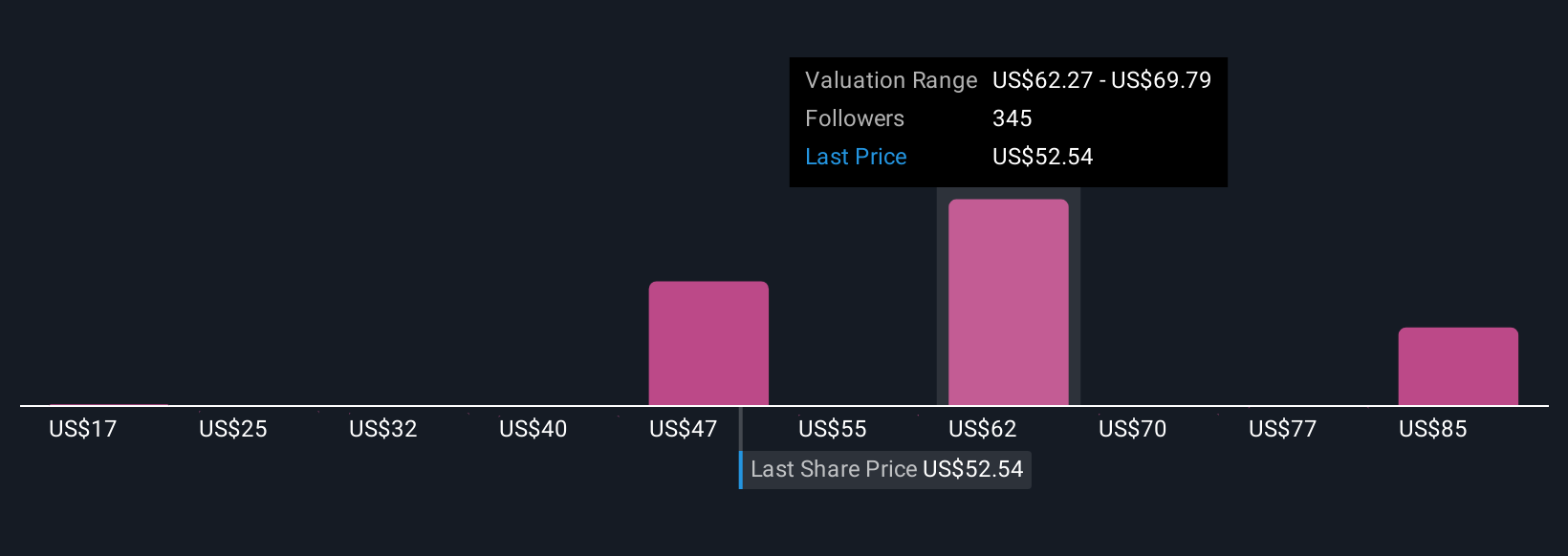

For example, some investors expect Hims & Hers Health could be worth as much as $114 per share if its platform model and margins keep scaling. Others see more risk and set their fair value closer to $28 per share based on concerns over regulatory scrutiny and slower international expansion.

For Hims & Hers Health, we’ll make it easy for you with previews of two leading Hims & Hers Health Narratives:

- 🐂 Hims & Hers Health Bull Case

Fair Value: $114.00

Undervalued by: 49.2%

Forecast Revenue Growth: 22.0%

- Hims is developing a vertically integrated, direct-to-consumer healthcare platform with strong fundamentals, zero debt, and rising margins. The company aims to be the infrastructure layer for personalized healthcare.

- Personalisation, robust subscriber growth, and successful partnerships in high-value categories such as weight loss and diagnostics are driving retention and monetisation. Operating leverage is fueling profitability.

- While regulatory and competitive risks exist, management’s strategic moves and platform expansion create an asymmetric, venture-style opportunity with a long runway for growth.

- 🐻 Hims & Hers Health Bear Case

Fair Value: $47.42

Overvalued by: 22.2%

Forecast Revenue Growth: 18.8%

- Ongoing regulatory, legal, and competitive risks, especially following the Novo Nordisk partnership termination, are increasing business uncertainty and dampening the growth outlook.

- Subscriber and app activity trends are softening, core revenue growth is decelerating, and analysts have reduced future price targets despite continued investments in new offerings and markets.

- Achieving analysts’ growth and profit targets requires sustained execution and margin expansion. International expansion and heavy reliance on high-growth segments expose the business to ongoing volatility.

Do you think there's more to the story for Hims & Hers Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives