- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (HIMS): A Fresh Look at Valuation After FDA Warning Letter Sparks Regulatory Concerns

Reviewed by Kshitija Bhandaru

If you are holding or eyeing Hims & Hers Health (HIMS), this week’s shakeup might have given you some fresh questions. The U.S. Food and Drug Administration just hit the company with a warning letter, citing Hims & Hers for making allegedly false or misleading claims about its compounded semaglutide products. The FDA said these online promotions implied the treatments were equivalent to FDA-approved drugs for weight loss, when in fact, they are not. Hims & Hers now has two weeks to respond and fix the issues or risk further regulatory action. This moment is certainly drawing market attention.

After the news broke, the stock fell roughly 8%, suggesting investors are taking the regulatory risk seriously. This comes in a year when shares have surged a staggering 155%, riding momentum from new product launches, including entries into the competitive testosterone and menopause markets, and ambitious growth targets. Still, regulatory scrutiny appears to have reminded the market that risk can emerge quickly for digital health platforms, especially those pushing aggressively into telemedicine and pharmacy services.

So with shares off their highs after an impressive run, is this a compelling entry point, or is the market already factoring in future growth for Hims & Hers?

Most Popular Narrative: 32.8% Undervalued

According to BlackGoat, the narrative signals that Hims & Hers Health is currently trading at a substantial discount to its estimated fair value, presenting a potentially rare opportunity for investors seeking strong upside in a fast-evolving healthcare platform.

The Case for Hims Hims & Hers Health is not a telehealth gimmick or a GLP-1 hype stock; it is quietly becoming the top-of-funnel infrastructure layer for healthcare in the United States. It is executing a strategy similar to Amazon, Spotify, and Costco: deliver more value per dollar spent, reinvest scale advantages, and win through customer-centric efficiency. However, unlike those companies, Hims operates in a $4 trillion market that is in urgent need of reinvention.

Curious about what underpins this bold conclusion? There is one crucial framework at the heart of this valuation, rooted in aggressive long-term revenue and profit expansion. Want to see exactly how Hims compares to industry leaders, and what sets this growth story apart? There are a few surprising drivers fueling this compelling price target. Find out what they are by exploring the full narrative.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory actions and sudden partnership changes could pose meaningful setbacks. This reminds investors that execution risk remains a central catalyst for this growth story.

Find out about the key risks to this Hims & Hers Health narrative.Another View: Market Metrics Tell a Different Story

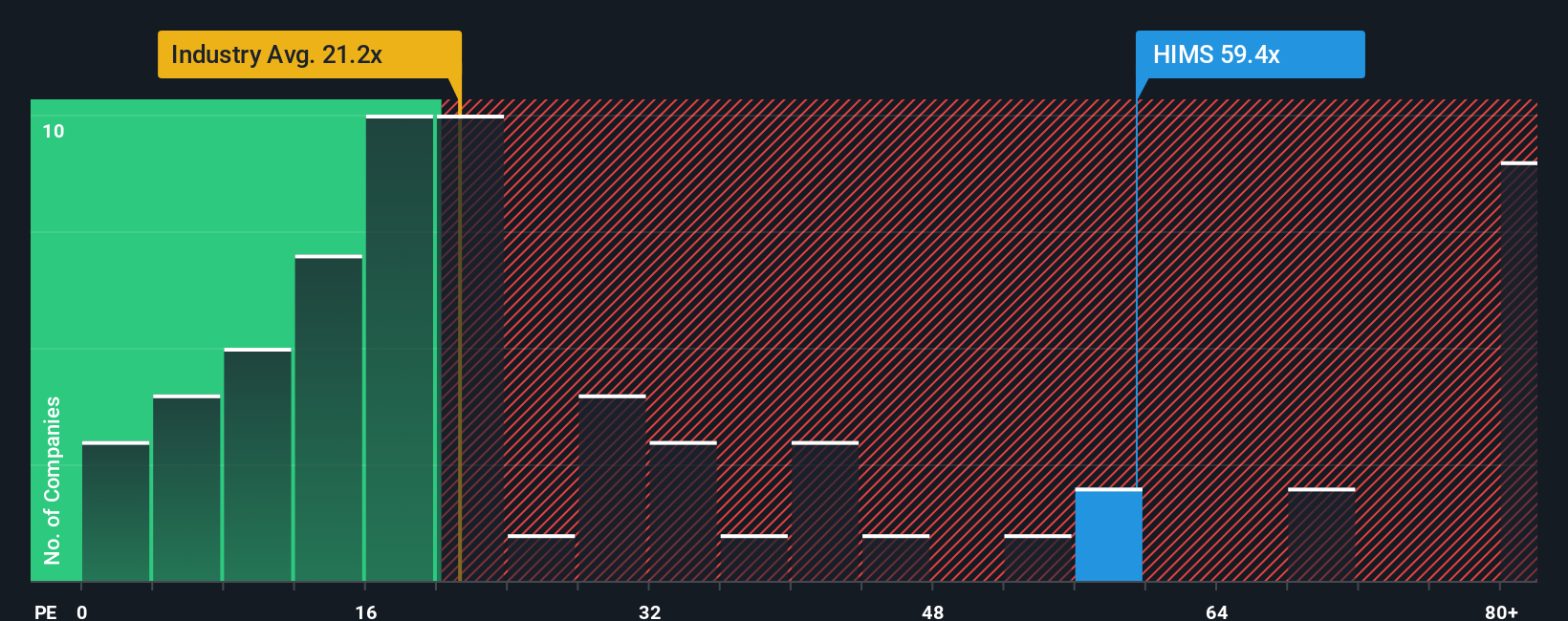

While the long-term outlook may appear bright by some calculations, a closer look at price-to-earnings compared to the sector average shows Hims & Hers trading at a significant premium. Could the market be overestimating its growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

Not convinced by this perspective or curious to reach your own conclusions? You can dive into the numbers and build your own take in just a few minutes. Do it your way

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for a single opportunity when you can explore other market leaders? Let Simply Wall Street guide you to inspired choices with unique stock screeners below. Miss out here and you could leave profits on the table.

- Discover tomorrow’s tech powerhouses by exploring AI-focused opportunities with AI penny stocks, which could be shaping the next era of innovation.

- Increase your portfolio’s income potential by targeting shares that pay reliable, high yields with dividend stocks with yields > 3%, designed for those who value solid, steady returns.

- Find undervalued gems trading below their intrinsic worth with undervalued stocks based on cash flows before the market responds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives