- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Here's Why Glaukos Corporation's (NYSE:GKOS) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Glaukos to hold its Annual General Meeting on 30th of May

- CEO Tom Burns' total compensation includes salary of US$765.0k

- The total compensation is similar to the average for the industry

- Glaukos' EPS declined by 36% over the past three years while total shareholder return over the past three years was 44%

The share price of Glaukos Corporation (NYSE:GKOS) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. The upcoming AGM on 30th of May may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Glaukos

Comparing Glaukos Corporation's CEO Compensation With The Industry

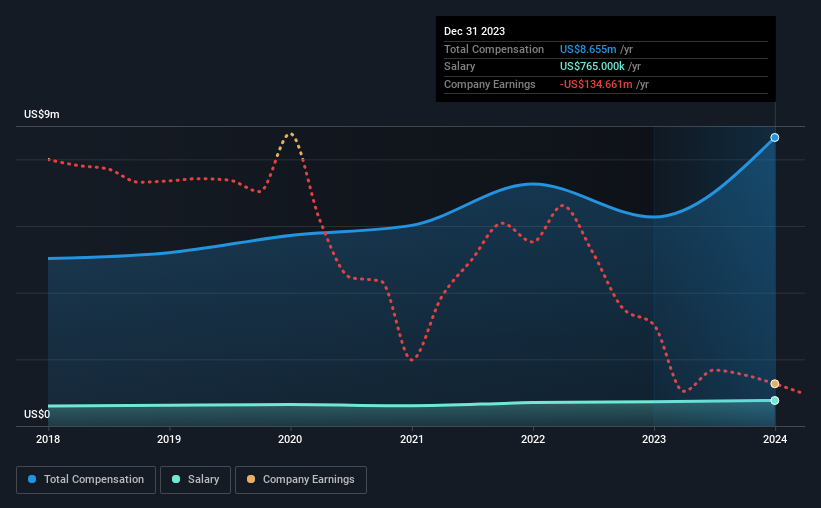

At the time of writing, our data shows that Glaukos Corporation has a market capitalization of US$5.4b, and reported total annual CEO compensation of US$8.7m for the year to December 2023. We note that's an increase of 38% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$765k.

On comparing similar companies from the American Medical Equipment industry with market caps ranging from US$4.0b to US$12b, we found that the median CEO total compensation was US$8.7m. So it looks like Glaukos compensates Tom Burns in line with the median for the industry. Furthermore, Tom Burns directly owns US$158m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$765k | US$730k | 9% |

| Other | US$7.9m | US$5.5m | 91% |

| Total Compensation | US$8.7m | US$6.3m | 100% |

Speaking on an industry level, nearly 25% of total compensation represents salary, while the remainder of 75% is other remuneration. Glaukos sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Glaukos Corporation's Growth

Over the last three years, Glaukos Corporation has shrunk its earnings per share by 36% per year. It achieved revenue growth of 13% over the last year.

Overall this is not a very positive result for shareholders. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Glaukos Corporation Been A Good Investment?

Boasting a total shareholder return of 44% over three years, Glaukos Corporation has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Glaukos that investors should think about before committing capital to this stock.

Switching gears from Glaukos, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, focuses on the development of novel therapies for the treatment of glaucoma, corneal disorders, and retinal diseases.

Adequate balance sheet and slightly overvalued.