- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (NYSE:HIMS) Appoints Mo Elshenawy As New CTO For AI-Driven Healthcare Transformation

Reviewed by Simply Wall St

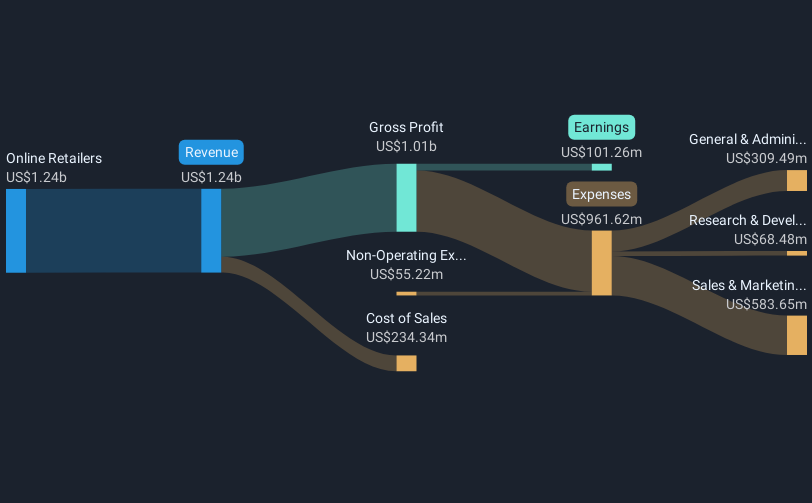

Hims & Hers Health (NYSE:HIMS) experienced a remarkable 97% share price increase over the past month, a move that coincided with significant executive changes. The appointment of Mo Elshenawy as Chief Technology Officer to spearhead AI initiatives and Nader Kabbani's new role as Chief Operations Officer may have instilled investor confidence. Strong Q1 2025 earnings results, with substantial growth in sales and net income, likely bolstered this sentiment. In addition, the strategic collaboration with Novo Nordisk to enhance obesity treatment access aligns with the company's healthcare transformation goals. These corporate developments provided supportive momentum against a backdrop of a broadly positive market.

You should learn about the 2 possible red flags we've spotted with Hims & Hers Health.

The recent executive changes at Hims & Hers Health, coupled with strong Q1 2025 earnings, could significantly influence its trajectory toward personalized telehealth services. These developments are expected to drive further interest in its AI initiatives and bolster revenue growth through enhanced healthcare solutions. Over the past three years, the company's total return of over 1506% is remarkably large, highlighting the robust momentum in its share price. When placed against the backdrop of the US market, Hims & Hers shares have notably outperformed over the past year, surpassing the broader market's return of 8.2% and significantly exceeding the US Healthcare industry's negative return of 11.2%.

The introduction of new leadership and strategic partnerships could further boost revenue projections, potentially exceeding the expected annual growth rate of 17.5%. However, analysts forecast a 21.5% annual earnings increase, above the 13.9% US market rate, which underpins optimistic future growth expectations. With a current share price of US$35.04 and a consensus price target of US$42.53, this presents a 17.6% potential upside, indicating investor confidence in achieving anticipated revenue and earnings growth. Nonetheless, the company's high Price-To-Earnings Ratio compared to industry averages suggests market participants should carefully assess valuation in relation to these changes.

Dive into the specifics of Hims & Hers Health here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives