- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (HIMS): Exploring Valuation Following Major Menopause Treatment Launch

Reviewed by Kshitija Bhandaru

Hims & Hers Health (HIMS) just rolled out personalized treatment plans focused on menopause and perimenopause, signaling an ambitious step into a critical segment of women’s health. This launch expands the company’s reach and addresses a clear market gap.

See our latest analysis for Hims & Hers Health.

The news around Hims & Hers Health’s entry into menopause care sent the stock soaring over 16% right after launch, but those early gains were quickly erased following a round of insider selling by CEO Andrew Dudum and fresh political scrutiny over drug pricing. While the share price is down 15.8% on the day, the long-term story is impressive, with a 124.7% total shareholder return in the past year and more than a tenfold gain over three years. Momentum is still strong, even amid short-term volatility.

If you’re following seismic moves in healthcare, it’s worth discovering See the full list for free.

With the stock still up dramatically over the past year but now trading below analyst targets despite robust growth, investors are debating whether Hims & Hers Health is being undervalued after recent volatility or if the market has already factored in its future potential.

Most Popular Narrative: 42% Undervalued

According to narrative author BlackGoat, Hims & Hers Health's estimated fair value stands dramatically higher than its recent close. This sets up a bold divergence between market sentiment today and the scenario mapped out in the most popular valuation narrative.

Hims is vertically integrating diagnosis, fulfilment, treatment, and retention under one platform, avoiding insurance entirely, and personalising care at scale. The result? Faster growth, higher margins, and better patient outcomes.

Want a peek into the engine driving this high fair value? The logic fuses unusually rapid scaling, deeply personalized healthcare, and an ambitious profit outlook that rivals disruptive tech giants. Curious about the key assumptions and the numbers behind this sharp market disconnect? Dive into the full narrative to see what BlackGoat sees on the horizon.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny on GLP-1 prescriptions and sudden partnership changes could quickly alter the growth trajectory and valuation outlook for Hims & Hers Health.

Find out about the key risks to this Hims & Hers Health narrative.

Another View: Market Ratios Paint a Different Picture

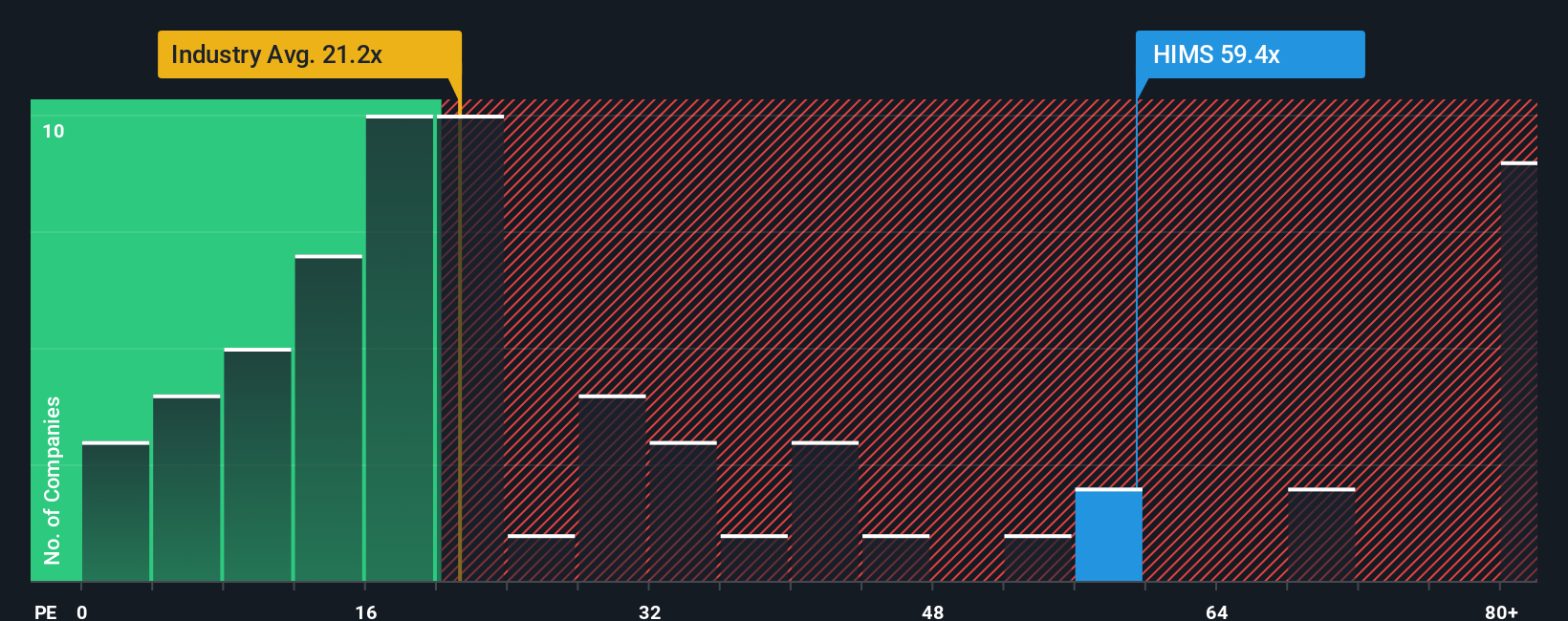

Looking through the lens of price-to-earnings, Hims & Hers Health trades at 58.1 times earnings, well above the industry’s 21.2 times and its peer average of 45.7. While it sits below the calculated fair ratio of 67, this steep premium suggests investors expect rapid growth. Is there enough upside to justify paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

If you see things differently or want to dive into the numbers on your own terms, you can build your own Hims & Hers Health story in just minutes, your way. Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open yourself to a world of different opportunities that others might miss. Don’t let the next big winner pass you by and give your portfolio a smarter edge now.

- Unlock the potential of technology by seizing opportunities among these 24 AI penny stocks excelling in artificial intelligence and automation innovation.

- Power your gains with these 878 undervalued stocks based on cash flows that signal strong upside, capitalizing on stocks trading at a bargain based on their cash flows.

- Jump into tomorrow’s financial landscape by tapping into these 79 cryptocurrency and blockchain stocks at the heart of digital currency and blockchain disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives