- United States

- /

- Medical Equipment

- /

- NYSE:HAE

Announcing: Haemonetics (NYSE:HAE) Stock Increased An Energizing 253% In The Last Five Years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Haemonetics Corporation (NYSE:HAE) shareholders would be well aware of this, since the stock is up 253% in five years. On top of that, the share price is up 12% in about a quarter.

Check out our latest analysis for Haemonetics

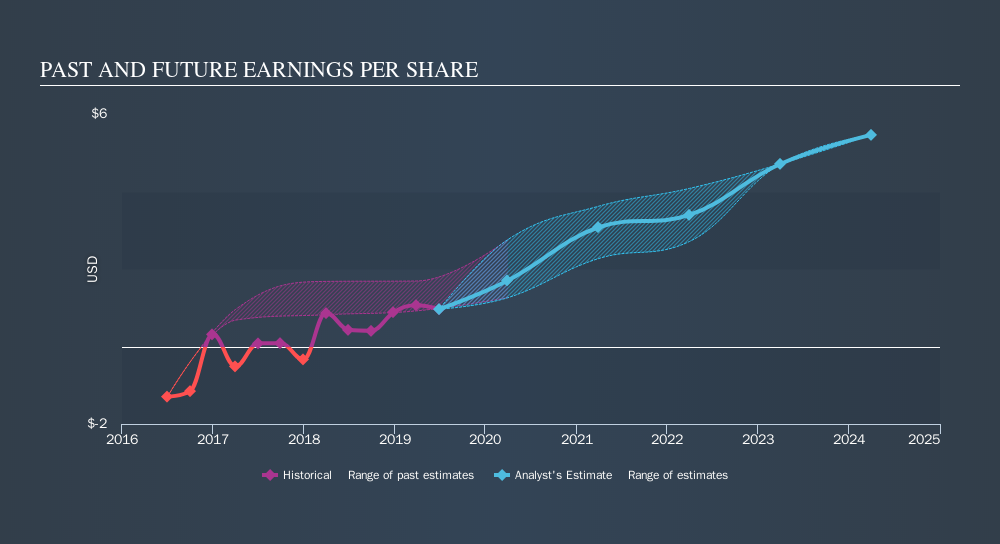

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Haemonetics became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

We know that Haemonetics has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Haemonetics's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Haemonetics shareholders have received a total shareholder return of 13% over the last year. However, that falls short of the 29% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HAE

Haemonetics

A medical technology company, provides a suite of hospital technologies solutions in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives