- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Risks To Shareholder Returns Are Elevated At These Prices For Glaukos Corporation (NYSE:GKOS)

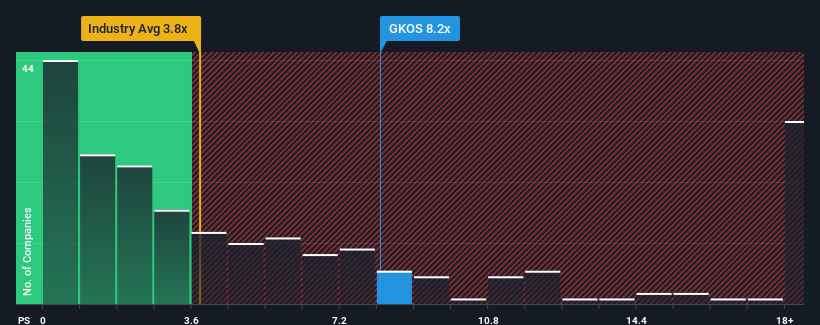

You may think that with a price-to-sales (or "P/S") ratio of 8.2x Glaukos Corporation (NYSE:GKOS) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.8x and even P/S lower than 1.5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Glaukos

What Does Glaukos' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Glaukos' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Glaukos' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Glaukos' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 10% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 9.0% each year, which is not materially different.

With this information, we find it interesting that Glaukos is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Glaukos currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Glaukos is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives