- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Globus Medical (GMED): Evaluating Valuation After New Products, Growth, and ROIC Slowdown

Reviewed by Kshitija Bhandaru

Globus Medical (GMED) is drawing attention as it grows revenue and earnings while launching new products and expanding into additional countries. However, investors are monitoring a noticeable fall in the company’s return on invested capital, which may be influencing recent share price moves.

See our latest analysis for Globus Medical.

Despite solid revenue and earnings growth, Globus Medical’s share price has lagged lately, with a flat one-year total shareholder return of -0.14%. The latest moves, such as aggressive product launches and rapid international expansion, have yet to translate into meaningful momentum for shareholders. This is likely because investors are taking a wait-and-see approach amid concerns about the company’s falling return on invested capital. Long-term holders, however, have still seen modest gains over a five-year period, reflecting the company’s underlying growth potential even as the market reassesses recent risks.

If Globus Medical’s innovation story has you thinking about what else is out there, consider broadening your search and discover See the full list for free.

With Globus Medical’s fundamentals remaining strong, but returns on new investments under scrutiny, is this recent pullback a buying opportunity before growth resumes, or is the market already taking future prospects into account?

Most Popular Narrative: 24.7% Undervalued

Globus Medical's narrative-driven fair value is $80.30, which stands nearly $20 above the latest closing price of $60.48. This substantial gap highlights high expectations despite recent share price stagnation and hints at a potential rerating if assumptions hold.

Continued innovation and adoption of robotics, navigation, and minimally invasive procedures — including expansion of the ExcelsiusGPS ecosystem, launch of the Excelsius XR headset, and robust product pipeline — position Globus to capitalize on healthcare digitization trends. These factors may drive higher ASPs, stronger market differentiation, and improved gross margins over time.

Want to know what’s fueling this bullish view? One key driver is an aggressive revenue growth forecast and a profit margin expansion rarely seen in medtech. Curious what ambitious financial benchmarks are baked into this price prediction? Click through to uncover the specifics behind this narrative's $80+ target.

Result: Fair Value of $80.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected integration of recent acquisitions or weaker than hoped international growth could challenge optimism around Globus Medical’s future targets.

Find out about the key risks to this Globus Medical narrative.

Another View: SWS DCF Model Offers a Different Perspective

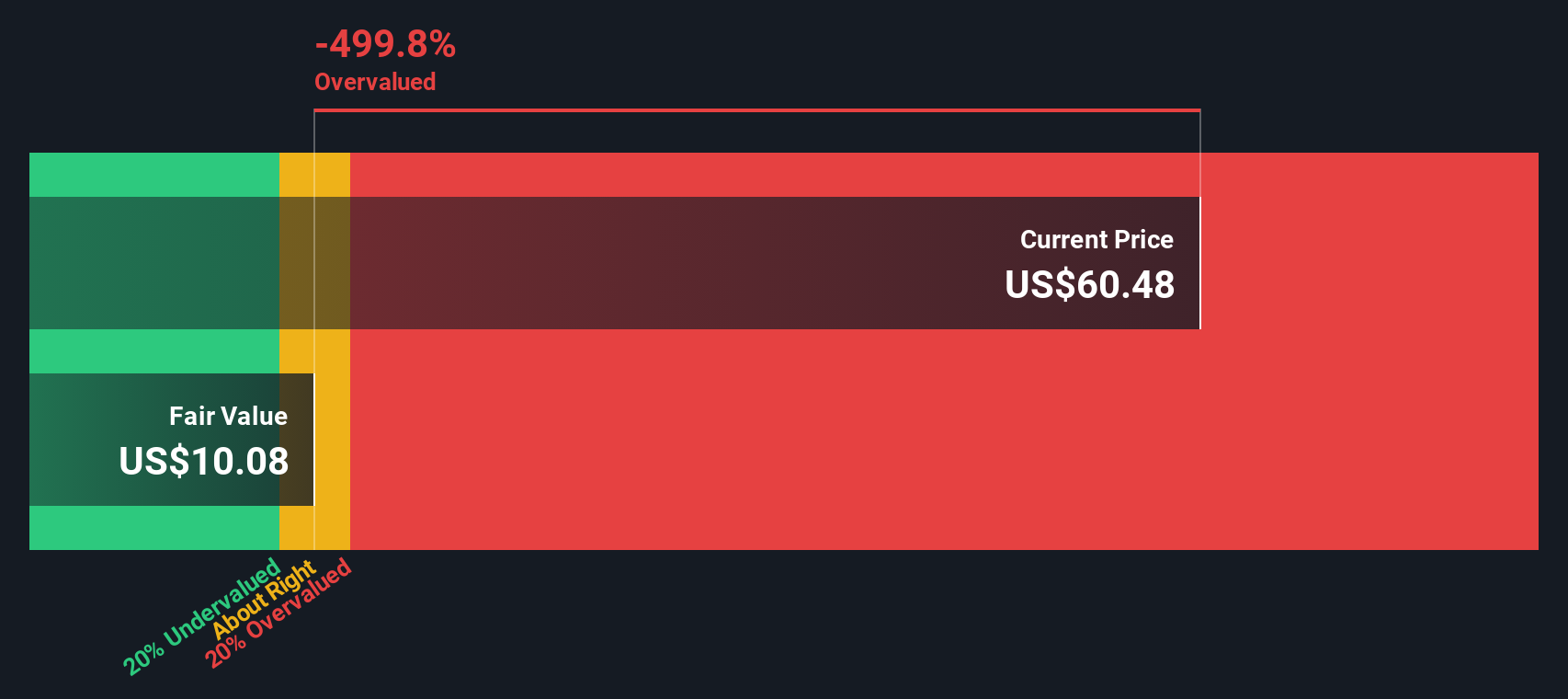

While the narrative fair value highlights upside potential, our SWS DCF model tells a different story. Based on projected cash flows, the DCF estimate places Globus Medical’s fair value well below the current share price. This suggests the stock may actually be overvalued on this metric. Could the market’s optimism be running ahead of fundamentals, or is the DCF model being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Globus Medical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Globus Medical Narrative

If you see things differently or want to dig into the details yourself, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Globus Medical.

Looking for More Investment Ideas?

Smart investors never stand still, and missing out on the next big trend means leaving returns on the table. Put the Simply Wall St Screener to work for you and make sure your portfolio leaves nothing to chance.

- Uncover emerging technologies that could transform healthcare by using these 31 healthcare AI stocks to see where artificial intelligence is making waves.

- Boost your search for potential bargains with these 901 undervalued stocks based on cash flows to find stocks that the market may be overlooking right now.

- Tap into a world of high-yield opportunities and secure income potential by screening these 19 dividend stocks with yields > 3% for robust yields and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives