- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Globus Medical (GMED): Evaluating Valuation After Launch of Innovative ANTHEM Elbow Fracture System

Reviewed by Kshitija Bhandaru

Globus Medical (GMED) is making waves with its latest product launch, the ANTHEM Elbow Fracture System. This new comprehensive plating system is engineered to help surgeons address a range of complex elbow fractures, which could potentially expand the company’s presence in orthopedics.

See our latest analysis for Globus Medical.

With fresh momentum from its product launch, Globus Medical has seen its share price climb 12.4% over the last 90 days. However, the 1-year total shareholder return remains down 18.9%. This suggests recent innovation is sparking renewed interest, even as longer-term holders await a stronger recovery.

If you’re interested in other promising medical technology names, consider expanding your search with the See the full list for free.

With analyst price targets implying significant upside from current levels, the question for investors is clear: does Globus Medical still offer attractive value, or has the recent rally already factored in the company’s future growth?

Most Popular Narrative: 25.8% Undervalued

With the latest fair value set at $80.30, Globus Medical trades at a discernible gap from its last close of $59.58. The narrative behind this target combines driving innovation with crucial growth catalysts, suggesting upside potential if execution continues.

Successful integration and synergy capture from the NuVasive and Nevro acquisitions are providing opportunities for increased cross-selling, cost efficiencies, and realization of deferred tax assets. These developments are expected to drive margin expansion, boost earnings, and enhance recurring cash flows in upcoming years.

Want to know the financial drivers behind this bullish scenario? The key to this narrative is in its ambitious projections for recurring revenue streams and future margins. Find out what truly powers this valuation and why it stands out among its peers.

Result: Fair Value of $80.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges from recent acquisitions and slowdowns in key international markets could quickly shift the growth outlook for Globus Medical.

Find out about the key risks to this Globus Medical narrative.

Another View: Putting Multiples in Context

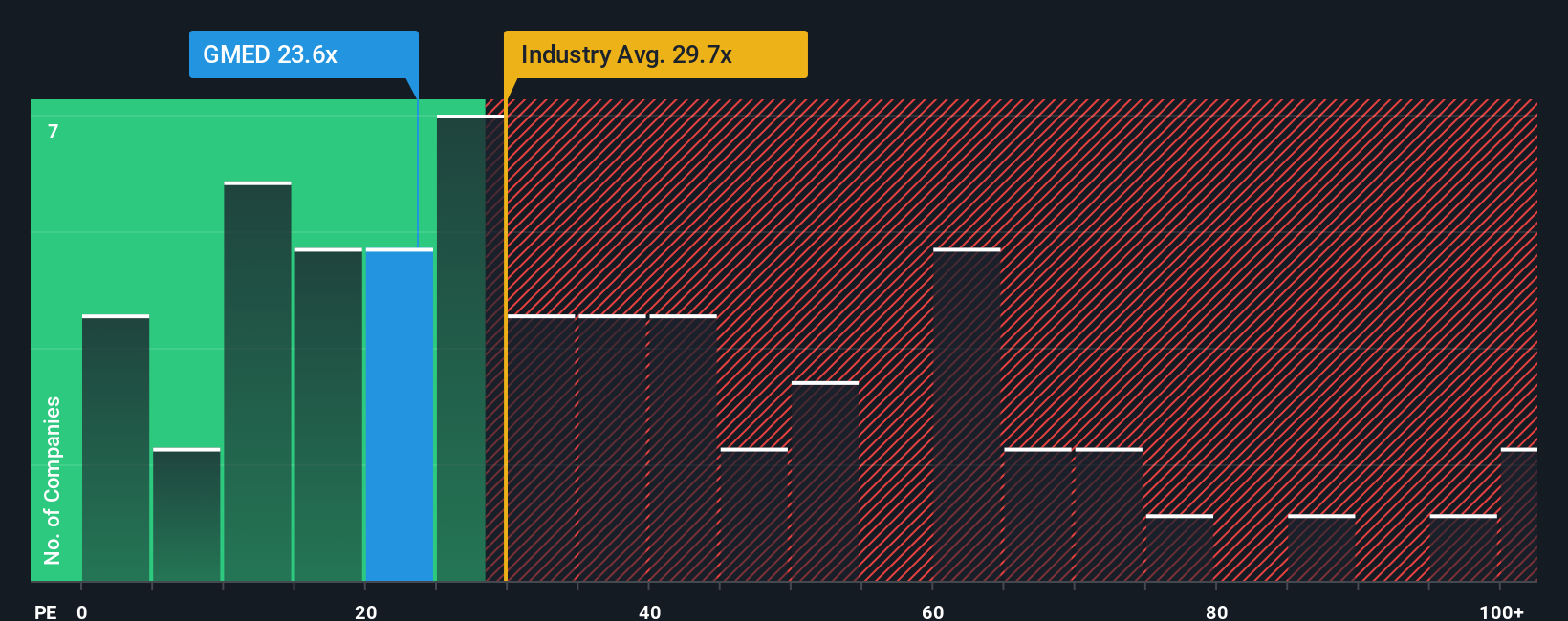

While analysts see upside, the current valuation based on price-to-earnings suggests Globus Medical is trading at 22.6x, which is well below both its industry average of 29.1x and its peer average of 48.7x. That is also under its fair ratio of 24.4x, hinting at a potential opportunity. But could this discount signal risks the market sees, or is it a window for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Globus Medical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Globus Medical Narrative

If you’re keen to analyze the numbers for yourself or want to craft your own view, it’s easy to shape your own scenario in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Globus Medical.

Looking for More Compelling Investment Ideas?

Opportunities move fast in the market, so make sure you seize the chance to uncover standout stocks using the Simply Wall Street Screener before others catch on.

- Explore industries transformed by artificial intelligence by checking out these 24 AI penny stocks set to redefine the tech landscape.

- Consider potential big gains by sizing up these 3600 penny stocks with strong financials with solid financials and high growth prospects.

- Enhance your passive income strategy and stability with these 18 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives