- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (HIMS) Legal Relief Raises Fresh Questions About Its Long-Term Regulatory Risks

Reviewed by Sasha Jovanovic

- In the past week, a U.S. federal judge dismissed Eli Lilly's lawsuit against Willow Health, a telehealth competitor to Hims & Hers Health, addressing legal concerns connected to compounded weight-loss drug offerings.

- This legal outcome alleviated investor fears about industry-wide litigation risks, even as Hims & Hers Health continues to face regulatory scrutiny and class-action complaints regarding its compounded GLP-1 drugs.

- We'll explore how this reduction in perceived legal risk could influence the company's long-term growth outlook and analyst expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Hims & Hers Health Investment Narrative Recap

To be a shareholder in Hims & Hers Health, you need to believe in the company's ability to drive sustained revenue growth through direct-to-consumer healthcare innovation, especially as it diversifies offerings in weight loss and men's health. The recent dismissal of Eli Lilly’s lawsuit against Willow Health helped reduce fears of industry-wide litigation, but does not eliminate the most important short-term catalyst: regulatory clarity on compounded GLP-1 drugs, which remains the biggest risk to the business as scrutiny continues.

Among recent announcements, the FDA’s warning letter on the marketing of compounded semaglutide is most relevant here, as it underscores the company’s ongoing regulatory exposure in its fastest-growing category. As investors assess the short-term outlook, regulatory responses, and their potential to impact both growth and reputation, take center stage following the positive legal news.

In contrast, investors should be aware that heightened regulatory scrutiny of compounded drug offerings could still impact Hims & Hers’ growth...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health's outlook anticipates $3.3 billion in revenue and $261.3 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 18.3% and represents a $67.7 million earnings increase from the current $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $47.42 fair value, a 18% downside to its current price.

Exploring Other Perspectives

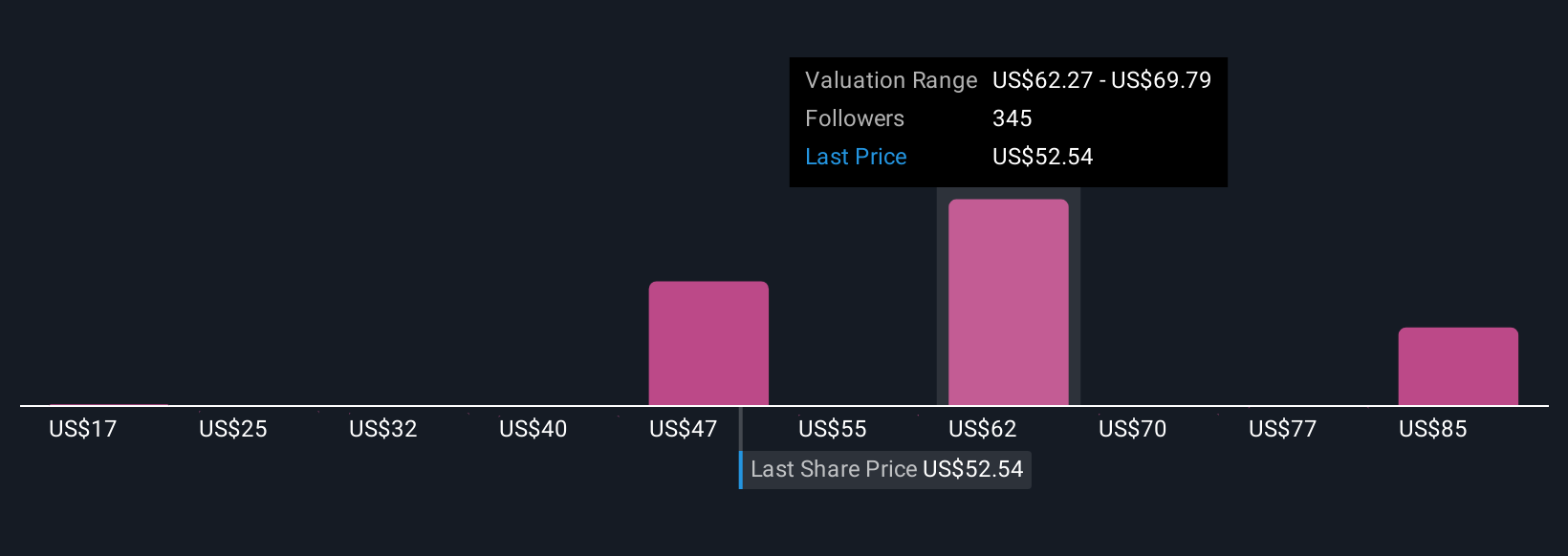

Fifty individual fair value estimates from the Simply Wall St Community span US$17.15 to US$92.35 per share, reflecting a broad range of expectations for Hims & Hers Health. These differing viewpoints mirror ongoing uncertainty around regulatory risks and may influence how future company performance is interpreted by the market.

Explore 50 other fair value estimates on Hims & Hers Health - why the stock might be worth less than half the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives