- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Glaukos (GKOS) Wins FDA Nod for Epioxa—Is a New Era in Keratoconus Care Taking Shape?

Reviewed by Sasha Jovanovic

- Glaukos Corporation recently received U.S. Food and Drug Administration (FDA) approval for Epioxa HD and Epioxa, its novel incision-free topical drug therapies designed to treat keratoconus, a rare and progressive eye disease.

- This marks a significant development as Epioxa offers an alternative to existing cross-linking treatments by avoiding the need for corneal epithelium removal, potentially enhancing patient comfort and reducing recovery time.

- We'll explore how FDA approval for Epioxa, which introduces incision-free keratoconus therapy, could impact Glaukos' growth outlook and competitiveness.

Find companies with promising cash flow potential yet trading below their fair value.

Glaukos Investment Narrative Recap

To be a Glaukos shareholder, you need to believe in the company's ability to advance innovative ophthalmic therapies that establish new standards of care, especially as procedures shift to less invasive options. The recent FDA approval of Epioxa, a next-generation incision-free therapy for keratoconus, provides meaningful validation for Glaukos' corneal health platform and may represent the clearest near-term catalyst, but risks remain around execution and emerging competition as the product launches. Glaukos’ scheduled Q3 2025 earnings call on October 29, 2025, is poised to provide investors with additional details regarding the Epioxa approval, rollout plans, and updates on financial and operational guidance. Of particular interest will be any commentary around professional fee adoption and payer coverage for new therapies, as reimbursement headwinds may be material for near-term results. In contrast, investors should be aware of ongoing reimbursement risk for ophthalmic procedures, which could…

Read the full narrative on Glaukos (it's free!)

Glaukos' narrative projects $856.9 million in revenue and $72.3 million in earnings by 2028. This requires 25.6% yearly revenue growth and a $165.1 million earnings increase from current earnings of -$92.8 million.

Uncover how Glaukos' forecasts yield a $117.50 fair value, a 55% upside to its current price.

Exploring Other Perspectives

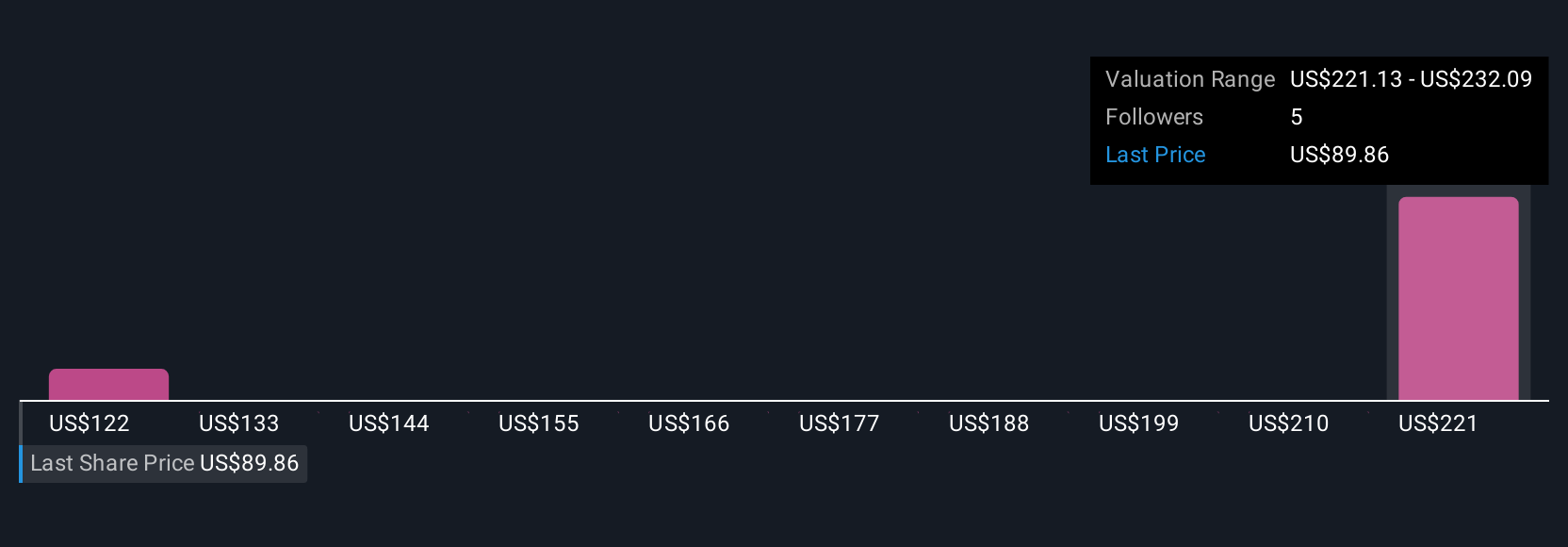

Simply Wall St Community members provided four unique fair value estimates for Glaukos, spanning from US$74.28 to US$165 per share. With competition intensifying across the ophthalmic device market, these diverging perspectives highlight the many factors shaping expectations around future growth.

Explore 4 other fair value estimates on Glaukos - why the stock might be worth over 2x more than the current price!

Build Your Own Glaukos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glaukos research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Glaukos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glaukos' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives