- United States

- /

- Medical Equipment

- /

- NYSE:EW

Edwards Lifesciences (NYSE:EW) Receives FDA Approval For Groundbreaking TAVR Therapy For Asymptomatic Patients

Reviewed by Simply Wall St

Edwards Lifesciences (NYSE:EW) recently celebrated the FDA approval of its SAPIEN 3 TAVR therapy for asymptomatic aortic stenosis patients, a significant development in cardiac care. This milestone, coupled with robust Q1 earnings and updated financial guidance, likely bolstered investors' confidence, contributing to a 5% share price increase over the past month. The company’s advancements align with broader market trends, marked by a 2% rise, driven by strong earnings and positive economic indicators, which may have collectively reinforced Edwards's performance amidst investor optimism.

Find companies with promising cash flow potential yet trading below their fair value.

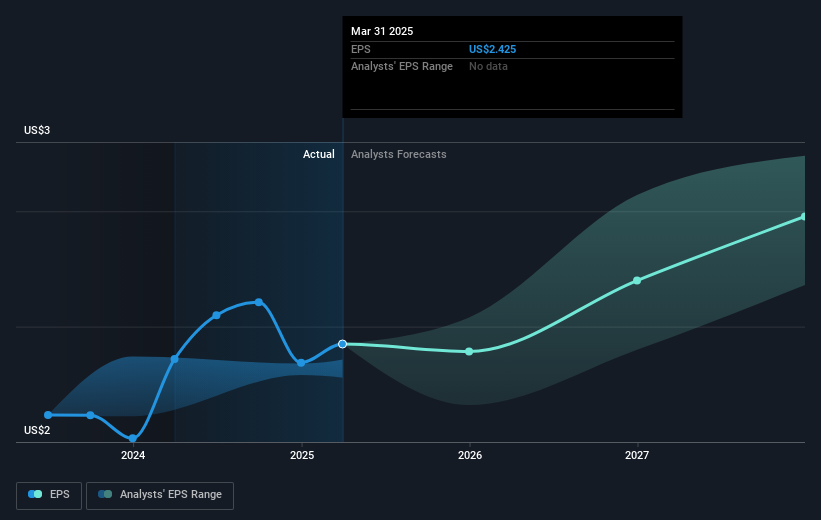

The FDA approval of Edwards Lifesciences' SAPIEN 3 TAVR therapy could significantly enhance the company's revenue streams by attracting new asymptomatic aortic stenosis patients. This aligns with earlier forecasts of strategic product launches spurring revenue growth. Analysts project annual revenue growth of 9.8% for Edwards, bolstered by key product approvals and expanding market access, potentially elevating future earnings. However, tariffs and competitive pressures remain risks to margin growth, necessitating careful financial oversight to maintain projections.

Over a five-year period, Edwards' total return, including share price and dividends, was a modest 3.44%. This performance indicates a more restrained growth compared to a 9.6% return by the US Market in the past year, highlighting challenges faced within the dynamic industry landscape. In contrast, the company's earnings growth in the last year lagged the wider Medical Equipment industry, which experienced a 10.2% rise, suggesting competitive pressures might be influencing long-term performance.

With a current share price of US$76.28, Edwards trades at a mere 5% discount to the analyst consensus price target of US$80.28. This indicates that market perceptions place it close to fair value, considering the earnings growth assumptions of analysts. Such small variance suggests that investors believe the company is priced appropriately, but any deviation in forecasted earnings or revenue projections could quickly alter this dynamic. Given the financial guidance updates and approved product offerings, Edwards Lifesciences could achieve enhanced profitability, yet it remains imperative for investors to evaluate these projections with caution.

Review our historical performance report to gain insights into Edwards Lifesciences' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Edwards Lifesciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives