- United States

- /

- Medical Equipment

- /

- NYSE:EW

Edwards Lifesciences (EW): Assessing Valuation Following Raised 2025 Guidance and New Valve Technology Launch

Reviewed by Kshitija Bhandaru

Edwards Lifesciences (EW) has caught the spotlight with its upcoming third-quarter earnings release and a recent increase in 2025 sales and EPS guidance. Investors are weighing the company’s confident outlook in addition to its global innovation efforts.

See our latest analysis for Edwards Lifesciences.

Edwards Lifesciences has stayed in the spotlight, not just for its updated guidance but also for innovation milestones such as the recent launch of advanced valve technology in Thailand and its presence at major investor events. The stock’s 1-year total shareholder return of 19% hints at momentum building after a stretch of sluggish long-term results, suggesting renewed optimism tied to future growth opportunities and global expansion.

If you find medical device breakthroughs compelling, this is a great moment to explore See the full list for free.

Despite management’s upbeat guidance and new product launches, Edwards trades about 14% below the average analyst price target. The question remains: is there still upside as momentum returns, or has future growth already been priced in?

Most Popular Narrative: 12.7% Undervalued

With a last close of $76.56, the most widely followed narrative estimates Edwards Lifesciences’ fair value at $87.73. That is a notable gap, fueled by bold projections about the company’s future growth drivers. This sets up a big debate about what is priced in versus what is not.

The expected approval of the early TAVR indication in the second quarter, along with policy and guideline changes in the U.S. and globally, represents a multiyear growth opportunity that could significantly enhance revenue streams in the future. The planned launch of the transcatheter tricuspid valve EVOQUE in 2024 is anticipated to uniquely position Edwards to gain market share and increase revenues as it becomes the first company to develop and offer this therapy.

Curious what assumptions fuel this bullish stance? Insiders debate future industry leadership, changing patient access, and a profit trajectory few would expect. What is the pivotal number inspiring this narrative’s ambitious fair value? You will want to see for yourself how they justify it.

Result: Fair Value of $87.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as tariff impacts or tougher competition in key markets could erode margins and challenge the bullish outlook for Edwards Lifesciences.

Find out about the key risks to this Edwards Lifesciences narrative.

Another View: What Do the Multiples Say?

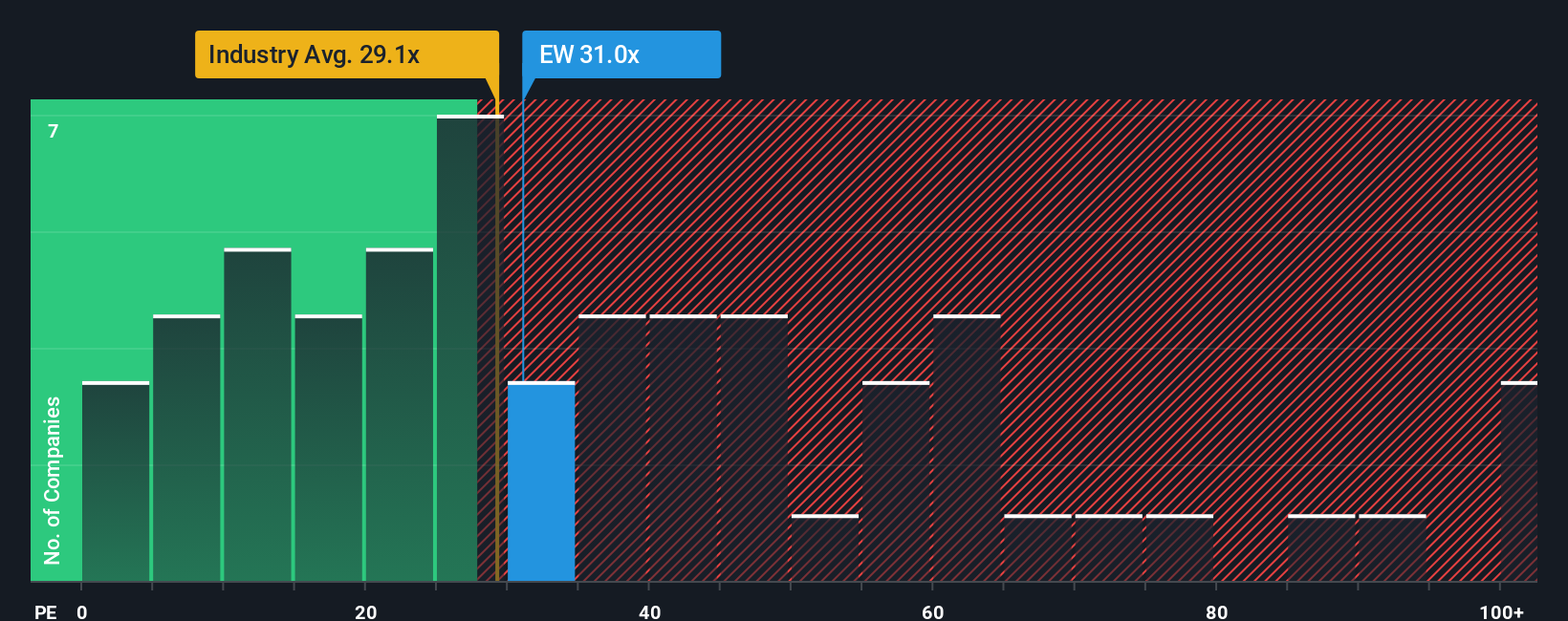

Looking at valuation through the lens of earnings ratios, Edwards Lifesciences trades at 31.8 times earnings. That is more expensive than the US Medical Equipment industry average at 31.1x, but actually below its peer average of 32.6x. However, the current ratio still sits above the fair ratio of 25.2x, which could signal caution if the market shifts toward that benchmark. With this gap, are investors paying a premium for Edwards' growth story or overlooking valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If you are inspired to dig deeper or would rather rely on your own research, you can investigate the numbers and craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Edwards Lifesciences.

Looking for more investment ideas?

Don’t let yourself miss out on market standouts. Use the Simply Wall Street Screener to get ahead of the curve and find your next smart opportunity.

- Capitalize on market mispricings by targeting opportunities among these 894 undervalued stocks based on cash flows, which deliver strong cash flow potential before others spot them.

- Boost your portfolio’s income with reliable options through these 19 dividend stocks with yields > 3%, offering yields above 3% and attractive dividend growth records.

- Ride the next wave of technological disruption by focusing on emerging trends with these 25 AI penny stocks, gaining traction in AI innovation and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives