- United States

- /

- Medical Equipment

- /

- NYSE:HAE

Haemonetics (HAE) Valuation: Assessing the Impact of PerQseal Elite’s CE Mark and New Leadership Moves

Reviewed by Kshitija Bhandaru

Haemonetics (HAE) just scored a major win with the CE Mark approval for its latest innovation, the PerQseal Elite vascular closure system. This fully bioresorbable and sutureless device is designed for large-bore vascular access and could open up significant opportunities in the European healthcare market. Alongside this regulatory milestone, Haemonetics also announced a slate of strategic leadership appointments aimed at driving operational strength and broadening commercial reach. Together, these developments put the company in the spotlight for investors who track healthcare technology and global growth stories.

Despite this step forward, Haemonetics’ stock price has had a tough run. Shares have dropped nearly 30% in the past three months and are down 32% over the past year, reflecting persistent market caution. Even as the company grows revenue and net income on an annual basis, investor enthusiasm has faded compared to figures from just a few years ago. Momentum has been squarely against the stock, with the latest moves closely watched against this challenging backdrop.

After such a rocky year, are recent catalysts like the PerQseal Elite launch a true inflection point for Haemonetics, or is the market already factoring in all the future growth?

Most Popular Narrative: 35.7% Undervalued

According to the most widely followed view, Haemonetics is trading well below its consensus fair value. This suggests the market is missing key upside drivers, while analysts are increasingly at odds about future targets and growth trajectories.

Enterprise-wide portfolio transformation, highlighted by the divestiture of low-margin businesses, disciplined capital deployment, and ongoing investment in automation and digital solutions, is driving substantial gross and operating margin expansion. Guidance for FY26 is 26 to 27%, and this is likely to support further improvements in net margins and free cash flow conversion.

Want to know what is powering this significant discount to fair value? There is a combination of growth, earnings, and margins fueling these bold analyst targets. The narrative is built on a set of financial forecasts that most investors never see. Want to uncover the hidden assumptions that could point to a major re-rating? The full story behind this valuation may surprise you.

Result: Fair Value of $78.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on key U.S. products and rising competition remain potential headwinds that could challenge Haemonetics' growth outlook in the years ahead.

Find out about the key risks to this Haemonetics narrative.Another View: Discounted Cash Flow Analysis

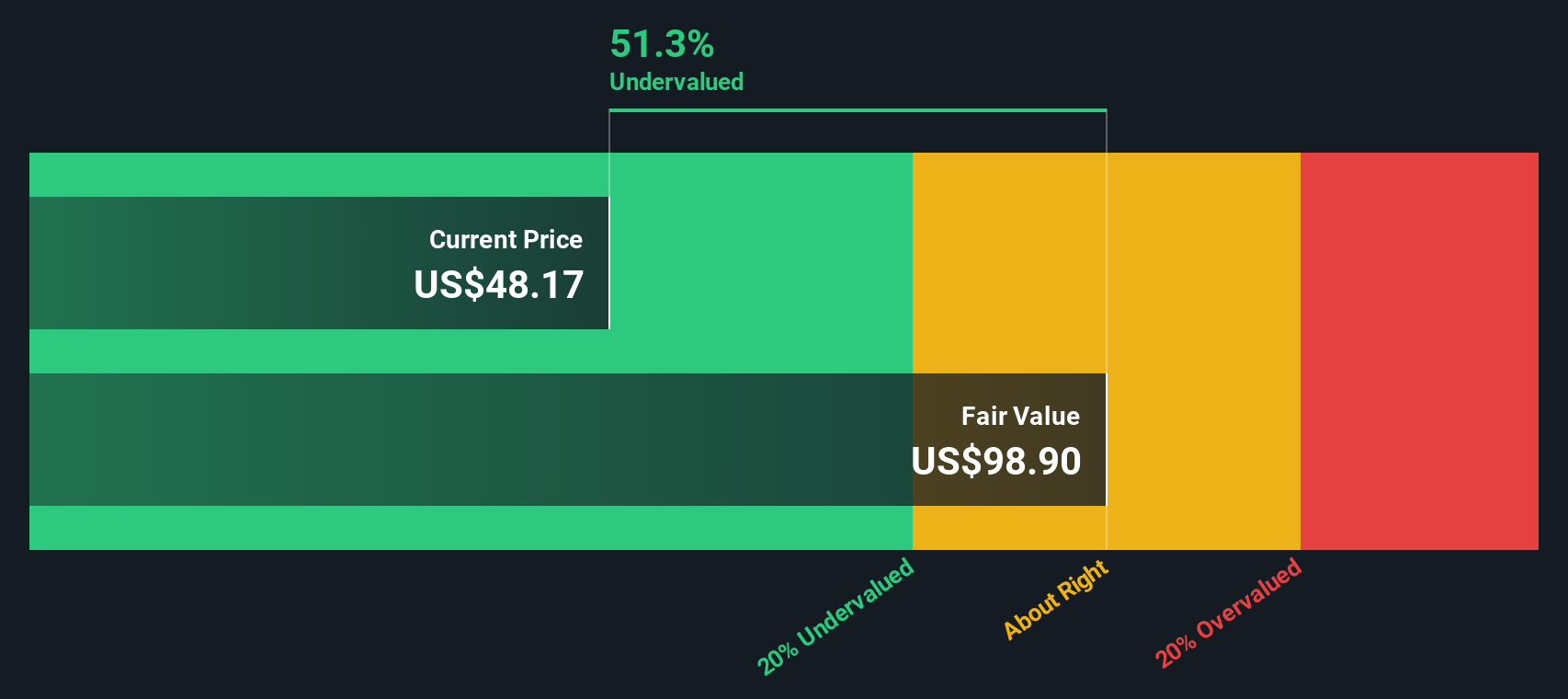

Our SWS DCF model also sees Haemonetics as undervalued in today's market. This adds more weight to the fair value debate. Could both methods be missing key risks, or is a turnaround truly in sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Haemonetics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Haemonetics Narrative

If you have a different perspective or want to take a closer look at the numbers yourself, it’s simple to explore and develop your own analysis in just a few minutes. Do it your way

A great starting point for your Haemonetics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the real gems are often found by looking beyond the obvious. Give yourself the edge by checking out these tailored investment screens before your next move. You will not want to miss out on what could be your portfolio’s next standout performer.

- Uncover the potential in up-and-coming market disruptors as you browse penny stocks with strong financials making strategic waves with strong financials.

- Spot breakthrough innovation in healthcare by searching for real contenders among healthcare AI stocks that are transforming patient outcomes with advanced technology.

- Start your search for overlooked bargains by targeting undervalued stocks based on cash flows that stand out based on deep cash flow analysis and untapped upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haemonetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAE

Haemonetics

A medical technology company, provides a suite of hospital technologies solutions in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives