- United States

- /

- Healthcare Services

- /

- NYSE:HCA

HCA Healthcare (HCA) Margin Contraction Reinforces Concerns on Profitability Versus Bullish Narratives

Reviewed by Simply Wall St

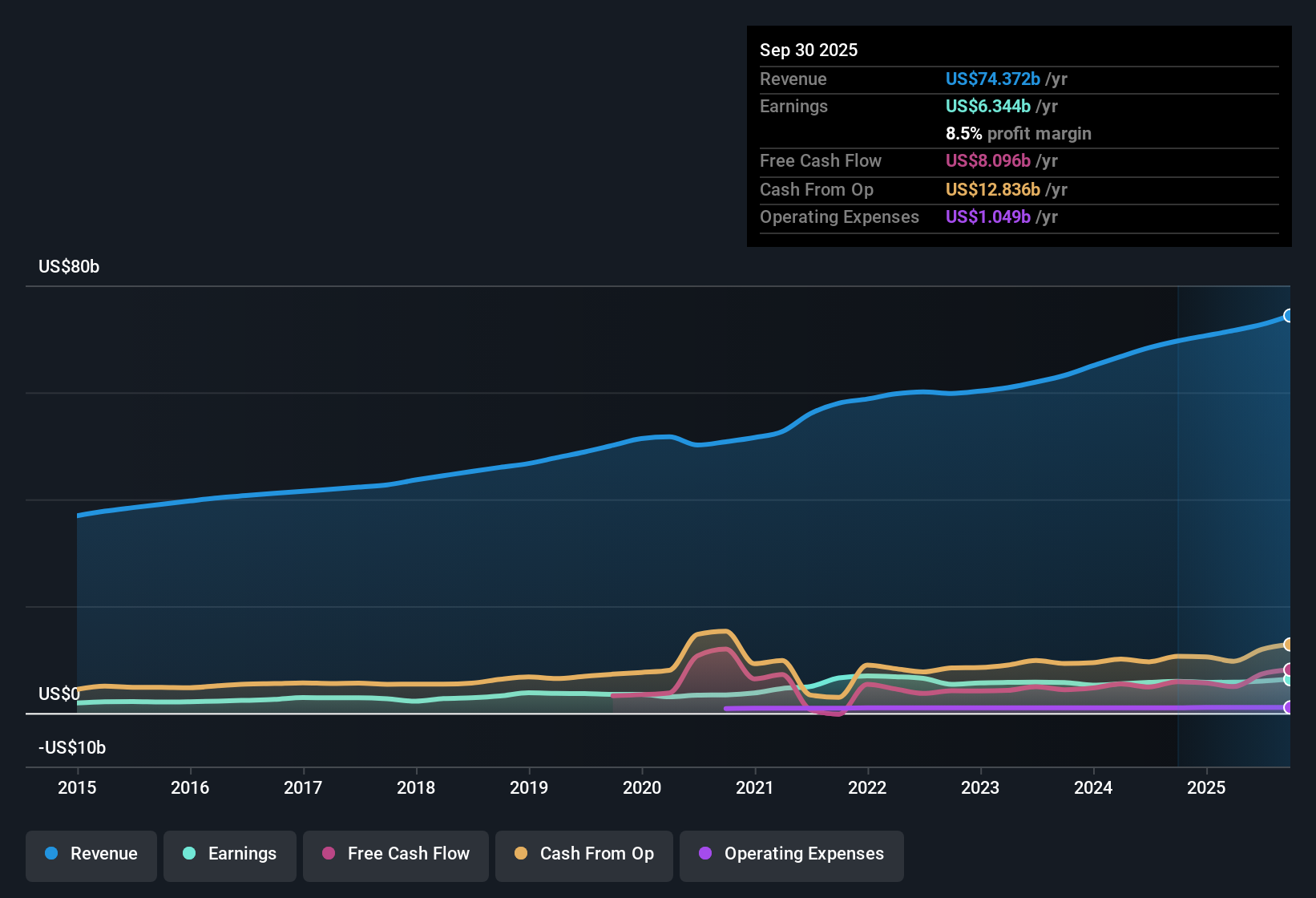

HCA Healthcare (HCA) reported its earnings are forecast to grow 4.8% per year, closely tracking its five-year average earnings growth rate of 4.2%. Revenue is projected to rise at 5% a year, which trails the broader US market’s 10% rate, and the current net profit margin of 8.2% represents a slight contraction from last year’s 8.4%.

See our full analysis for HCA Healthcare.Now, let’s see how these headline numbers measure up to the prevailing narratives and expectations, both from the community and the market at large.

See what the community is saying about HCA Healthcare

Analysts Project 7% Annual Decline in Shares Outstanding

- Wall Street expects the number of HCA Healthcare shares to decrease by 7.0% per year over the next three years. This trend can support earnings per share even with moderate profit growth.

- According to the analysts' consensus view, decreasing share count, combined with expected revenue growth of 5.5% annually and earnings reaching $6.9 billion by 2028, could help maintain solid EPS progression as the business scales up.

- Consensus also highlights that operating margin improvement, achieved through cost management and reduced contract labor, should reinforce these gains.

- Still, consensus notes analysts expect slightly narrowing profit margins over this period, from 8.2% to 8.1% despite overall growth drivers.

- To see how consensus views shape the long-term outlook, dig into the full narrative and how analysts weigh growth and risks. 📊 Read the full HCA Healthcare Consensus Narrative.

Valuation Gap Widens Versus DCF Fair Value

- At $447.04, HCA’s share price trades at a steep discount to the DCF fair value of $815.34. This is roughly 45% below what long-term discounted cash flow suggests.

- Within the analysts' consensus, good relative value and the below-peer Price-To-Earnings Ratio of 17.5x (compared to 21.7x for the healthcare industry) draw attention as bright spots that offset modest profit growth.

- Consensus further points out that the current market price sits well under both peer valuation averages and DCF-calculated intrinsic value, reinforcing the view that HCA may be undervalued based on fundamentals.

- However, the muted gap between today's price and the latest analyst price target ($436.10) signals expectations are already baked in and re-rating potential could be limited without fresh catalysts.

Margins Supported by Cost Controls but Face Regulatory Risks

- Net profit margin sits at 8.2%, a tick below last year’s 8.4%. Consensus expects margins to edge slightly lower to 8.1% over three years, noting pressure from higher professional fees and changing Medicaid volumes.

- Analysts' consensus narrative acknowledges that operational efficiency, helped by improved payer mix and investment in technology like AI, should help offset some margin contraction. However, it cautions that ongoing regulatory and reimbursement risks could constrain net profit if cost pressures build.

- The consensus narrative flags regulatory uncertainties and potential changes to Medicaid supplemental programs as the most important factors that could unexpectedly weigh on profits.

- This tension shows how HCA’s margin story remains finely balanced. Improved efficiency can blunt but not erase policy and cost headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for HCA Healthcare on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the figures? Share your outlook and shape the story in just a few minutes. Do it your way

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While HCA Healthcare’s growth and value stand out, the outlook is limited because of narrowing profit margins, regulatory uncertainty, and muted re-rating potential at current prices.

If you want companies with more consistent, reliable expansion, focus on steady performers through all cycles using stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives