- United States

- /

- Healthcare Services

- /

- NYSE:HCA

Will Raised Guidance and Strong Volumes Shift HCA Healthcare’s (HCA) Investment Narrative?

Reviewed by Sasha Jovanovic

- HCA Healthcare recently reported third-quarter results that surpassed analyst expectations, alongside a raised full-year guidance for revenue, earnings, and net income through 2025 and a declared US$0.72 per share quarterly cash dividend payable in December.

- Growth was driven by increased patient volumes, higher Medicaid supplemental payments, and ongoing investments in operational and digital initiatives, highlighting continued confidence in healthcare demand and performance improvements.

- We’ll examine how HCA's upgraded earnings guidance and strong operational momentum could influence the broader investment narrative for the company.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

HCA Healthcare Investment Narrative Recap

Investors who see potential in HCA Healthcare typically believe in the resilience of healthcare demand and the company's continued ability to grow patient volumes, control costs, and invest in technology and capacity. The latest earnings and raised guidance reinforce confidence in operational momentum; however, their impact on the most pressing risk, federal policy and reimbursement uncertainty, is not material in the immediate term, though policy shifts remain a potential disruptor.

Among HCA's latest announcements, the board's decision to declare a US$0.72 per share cash dividend following robust earnings is a testament to the management's confidence in cash flow stability and shareholder returns. While this aligns with positive catalysts like rising admissions and margin improvements, ongoing vigilance is required as reimbursement environment risks still loom over the sector.

However, investors also need to consider the less visible risks around regulatory and federal reimbursement uncertainty that could quickly affect results if ...

Read the full narrative on HCA Healthcare (it's free!)

HCA Healthcare's outlook anticipates $85.4 billion in revenue and $6.9 billion in earnings by 2028. This assumes a 5.5% annual revenue growth rate and a $0.9 billion increase in earnings from the current $6.0 billion.

Uncover how HCA Healthcare's forecasts yield a $417.52 fair value, a 7% downside to its current price.

Exploring Other Perspectives

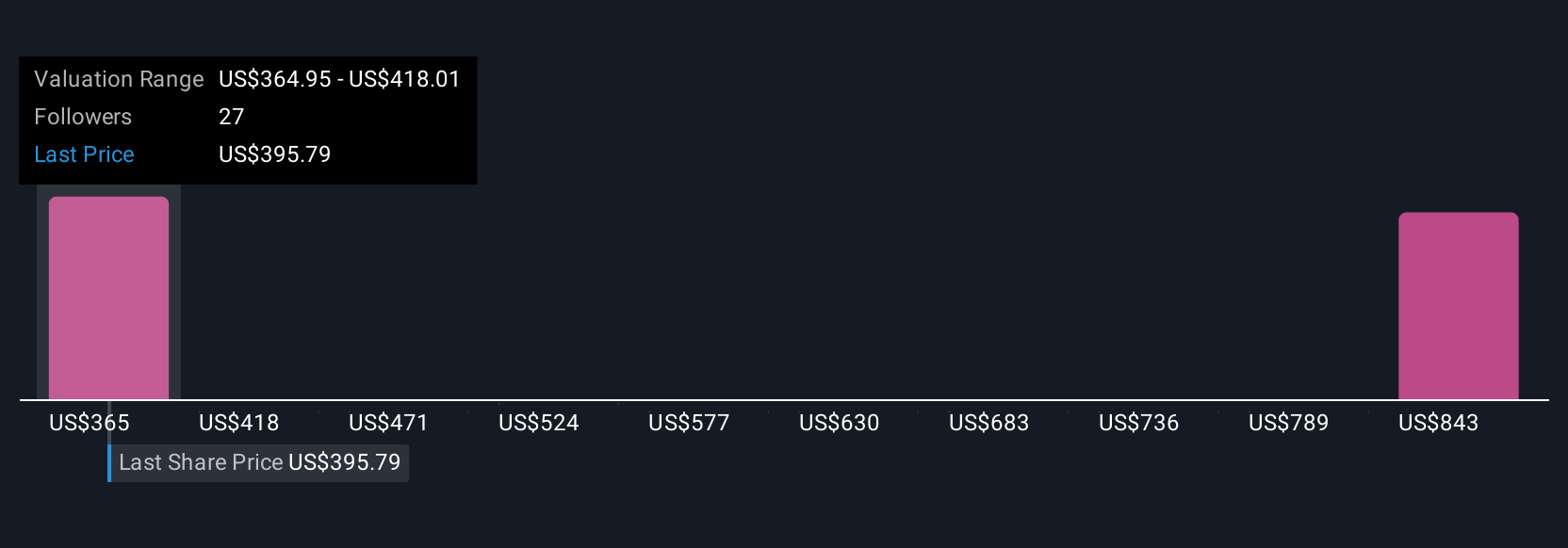

Six Simply Wall St Community members estimate HCA's fair value between US$366 and US$815 per share. While forecasts for broad-based volume growth support optimism, you’ll find sharply contrasting views on long-term performance worth considering.

Explore 6 other fair value estimates on HCA Healthcare - why the stock might be worth 18% less than the current price!

Build Your Own HCA Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HCA Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCA Healthcare's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives