- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Could Globus Medical’s (GMED) New Trauma System Signal a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Globus Medical recently launched the ANTHEM™ Elbow Fracture System, a comprehensive solution featuring anatomically contoured plates and polyaxial locking technology aimed at simplifying and enhancing the surgical treatment of complex elbow fractures across varying severities.

- This product introduces a highly versatile plating portfolio that directly addresses surgeon workflow needs while expanding Globus Medical’s presence in the trauma care segment.

- We'll explore how the advanced design and workflow benefits of the ANTHEM™ Elbow Fracture System may impact Globus Medical’s investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Globus Medical Investment Narrative Recap

Owning shares of Globus Medical means believing in the company's ability to deliver consistent growth through product innovation and operational execution, particularly as it expands its portfolio in trauma care and surgical solutions. The ANTHEM™ Elbow Fracture System launch reflects Globus Medical’s push to diversify and may support its competitive positioning, though it does not directly alter the most immediate catalysts or address the largest looming risks such as integration challenges from recent acquisitions.

Globus Medical’s recent announcement of the DuraPro™ Navigation System is particularly relevant given its synergy with the company’s robotics and navigation platforms. This integration-focused product aligns with existing catalysts around digital surgery adoption and enhanced procedural efficiency, which could become increasingly important in sustaining revenue growth as competition intensifies.

However, investors should be mindful that, despite these innovations, integration risks from the NuVasive and Nevro acquisitions could present operational hurdles if...

Read the full narrative on Globus Medical (it's free!)

Globus Medical's outlook forecasts $3.4 billion in revenue and $538.8 million in earnings by 2028. This is based on 9.0% annual revenue growth and an increase in earnings of about $182 million from the current $356.6 million.

Uncover how Globus Medical's forecasts yield a $80.30 fair value, a 28% upside to its current price.

Exploring Other Perspectives

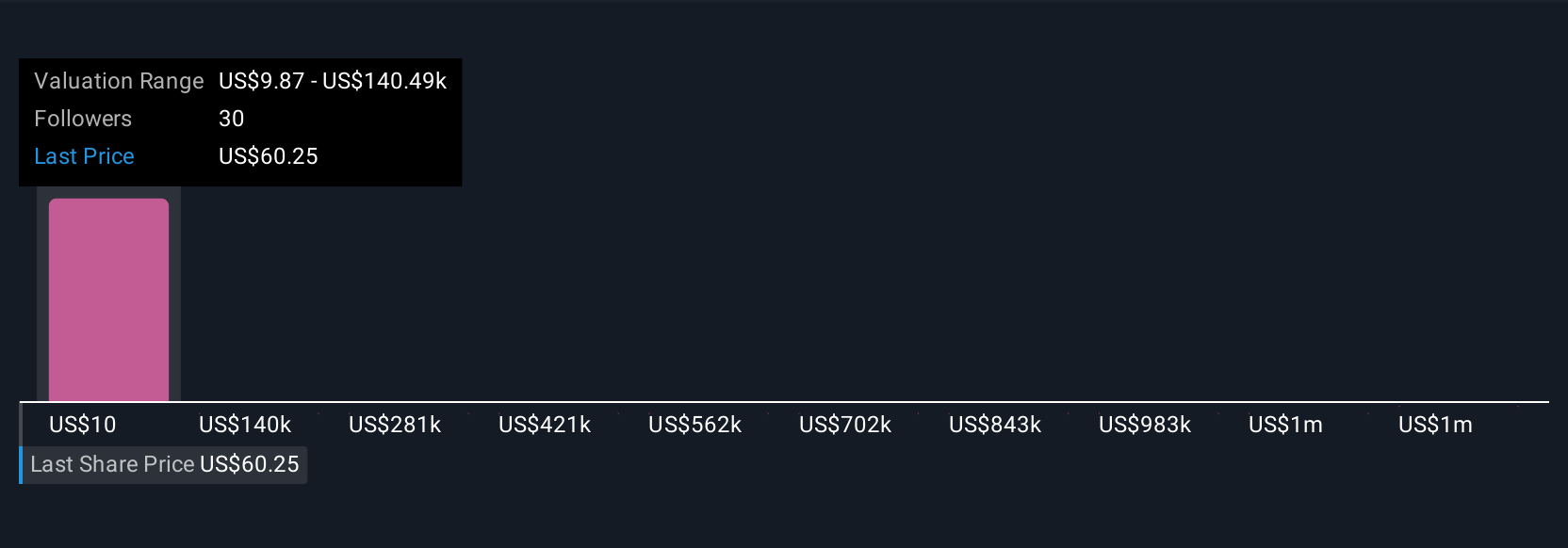

Four distinct fair value estimates from the Simply Wall St Community span from as low as US$10.06 to US$80.30 per share. While many are encouraged by Globus Medical’s expanding product pipeline, others remind you to consider challenges such as ongoing integration risks that might affect longer-term performance and margins.

Explore 4 other fair value estimates on Globus Medical - why the stock might be worth as much as 28% more than the current price!

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives